Ho Chi Minh City Serviced Apartment Quarterly report | Q4 2017

PERFORMANCE

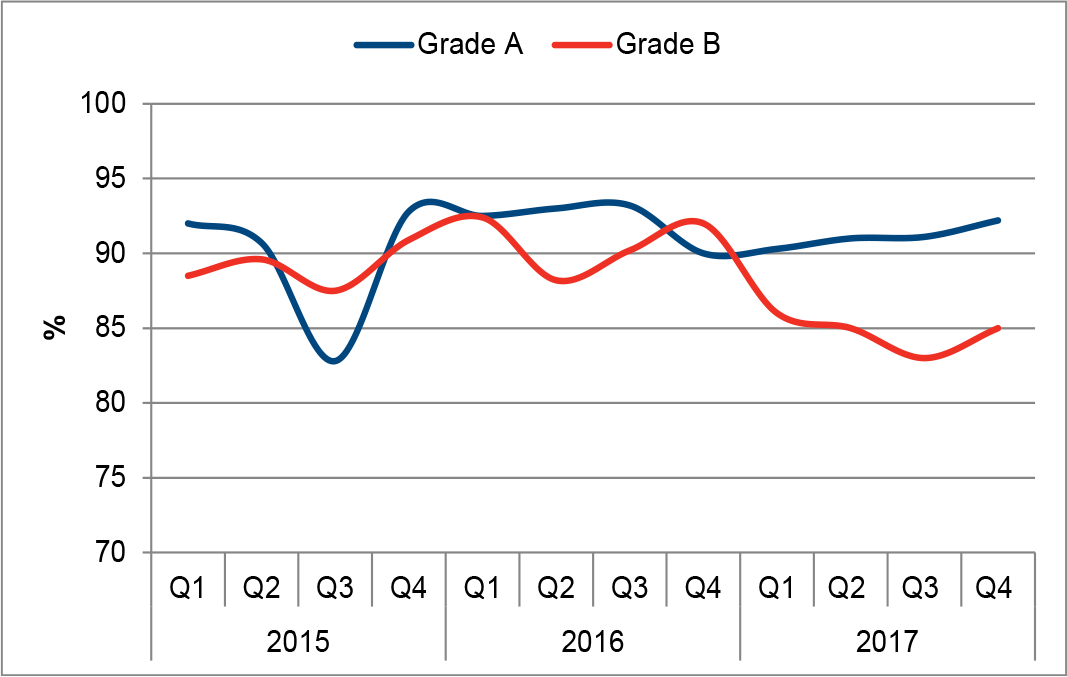

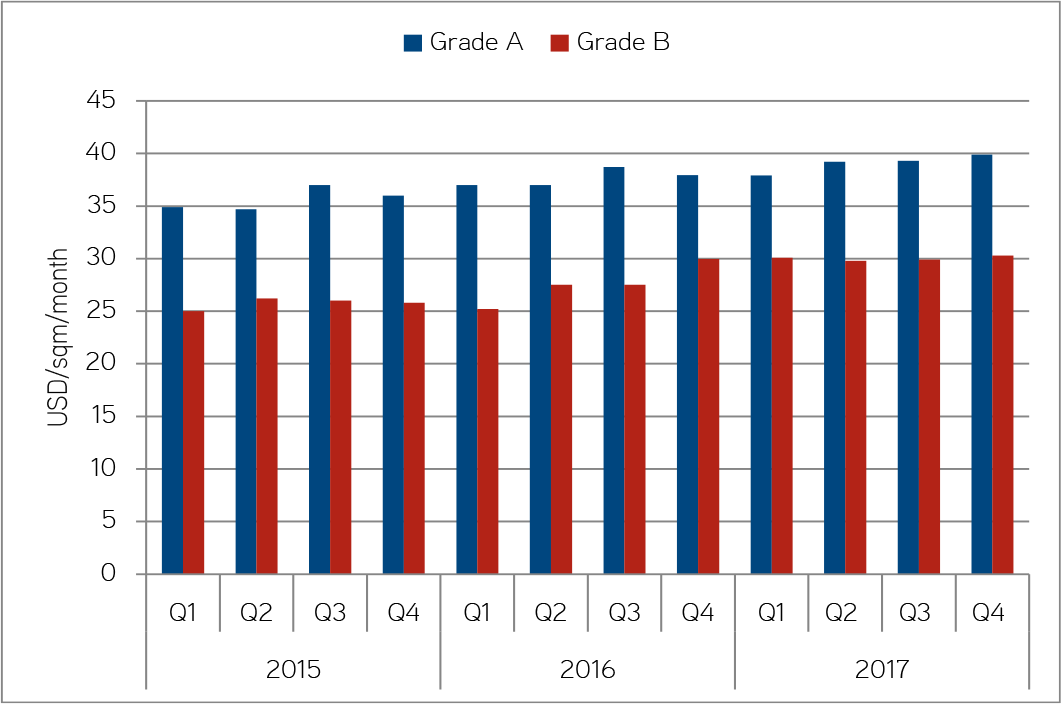

High volume of business travelers and tourists at the end of the year helped push up occupancy rates of serviced apartments in Q4 2017, recording at 92.2% for Grade A and 85% for Grade B, equivalent to an increase of 1.2 ppts and 2.0 ppts on a quarterly basis. Landlords, therefore have taken advantage of the solid demand to raise their asking rents. More specifically, Grade A’s average asking rent increased by 1.5% compared to the previous quarter and 5.2% y-o-y to a high level of US$ 39.9/sqm/month, while an improvement of 1.3% q-o-q (equivalent to 1.1% y-o-y) was also witnessed in the Grade B’s average asking rent, reaching US$ 30.3/sqm/month.

Serviced Apartment, Occupancy Rate

SUPPLY

The last quarter of 2017 welcomed Sherwood Suites, a high-quality service apartment development with nearly 160 units in District 3, increasing the total stock by 4.1% compared to the previous quarter. The total existing stock comprises of more than 1,100 Grade A units and approximately 3,100 Grade B units, accounting for nearly 25% and 75% of the total market respectively. Due to limited land availability in the Central District, decentralization trend have increased with many new developments scattered in outlying districts such as District 2, District 7 and Tan Binh District.

Serviced Apartment, Average Asking Rent

DEMAND

According to the Travel and Tourism Competitive Index (TTCI) published by the World Economic Forum, Vietnam was ranked one of the most attractive destinations to develop a travel and tourism business across the Asia-Pacific region in 2017. The Vietnam travel industry has boomed in the recent past thanks to the rise of budget airlines and accommodation options. The latter has expanded into an industry of its own and along with hotels, villas, bungalows and chalets, now serviced apartments can also be chosen from the list. In Ho Chi Minh City, the growing awareness of consumers regarding serviced apartments has continued to fuel demand for this sector as they offer a lot more privacy and freedom than hotels with monetary efficiency and more elaborate options such as kitchen, pool, laundry room, gym and even house-keeping services.

OUTLOOK

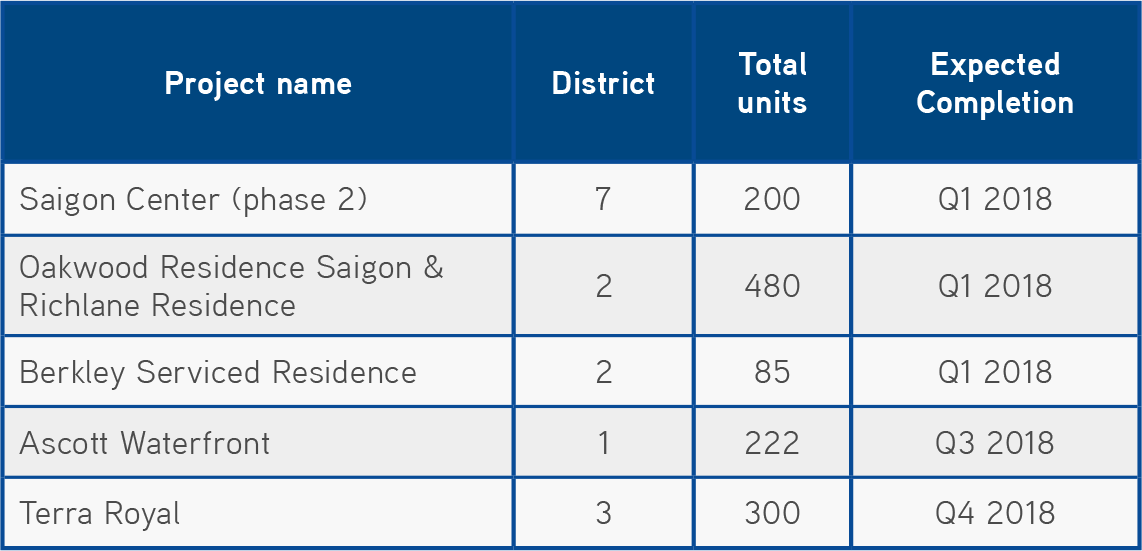

Serviced apartment, Significant Future Projects under construction

Q1 2018, an estimated 1,280 units of serviced apartment supply will enter the market by the end of 2018. In spite of the fact that landlords have enjoyed favorable market conditions with high occupancy rates and steadily increasing rental rates, Ho Chi Minh serviced apartment market has seen increased competition from new buy-to-let apartments. The rivalry is forecasted to be more bitter in the next coming periods as rental apartments offer approximately a half or even a third of rents offered by serviced apartments in the same location. Additionally, with a huge amount of new condominium supply to be launched since 2018, rents of buy-to-let will become more competitive and then the market is expected for bidding wars.

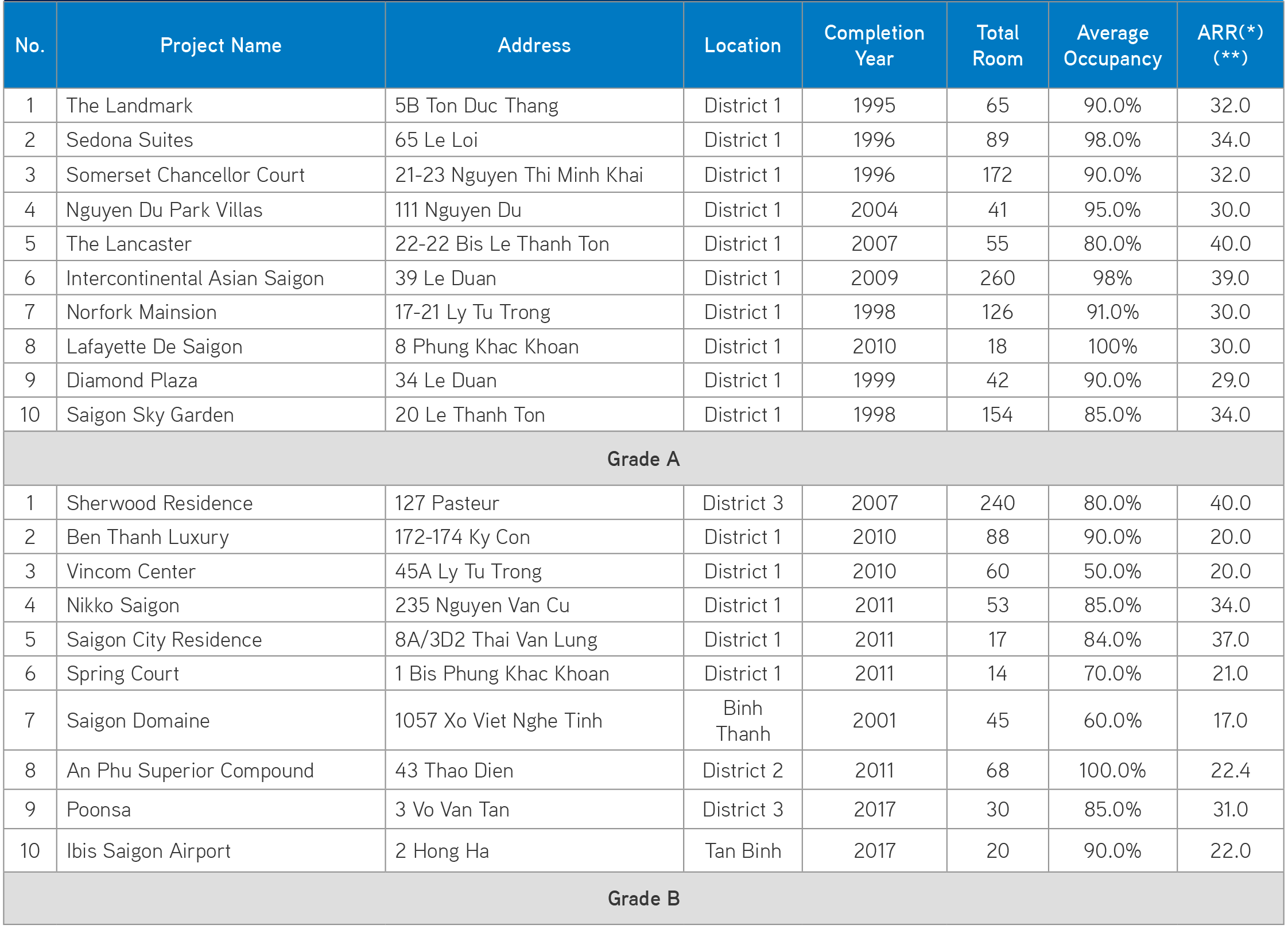

SIGNIFICANT SERVICED APARTMENT PROJECTS

(*) US$/sqm/month

(**) ARR (Average Rental Rate): All rents are stated in gross rents per sqm, not including VAT (10%) and serviced charge.

Song Chau Group.

Related news

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2019

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2019