Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2020

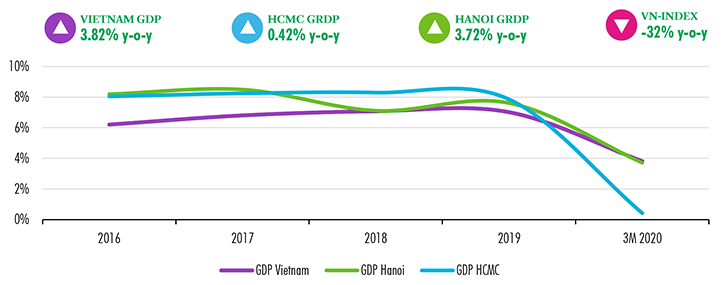

Vietnam’s economy

-

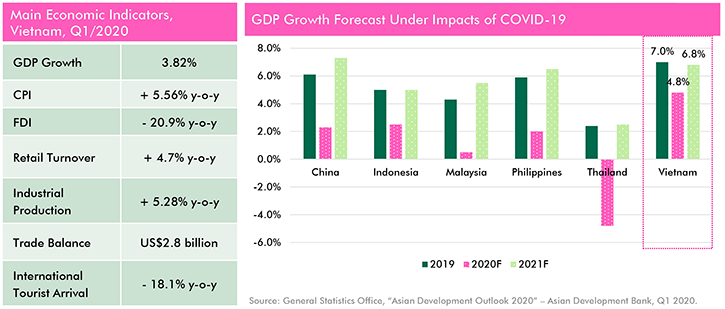

‘GDP’ In the first quarter of 2020, Vietnam GDP growth was recorded at 3.82% y-o-y, the slowest growth rate in the period of 2011 - 2020.

-

‘CPI’ Q1 2020, CPI was up by +5.56% y-o-y due to the high consumption in the Lunar New year and the impact of the Covid-19 outbreak.

-

'Export' In the first quarter of 2020, exports only grew by +0.5% y-o-y, much lower than the +4.7% y-o-y growth rate observed in Q1 2019.

-

‘FDI’ Total registered foreign direct investment in Vietnam in Q1 2020 reached US$8.6 billion, down by -20.9% y-o-y. In this period, the production and distribution of electricity, gas, water and air-conditioning attracted the most foreign capital, about US$4.0 billion. The manufacturing and processing industry ranked second with over US$ 2.7 billion, accounting for 32% of total registered capital.

-

‘International arrivals’ With travel restrictions, quarantine measures and reluctance to travel due to the Covid-19 outbreak, Vietnam’s hospitality market in Q1 2020 was severely affected. Vietnam welcomed 3.7 million international tourist arrivals in Q1, down by -18.1% y-o-y.

Office Market

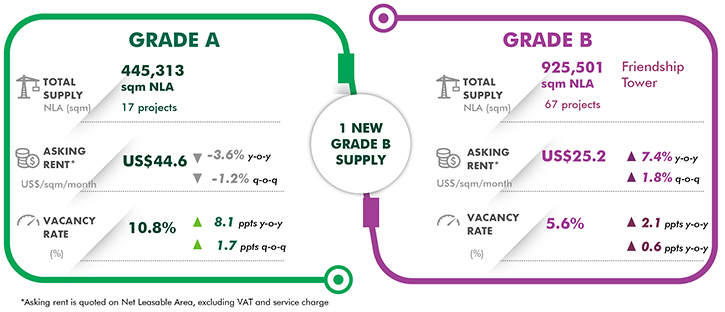

As of Q1 2020, HCMC office market received one new Grade B supply - Friendship Tower - located at Le Duan Street, District 1, with a total NLA of 13,700 sqm. With this new building, the total supply of HCMC office market reached 1,370,814 sqm NLA. Friendship Tower had asking rents ranging from US$45 – US$47 psm pm and its occupancy rate achieved 50% after more than 9 months of pre-lease.

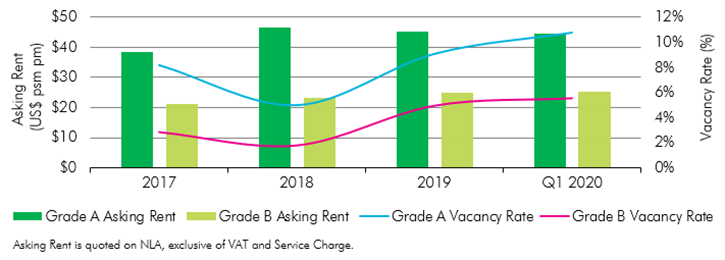

In Q1 2020, the average asking rent of Grade A segment was recorded at US$44.6 psm pm, a decrease of 1.2% q-o-q and 3.6% y-o-y. This decline was due to the relocation of tenants at some Grade A buildings and many landlords being forced to reduce rental rate to attract new tenants.

As the market had one new supply located in prime location within the CBD and its rent was higher than the average rental rate of Grade B, the rental rate of this segment increased by 1.8% q-o-q and 7.4% y-o-y, equivalent to US$25.2 psm pm.

In terms of vacancy, Grade A segment’s vacancy was at 10.8%, a slight increase of 1.7 ppts q-o-q and 8.2 ppts y-o-y due to some large tenants moving out from those buildings with low-quality management. Grade B segment, on the other hand, registered a vacancy rate of 5.6%, slightly up 0.6 ppt q-o-q and 2.1 ppts y-o-y due to new supply entering the market in the review quarter.

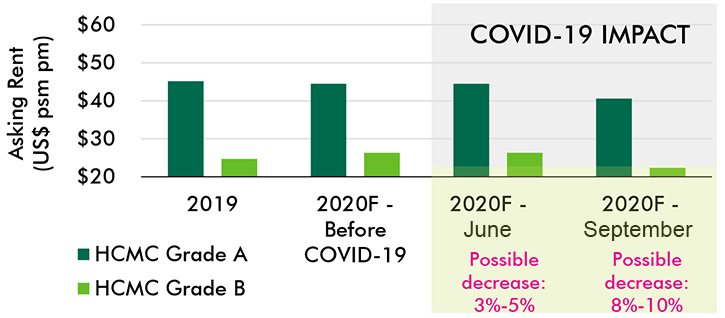

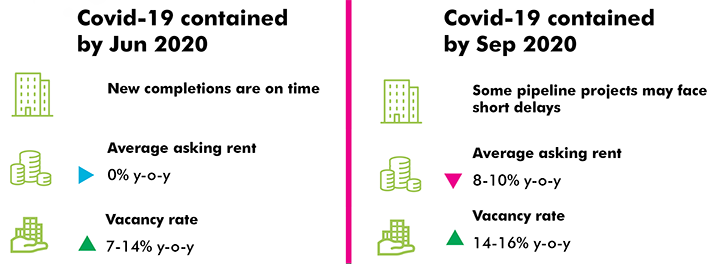

The office market has yet to record signifinicant impact from Covid-19. However, with the complexity of this pandemic in Vietnam and in other countries around the world, the tenants have persuaded landlords to cut off rental rate by 15%-20% in order to mitigate their rental cost and compensate for their revenue loss. In return, landlords have been providing various financial incentives such as deferment or extension of payments. If the disease is exacerbated, landlords may cut off rental rate for tenants in the short term.

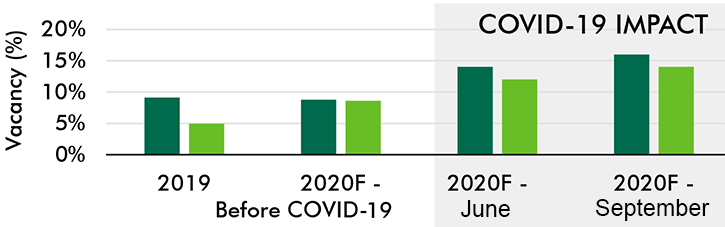

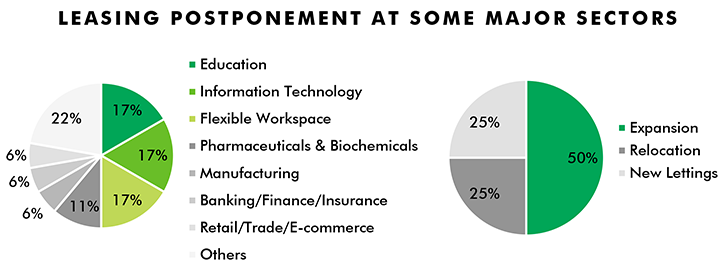

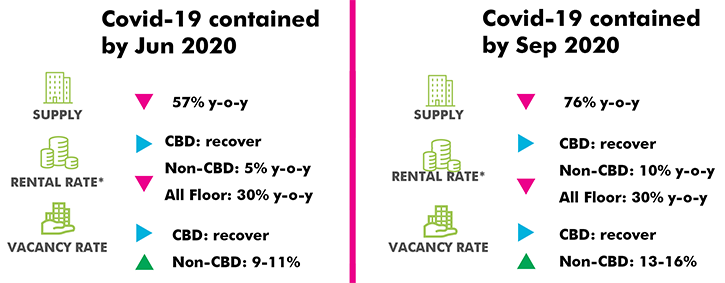

Besides, many recorded some delayed and canceled transactions by the end of Q1 2020 as international tenants were facing difficulty in visting potential sites. Such travel restrictions will possibly lead to the decrease in absorption of new supply, especially when HCMC office market is expected to welcome more than 70,000 sqm NLA by the end of 2020. Hence, the market vacancy rate will increase regardless of how soon the disease will be contained. Should the disease is contained before June 2020, the vacancy rate will only increase from 7% to 14%.

However, if the disease lasts to September 2020 then vacancy rate of the office market might escalate to 14% - 16%. If the outbreak is to be contained before June 2020, the rental growth outlook might still remain positive, in case of the disease is being contained only by September 2020, outlook will be more bearish, with rental rate expected to decrease by 8% to 10% as companies will witness more revenue losses and will request landlords to cut off rent.

-

New completions are on time.

-

Rental rate will continue to grow slightly.

-

Vacancy rate might reach 7% - 14%.

- Some new projects will be delayed shortly due to the postponement of materials imports.

- Rental rate might shrink by 8% - 10%.

- Vacancy rate will increase up to 10% - 16%.

Condominium market

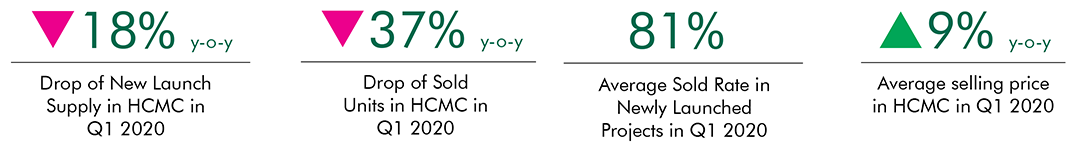

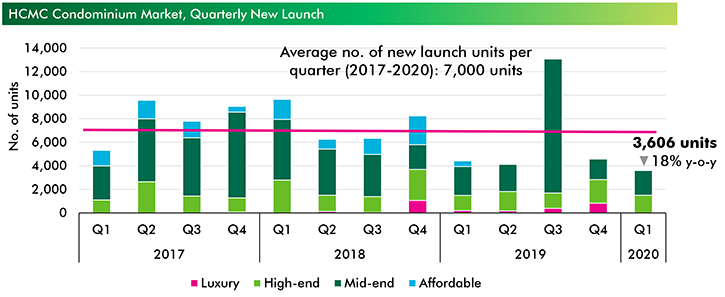

The Covid-19 outbreak combined with licensing issues and prolonged Tet holiday have greatly reduced new launch supply in HCMC. Many projects in Nha Be District, District 2, District 9, District 10 have postponed their launching events due to the government's directive on social distancing as an effort to curb the spread of virus. In Q1 2020, new supply volume was recorded at 3,606 units from 11 projects, a drop of 21% q-o-q and 18% y-o-y.

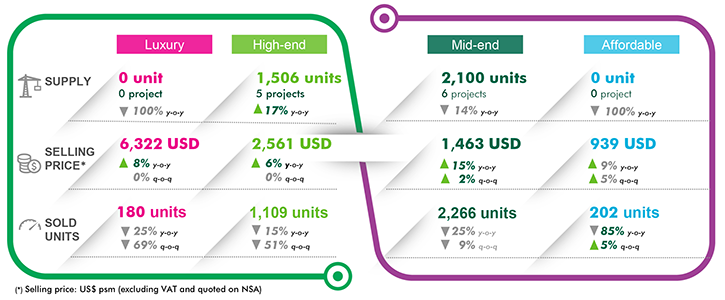

The average selling price for the primary market is at USD1,936 psm, up 2% q-o-q and 9% y-o-y. The price point in the mid-end segment for new launch supply is 15%-30% higher in comparison with the level previously seen in surrounding areas. The new launch supply in mid-end segment in this quarter witnessed price increase from developers due to limited supply and good booking "reservation" rate. Meanwhile, luxury and high-end projects’ prices remain stable from the previous quarter and higher than the same period last year, respectively at 8% and 6%.

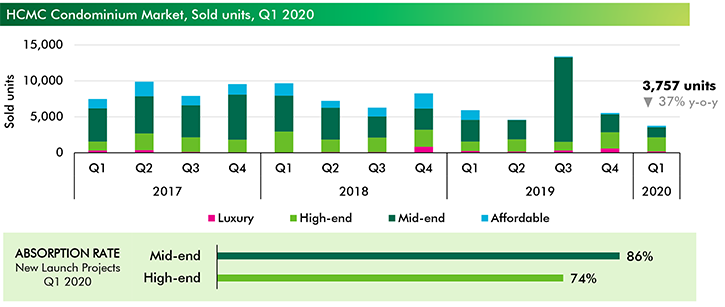

In the context of limited supply and rising price, take-up remains positive especially for the mid-end segment. High sold rate reaching 80% to 100% has been recorded at projects that are developed by reputable developers. However, with the looming risk of Covid-19 pandemic since mid-March and the strengthening of social distancing measures, buying demand has decreased during this period. In the first quarter, 3,757 units were sold, a decrease of 32% q-o-q and 37% y-o-y. The market continues to absorb the remaining inventory from existing projects.

In terms of segmentation, the mid-end segment continues to dominate with 58% of new supply in Q1 2020, helping to maintain stability of the market by satisfying much of end users’ demand. In terms of location, HCMC condominium market continues to expand East and South, concentrating in District 2, District 7, District 9 and Binh Chanh District.

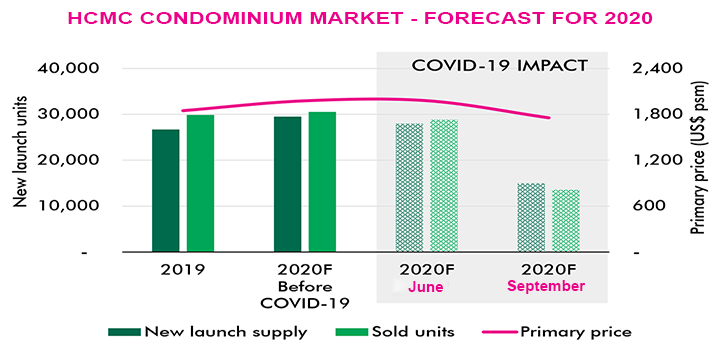

Since the government’s directive of 15 days of “nationwide social distancing” put into effect in early April, many projects will continue to delay the launch date. New launch supply is predicted to improve in the second half of 2020 and achieve a total of 28,000 units – in the scenario that the pandemic will be contained by the end of second quarter this year (in case of the pandemic will be contained by June). Mid-end and affordable segments will continue to account for a high proportion of new launch supply. In terms of location, the East remains a hot spot in the real estate market, with many new projects in District 2 and District 9.

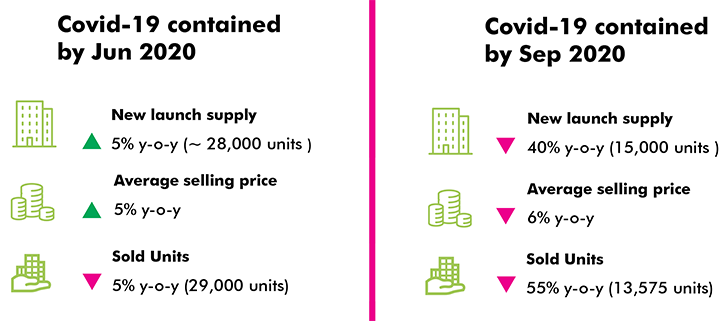

The pandemic will be contained by June: the average market wide selling price is expected to increase 5% y-o-y, with mid-end and affordable segments forecasted to have a modest growth rate of 1%-3% y-o-y due to a large competitive supply. High-end segment is expecting a price increase by 5% by year. Many luxury projects are licensed in District 1 and District 3, and the selling price is expected to increase 5%-7% y-o-y, considering the limited land bank in CBD. The sold units volume is forecast to drop by 3% y-o-y, mostly attributed to decrease of transactions in high-end and luxury segments.

The pandemic will be contained by September: there will be a significant drop in new launch supply at 40% y-o-y, with approximately 15,000 units launched in 2020. The decline in supply will mainly concentrate in high-end and luxury segments. Primary selling price is forecast to drop by 6% y-o-y as the majority of supply will be in the mid-end segment. Transaction volume under this scenario will plummet due to government’s restriction in meetings and gatherings in public places. CBRE forecasts that there will be approximately 13,575 sold units for FY2020, a decrease 55% y-o-y.

The government’s mandate of social isolation and ban of public gatherings has greatly impacted developers' sales strategy. Developers so far have responded quickly by using mobile applications, online property materials, mockup unit videos to attract customers. Besides sales activities, post-sales services, especially property management service, have become more important than ever in recent years, and especially so following the Covid-19 outbreak. End-users and investors now expect higher standards of property management and attention to other hygiene-related issues, as well as wellness facilities.

Forecast: Covid-19 contained by June 2020

- New launch supply will be 28,000 units, increase by 5% y-o-y.

- Average selling price will increase by 5% y-o-y.

- Sold units will be 29,000 units, decrease by 5% y-o-y.

Forecast: Covid-19 contained by September 2020

- New launch supply will be 15,000 units, decrease by 40% y-o-y.

- Average selling price will decrease by 5% - 6% y-o-y.

- Sold units will be 13,575 units, decrease by 55% y-o-y.

Condominium ranking criteria:

- Luxury: projects that have primary prices over US$4,000 psm

- High-end: projects that have primary prices from US$2,000 psm to US$4,000 psm

- Mid-end: projects that have primary prices from US$1,000 psm to US$2,000 psm

- Affordable: projects that have primary prices under US$1,000 psm

(Selling price excludes VAT.)

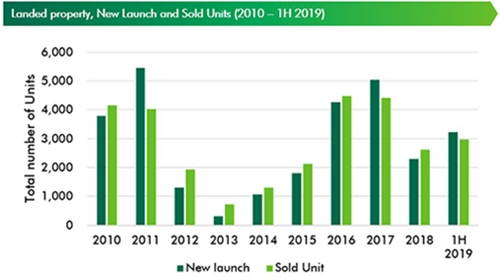

Landed property (Ready-built Villa and Townhouse)

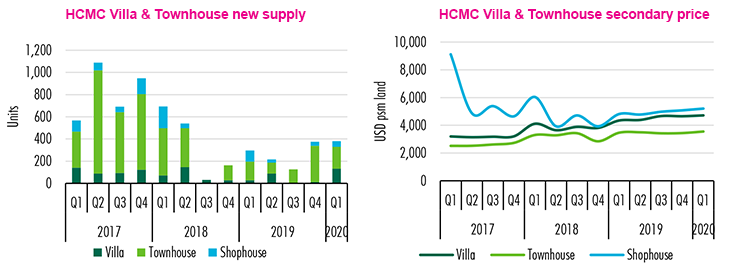

Impact of the Covid-19 on HCMC ready-built villa and townhouse market in Q1 2020 was minimal due to limited new supply and most of them being launched before the social distancing policy implemented. Total new supply in Q1 were only 381 units from four projects. In which, there was roughly 219 units from the first phase of Zeitgeist, the new township project located in Nha Be district.

Verosa Park Khang Dien is a new official launch this quarter, townhouse and villa project was even finished and ready to handover end March 2020. This project contributed to more than 60% of the total units launched this quarter, which was recorded at 443 units.

New projects reported 68% -100% sold rate in Q1 2020. Primary price of new launch was from US$2,600 - 4,600 per sqm (on land area) for townhouse and shophouse respectively in Nha Be district to USD5,000 - 5,330 per sqm in Thu Due district. Shophouse remained as the most attractive product of project launched in this quarter. Cumulative sold rate of primary market decreased to 95.7% in this quarter in comparison to 96% of Q4 2019.

The secondary market in Q1 2020 remained stable (asking price increased slightly, from 1.3% to 3.2% q-o-q) when buyer turned into wait-and- see mode due to the strong disease outbreak in March 2020. The significant decrease of amount of site visit and selling activities slowed down asking price escalation in this quarter.

Looking forwards, construction start of new infrastructure projects such as Nguyen Huu Tho - Nguyen Van Linh intersection, My Thuy 3 Bridge (My Thuy intersection) and speeding process of Ring Roads and inter-province expressways after the disease contained is expected to support demand in the remaining quarters of 2020.

Retail market

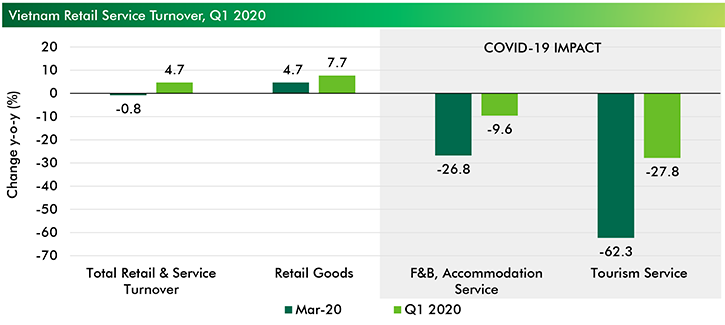

Retail is one of the sectors most affected by Covid-19. In Q1 2020, total revenue from F&B, accommodation service and tourism service decreased by 9.6% and 27.8% y-o-y, respectively. In shopping centres, the amount of footfall started decreasing in February and was down by 80% as of March 2020. Categories that were forced to shut down like Education received no revenue while F&B, Fashion & Accessories and Entertainment saw revenue going down by 50-80%. Some F&B retailers have to go through mass shutdowns such as “Golden Gate” (estimated that 50% of stores were shut shown, mostly in Hanoi), coffee brands, milk tea brands, etc. Some tenants encountered temporary closures in shopping centres yet no early termination was recorded thanks to rents support from landlords. Since the notice of temporarily halting unnecessary businesses by the Government, all landlords announced their shopping centres to be shut down at least until April 15.

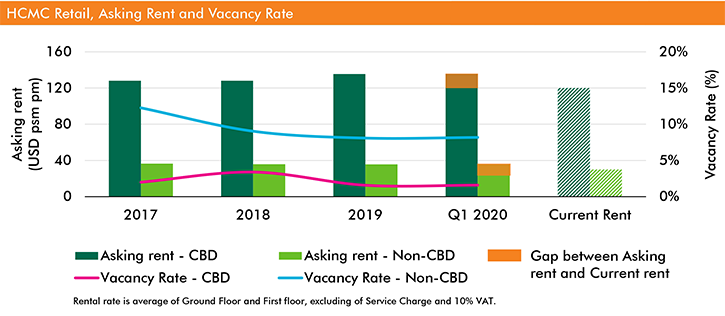

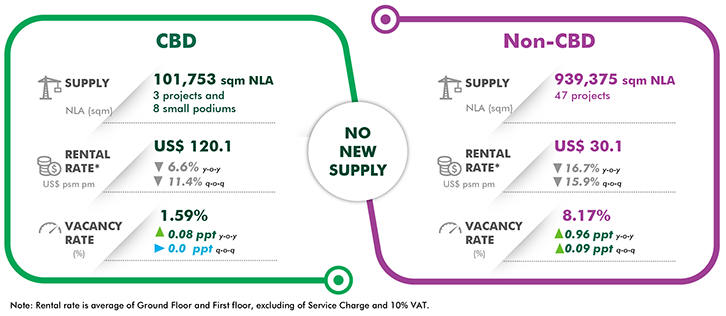

Most shopping centres’ landlords in HCMC started applying 10-30% rent reduction policy for all tenants since March 2020 while a few started in February. Up to 50% rent reduction was applied for categories of forced shutdown. As of end of Q1/2020, rental rate at Ground floor and First floor in the CBD and non-CBD decreased by 11.4% and 15.9% q-o-q, respectively. For upper floors, the decrease can be more severe. Compared to last year, rental rate in CBD and non-CBD decreased by 6.6% and 17.6%, respectively. Per vacancy rate, thanks to rent reduction policy, there has been not any early termination and occupancy rate almost remained the previous level. Vacancy rate stayed the same in the CBD while vacancy rate slightly increased by 0.9 ppt in non-CBD areas.

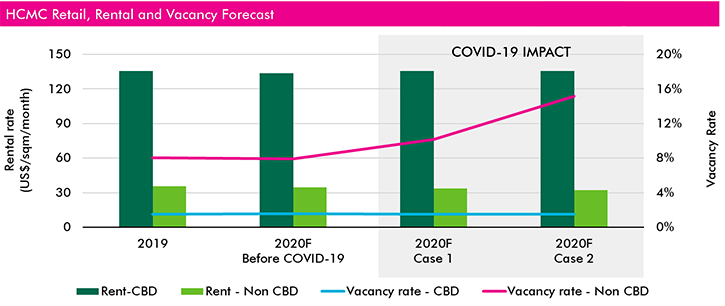

If the disease can be controlled within Q2 2020, chances are vacancy rate in the CBD remains stable until end of year while that in the non-CBD can increase by 1-2 ppts. Per rental rate on Ground Floor and First Floor at year-end, CBD’s rent can fully recover to the pre-Covid 19 level while non-CBD’s rent can end at 5% lower than previous level. In case that the disease prolongs until September 2020, vacancy rate will increase in both markets with more severity to be seen in the non-CBD areas with estimated increase of 5-7 ppts. Non-CBD’s rental rate on Ground Floor and First Floor can end at 10% lower than previous level while CBD’s rental rate still can still fully recover. For rents on other floors, landlords are likely to keep the current rent reduction of 30% until the end or the year and allow delayed payments to maintain the current tenants.

New brands entrance/ expansion was slowed down in Q1 2020. Daniel Wellington (accessories) and Edelkochen (Home appliances) were two among new tenants (at Crescent Mall) because of their previous opening plan. Future projects that are under construction/leasing show signs of delay and we expect new supply of 2020 can be affected. In Q1/2020, there was not any new project and total supply remained the 2019 level, which was 1,050,000 sqm NLA. If the disease will not be controlled in Q2 2020, new supply forecast could only be of 20% the level we forecast last year. Completed and for-lease projects may be forced to postpone opening date.

Unlike the negative situation of shopping centres under the effect of Covid-19, online retail sales recorded a positive growth in the quarter. According to Nielsen consumer survey in February 2020, expenditure on necessities such as dry foods, healthcare and hygiene goods increased by an average of 35-70%. Online retailers such as Tiki, Speed Lotte, etc. recorded an increase in daily orders of at least 2-4 times. Online retail service of Co.opmart increased by 4-5 times in this period. The delivery service of Grab quickly introduced Grabmart, a new service that does the shopping on behalf of customers. These showed the swift actions from retail players to adapt to fast changing trends on the market. Online retail sales, despite impressive growth rate in the past few years (average annual growth of 39% in past five years, which is higher than traditional retail’s growth of 10% in the same period), still only account for 4% of total retail sales in Vietnam.

In spite of delayed amount of supply coming online in 2020, the market is still expecting 400,000 sqm of NLA currently under planning and under construction in the next three years, in different areas in the city. The restart of Metro line No. 1 construction, and discussion regarding implementation of Line No. 2, No.5 will have positive effects on the local retail market in creating new retail clusters in the city, the most notable of which is the East, including Thu Thiem New Urban Area.

Song Chau Group.

Related news

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2019

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2019

Vietnam’s Economic Backdrop Quarterly Reports | Q2 2019