Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2017

Office market

In 2017, Ho Chi Minh City, Vietnam welcomed 4 new supply, 1 Grade A building and 3 Grade B buildings. Q4 2017 specifically welcomed Etown Central, a 36,450 sqm building located in District 4, Ho Chi Minh City with 27 floors and 4 basements to join Grade B supply. This building already boasted 40% vacancy rate in the first quarter of operation and is looking forward to a rapid absorption.

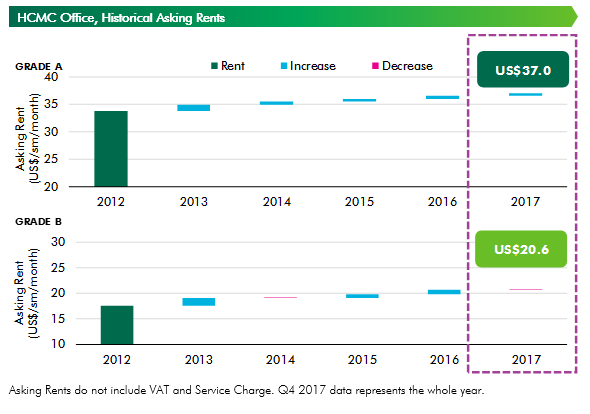

Asking Rents” for both Grades displayed a stable trend, with Grade A and Grade B achieving US$37.04 and US$20.63, respectively. “Grade A reported an increase of 1.3% y-o-y while Grade B displayed almost no change y-o-y. Grade A increased slightly at 0.9% q-o-q while Grade B dropped 0.5% q-o-q.

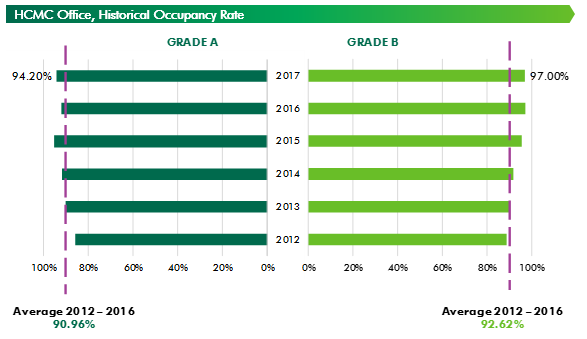

Occupancy rate for Grade A was reported at 94.20% with “Saigon Centre Phase 2” the only new Grade A supply in both 2017 and the previous quarter, continuing to be absorbed by the market. Grade A occupancy rate displayed an increase of 2.2 ppts y-o-y and 0.8 ppts q-o-q. Grade B boasted an exceptional 97% occupancy rate, equivalent to only 3% vacancy rate despite the new supply from “Etown Central”. Changes for Grade B occupancy rate remained minimal, barely a decrease of 0.2 ppts y-o-y and 0.3 ppts q-o-q.

Net absorption in the review quarter was exceptional for Grade B because of leasing spaces from Etown Central as well as vacant spaces in District 7, Ho Chi Minh City from the previous quarter being absorbed by the market, which contributed to 33,258 sqm to overall Grade B. Grade A continued to absorb the remaining space from Saigon Centre Phase 2, recording only 2,869 sqm for overall Grade A.

Regarding tenant trends this quarter revealed a rising demand for space larger than 700 – 1,100 sqm, accounting for 33% of total enquiries. Tenants from Manufacturing and Professional Services each accounted for 19%, while F&B accounted for 10%. The end of the year saw renewal started to account for 19% of total enquiries, while New Letting and Relocation drove up the leasing activities with 24% and 48% of total enquiries.

Overall, 2017 witnessed the office market bustling with new supply and healthy absorption. 2018 onwards will witness the market coming up with better supply albeit at a slower pace than 2017, with only 1 Grade A in the CBD – Deutsches Haus while Grade B supply will continue to spread out at decentralized districts like District 2 and District 10 in Ho Chi Minh City. Rental growth will increase at a slower pace as existing supply will remedy their rents more strategically while vacancy rate will surge up momentarily before dropping down just as quick as the market will continue its healthy absorption momentum with new supply.

Condominium / apartment market

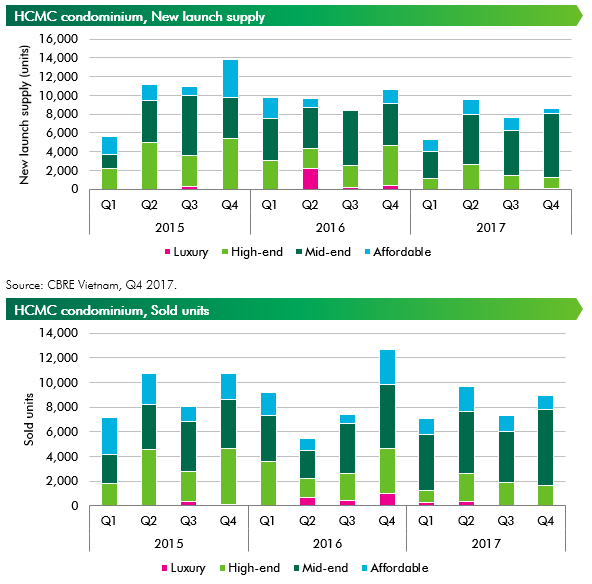

The end of 2017 marked a transformation of the condominium market from robust growth to more sustainable growth. Even though total new supply showed a decrease, good product configuration helps the market to maintain good absorption.

In Q4 2017 the market welcomed 8,559 new units, an increase of 12% q-o-q, bringing total 2017 new supply and accumulated supply ‘since 1999’ to 31,106 and 228,903 units, respectively. Total new supply in 2017 decreased by 18% y-o-y, assisting the inventory from 2015 and 2016 to be absorbed. In 2017, it is observed that developers have put more focus into products’ design, facilities, finishing materials to better meet demand from increasingly discerning clients. More effort has also been put into sales and marketing strategies.

In terms of market segmentation, mid-end segment accounted for 64% of total new supply in 2017 (compared to 40% in 2015), showing movement of the market to serve more end-user, laying foundation for a more balanced residential market. In terms of location, Ho Chi Minh City’s condominium market continued to expand towards the East and the South, with high concentration of new projects in District 2, District 7, District 9 and Binh Thanh District (County).

Sales performance has been positive in both Q4 2017 and for the whole 2017. In Q4, 8,934 units were sold, an increase of 23% q-o-q and decrease of 29% y-o-y. Total number sold units in 2017 was estimated at 32,905, a decrease of 5% y-o-y, but this is the first time in the past 5 years that the market recorded total sold units outnumbering total new units. Average sold rates of newly launched projects was recorded at 75%. High sold rates from 90% to 100% were observed at projects from reputable developers with prime locations, such as Empire City, d’Edge Thao Dien, Saigon South Residence, Lavita Charm, Mizuki Park... The mid-end segment accounted for 60% of total sold units in 2017.

Average selling price from developers in Q4 2017 was recorded at 1,564 USD/sqm, an increase of 4.8% q-o-q while a decrease of 3.6% y-o-y. The y-o-y decrease was due to more supply of mid-end units in Q4 2017. For the whole 2017, average price reached 1,558 USD/sqm, an increase of 4% compared to 2016. High-end segment recorded a y-o-y increase of 4% in selling price thanks to introduction of high-quality products such as d’Edge Thao Dien, Tilia Residence “Empire City”, Sunwah Pearl, Diamond Island.

In 2018, it is forecasted that mid-end segment will continue to account for the biggest proportion of the market, while high-end and luxury segments will observe more considerate new supply, helping the market to develop more sustainably. The East and South will continue to be hotspots of the market, with more new launches in District 2, District 7, District 8 and Binh Thanh District (County) such as One Verandah, GEM Riverside, Midtown, High Intela, Green Field. Average selling price in 2018 is expected to increase by 3%, with high-end and luxury segment showing increase of 5%, and mid-end and affordable segment increasing with a lower rate of 1.5%.

Condominium ranking criteria:

- Luxury: projects that have primary prices over US$3,500/sqm

- High-end: projects that have primary prices from US$1,500/sqm to US$3,500/sqm

- Mid-end: projects that have primary prices from US$800/sqm to US$1,500/sqm

- Affordable: projects that have primary prices under US$800/sqm

Retail market

Q4 2017 welcomed a new supply of 21,300 sqm which came from The Garden Mall “former Thuan Kieu Plaza” District 11 and the retail podium of Viettel Complex (District 10). In 2017, seven new retail projects with a total of 74,183 m2, which accumulated to a total existing supply of 820,840 sqm in Ho Chi Minh City, Vietnam. These projects are in non-CBD area and there was no new retail space added to CBD area.

This year’s new supply only accounted for approximately 38% of last year’s, yet the market was still booming with various international brands “mostly in mid-range fashion and F&B” entered Vietnam and opened their first store in Ho Chi Minh City.

While the heat from H&M and Zara’s entrance to Vietnam last quarter had not cooled down, well-known international fashion houses came to Vietnam. (Desigual - Spain), (Trendiano - Korea) and (COACH - France) opened their first store in Saigon Centre. The Garden Mall officially opened and their anchor tenants included F&B stores on ground floor and Phuong Nam Book City’s 3,000 sqm (Book Jungle) concept. On the other hand, foreign F&B companies mainly from Asia such as (PastaMania - Singapore), (Chamichi - Thailand) and (Hokkaido Baked Cheese Tart - Japan) and the like, flooded the market. Good and services catering to youngsters will be a future trend since this population’s disposable income and sophisticated taste will increase.

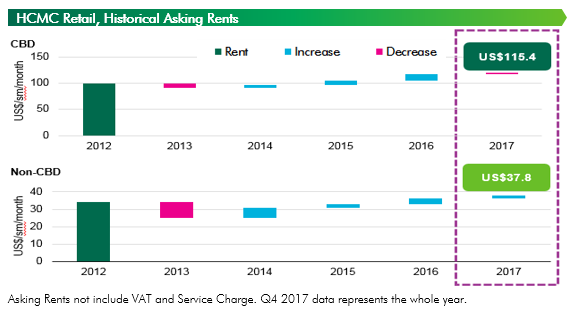

In terms of rental rates, there were no changes in CBD area and stayed at US$115.4/sqm/month since no new supply was added to the area this quarter. This year, asking rent went down to 2.2% y-o-y. This decrease mainly resulted from Union Square’s removal from surveyed basket (only some front stores are operating) in Q4 2016 for renovating and tenant mix reorganizing.

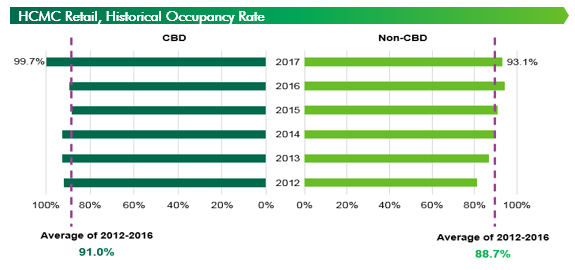

Rental rates in non-CBD area was US$37.8/sqm/month, a decrease of 0.1% q-o-q and an increase of 3.8% y-o-y. A few retail projects adjusted their asking rent prices to get more tenants to fill out their vacancy space. Besides, others offered flexible rent terms and conditions such as fixated rates or a turn over share on revenue which might range from 20% to 25% and no fixated rates in the beginning of the rent term. Vacancy rate in CBD area was next to nothing thanks to the limited land supply in this area. This year recorded the highest occupancy rate in Ho Chi Minh City. Meanwhile, non-CBD’s vacancy rate was the same as that of last year and stayed at 6.9%, a decrease of 6.1 percentage point q-o-q.This year’s net absorption was 47,618 sqm, which accounted for only 31% of last year’s. The decrease in net absorption was associated with the decrease in new supply.

Within the next three years, retail market will be more competitive as a large amount of supply from community retail podium will be launched. Ecommerce, which had recently got much attention from investors and consumers, will develop quickly. By 2020, the revenue from eCommerce was predicted to hike to 60% compared to that in 2017 and account for nearly 1.5% of total retail revenue in Vietnam.

Speaking of future supply, 13 out of 15 under construction projects with a total supply of 638,082 sqm are in non-CBD area and will be completed in 2018-2020. Half of the 15 projects will be finished in 2019 and some notable ones include Sala Shopping Centre District 2 – 60,054 sqm, Vinhomes Central Park’s commercial space Binh Thanh District – 59,000 sqm and Elite Mall District 8 – 42,000 sqm. Union Square will be re-opened in the same year.

Song Chau Group.

Related news

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2019

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2019