Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2021

VIETNAM'S ECONOMY

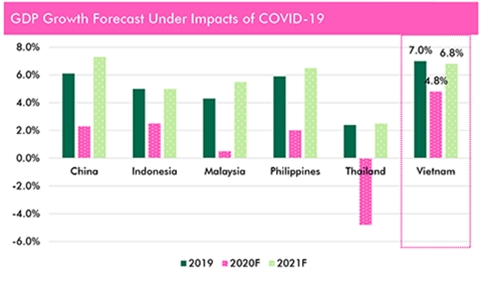

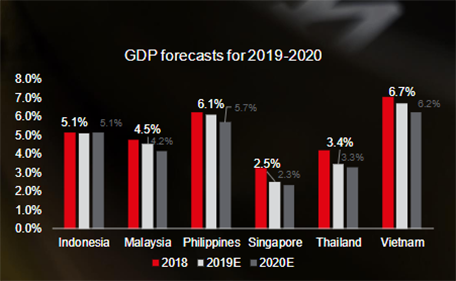

GDP in the second quarter of 2021 was estimated to increase by 6.61% over the same period last year, higher than the growth rate of 0.39% in the second quarter of 2020. GDP in the first 6 months of 2021 increased by 5.64%, Vietnam performed relatively well despite the Covid-19 pandemic breaking out in many localities across the country from the end of April.

Average CPI in the second quarter increased by 0.45% compared to the previous quarter and by 2.67% over the same period in 2020. The average CPI in the first 6 months of 2021 increased by 1.47% compared to the same period in 2020. The main reasons for the increase in CPI were due to the increase in price of input materials and the increase in electricity and domestic water prices.

FDI: Total foreign investment capital into Vietnam as of June 20, 2021 including newly registered capital, adjusted registered capital and value of capital contribution and share purchase by foreign investors reached nearly 15.27 billion USD, down 2.6% over the same period last year. There are 804 newly licensed projects with registered capital of nearly 9.55 billion USD, down 43.3% in number of projects and up 13.2% in registered capital over the same period last year.

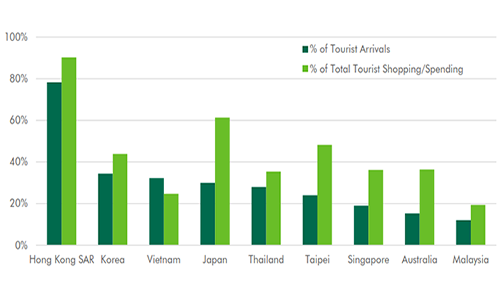

International Arrivals in the first 6 months of 2021, international visitors to Vietnam reached 88.2 thousand arrivals, down 97.6% over the same period last year as Vietnam continued to implement measures to prevent and control the Covid-19 pandemic. Most of the arrivals are foreign experts and technical workers as well as drivers transporting goods at the road border gates.

OFFICE MARKET

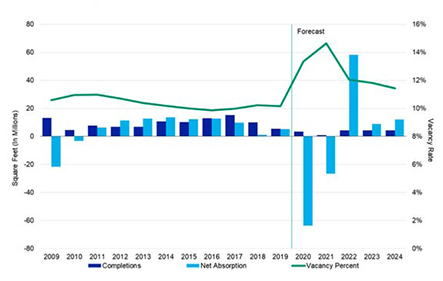

In Q2 2021, the HCMC office market had one new Grade B office building which was AP Tower in Binh Thanh District, adding 10,841 sqm of NLA to the total supply. The second quarter of 2021 witnessed the new wave of COVID-19 in which recent cases rose to a record high since the initial outbreak. Many companies were more open to working from home or rotation policy.

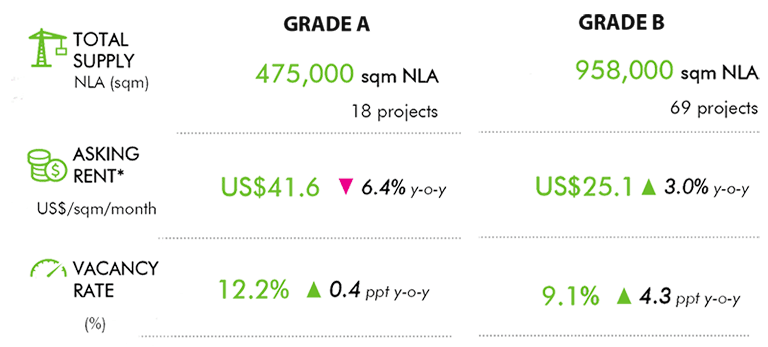

In HCMC, landlords offer support case by case, for example, free rent and/or service charge for companies which were forced to close because of the pandemic and more lenient policy for renewal contract. As of Q2 2021, the total supply was 1,433,327 sqm NLA from 18 Grade A buildings and 69 Grade B buildings.

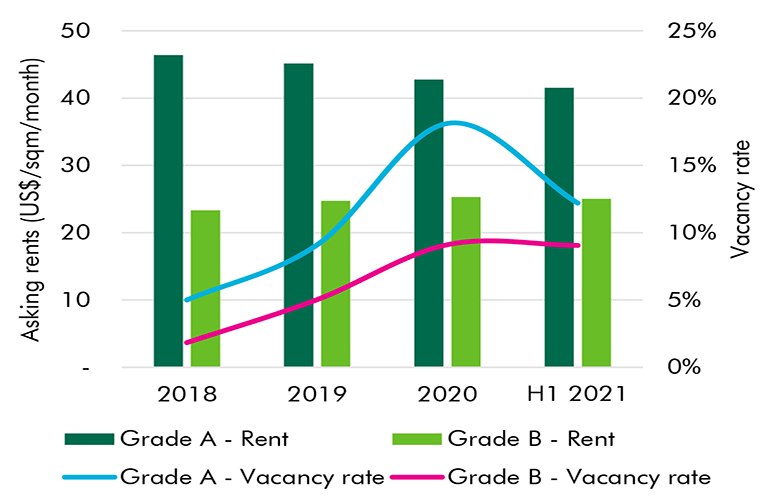

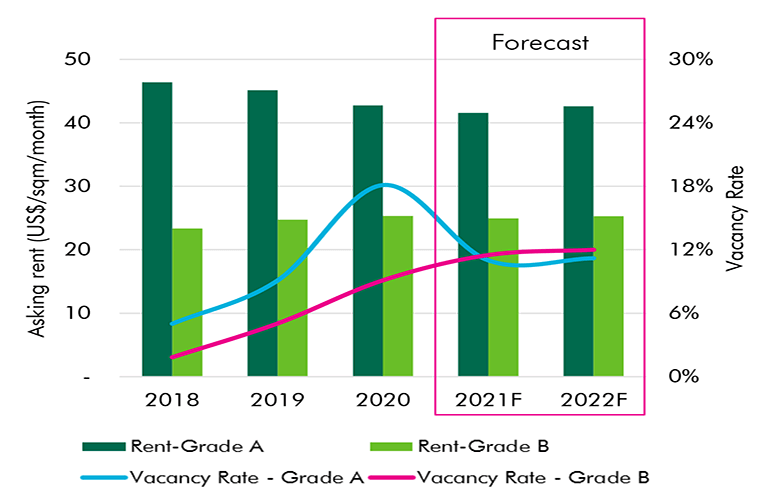

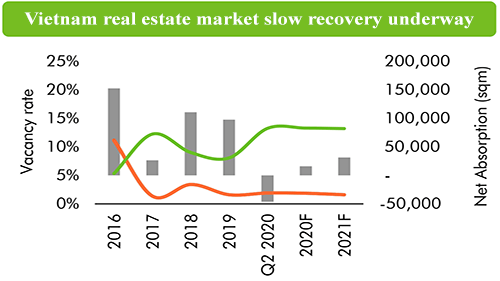

Vacancy in Grade A continued to decrease by 2 ppt q-o-q mostly due to new leased areas at newly buildings in District 1 and District 7, which offer high quality and closeness to existing office clusters. In the Grade B segment, the vacancy rate was stable while old buildings continued to witness occupier return spaces and move to newer buildings in Tan Binh District, District 1, District 2 and District 7 and Binh Thanh District. As of Q2 2021, the vacancy rate of Grade A and Grade B segments was 12.2% (up 0.4 ppts y-o-y) and 9.1% (up 4.3 ppts y-o-y), respectively.

Regarding the rental rate, Grade A’s decrease trend has slowed down to 1.2% q-o-q while Grade B’s rental rate was stable. The rental rate of Grade A and Grade B was US$41.6 psm pm (down 6.4% y-o-y) and 25.1 psm pm (down 1.0% y-o-y), respectively. Net absorption was positive for Q2 2021 at both Grade A and Grade B building, bringing total net absorption for H1 2021 to over 33,300 sqm NLA.

In the last six months of 2021, the market is expected to welcome three new more Grade B buildings, with a total NLA of 34,500 sqm of NLA. Until 2022 forwards, the city will receive more Grade A new supply, for example Etown 6, One Central and new prime office in Thu Thiem New Urban area.

CONDOMINIUM MARKET

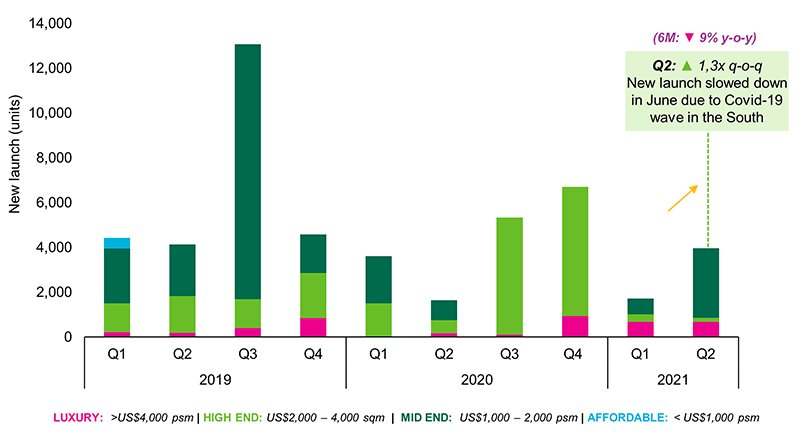

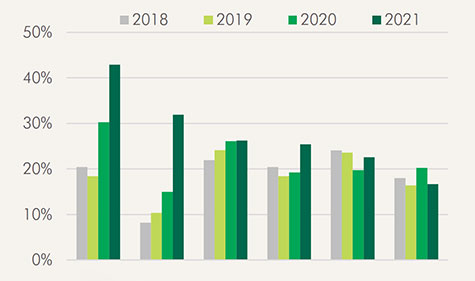

In Q2 2021, there were 3,968 condominium units launched in Ho Chi Minh City, which was double that of the previous quarter and showing a recovery of sales activities. However, with 5,600 units, the total new condominium launch in H1 2020 was still 9% lower y-o-y because of COVID-19 resurgence. In terms of segment, 79% of units launched in Q2 2021 were from the mid-end segment while the remaining were in the luxury and the high-end segment.

Sales momentum was relatively positive in Q2 2021 as compared to the previous quarter, with over 80% of units launched during the quarter having been absorbed. In Q2 2021 there were 4,700 sold units, increased by 76% q-o-q. The sales picked up in Q2 thanks to active sales activities before the travel restriction period. Diversification in sales channels (online channels combined with direct marketing via sales events, limited buyer per section, etc.) and the introduction of innovative sale policies have boosted the sales during the quarter. Local buyers are key focus of developers during the first half of the year as foreign sales have been disrupted due to the suspension of international flights since last year.

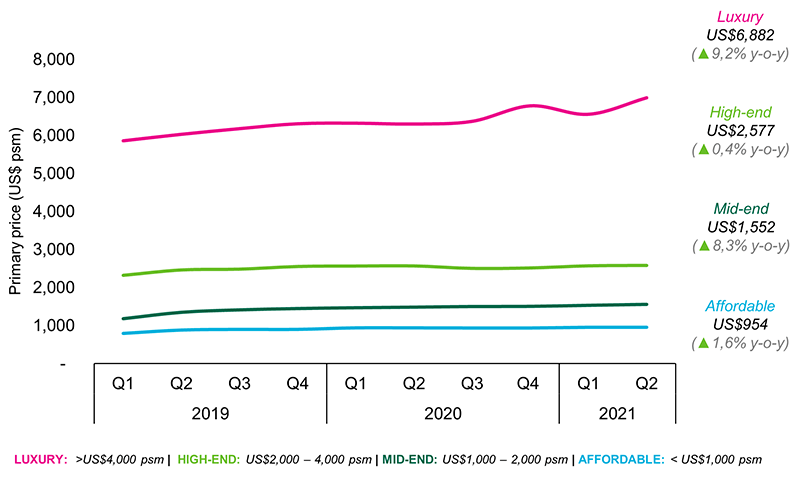

Selling prices in the primary market in Q2 2021 averaged US$2,260 per sqm (Exclusive of VAT), up by 16.5% y-o-y. The luxury and mid-end segments recorded high price escalation, 9.2% and 8.3% y-o-y, respectively. The significant price escalations were due to a lack of supply in the mid-end segment and the branded residence project in the luxury segment. High-end and affordable segments had modest growth rates in the review quarter, 0.4% and 1.6% y-o-y, respectively.

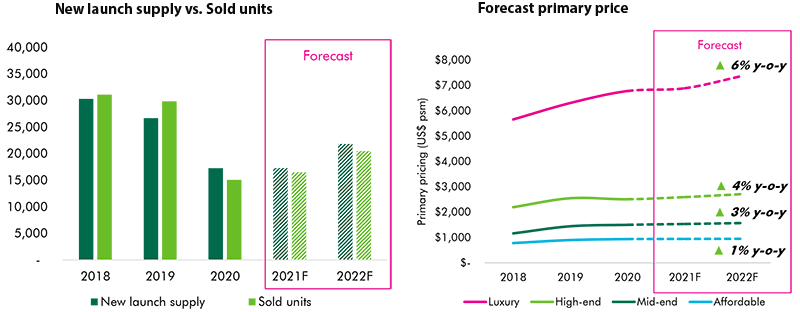

Moving forward, the level of new supply is expected to stay at around 17,000 - 18,000 units in 2021. Vaccine visa and increasing vaccine rate will drive foreign buyers back to Vietnam. The annual total of sold units might be around 15,000 – 17,000 units in Ho Chi Minh City given the limited supply and COVID-19 situation.

Primary prices will continue to increase at a slower pace so the market could absorb the remaining units. Primary prices will increase by 1%-4% y-o-y in all segments except the luxury segment. The luxury segment will increase by 6% in 2021 and 2022, thanks to new branded residence projects in District 1.

LANDED PROPERTY (READY-BUILT VILLA AND TOWNHOUSE)

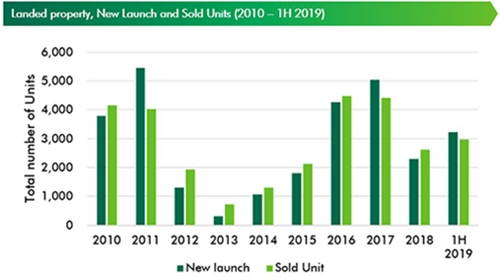

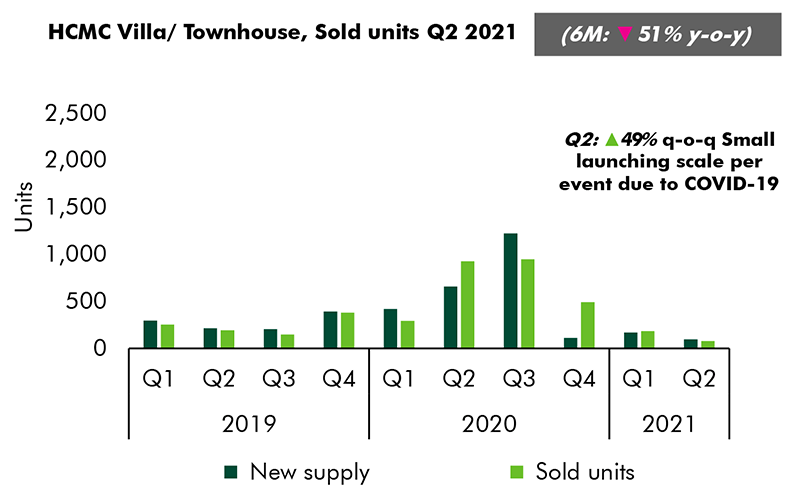

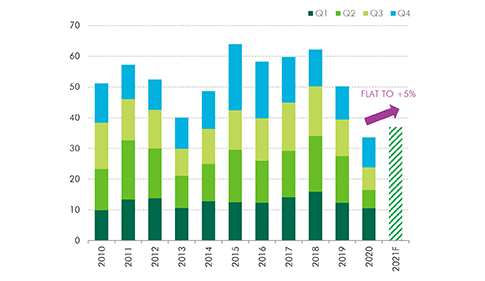

New supply remained limited and mostly located suburban districts. H1/2021 primary supply of over 770 dwellings was the lowest for five years, down 44% y-o-y. The H1 approximately 500 sales were down 51% y-o-y. In Q2 2021, primary supply of 570 dwellings was up 21% q-o-q but down 30% y-o-y. Townhouse had 49% share. New quarterly supply of 300 dwellings were from a single District 12 project and four launches of next phases in Thu Duc City, Go Vap and Tan Phu.

In Q2 2021, sales of around 300 dwellings increased 49% q-o-q with absorption at 53%, up 10 ppts q-o-q. New launches were 75% absorbed. Go Vap and Thu Duc City accounted for nearly 90% of quarterly sales, mostly from launches at Cityland Park Hills and Van Phuc City projects.

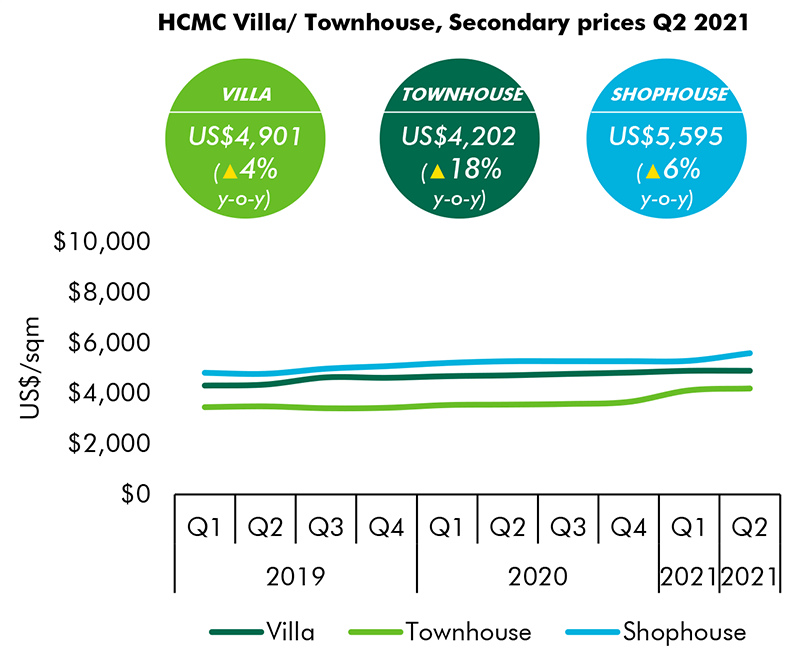

Limited primary supply generated secondary price escalation. In Q2 2021, the average secondary prices of our constant basket increased 13% y-o-y. District 7 had the highest y-o-y price growth, up 20%, followed by District 9, Districts 2, Go Vap and Nha Be with a range of 13% to 19% y-o-y.

Future supply to 2023 is expected to reach 9,700 dwellings/ plots. Thu Duc City will supply the most with a 32% share, followed by Binh Chanh with 24%. HCMC plans to turn five suburban districts Hoc Mon, Binh Chanh, Nha Be, Cu Chi and Can Gio into ‘urban districts’ in 2021-2030. These districts with large land banks are becoming key residential development targets.

RETAIL MARKET

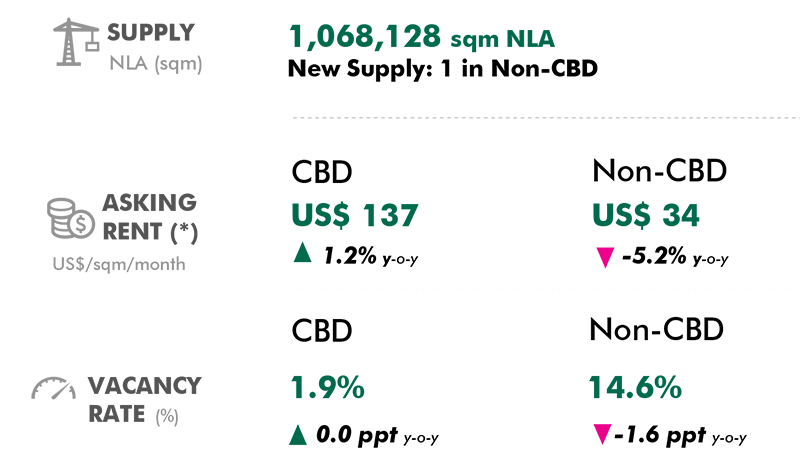

In Q2 2021, Co.opmart Truong Chinh in Tan Phu District opened with 16,000 sqm of NLA . After several quarters without new supply; as of Q2 2021, the total retail supply in HCMC was at 1,068,128 sqm NLA. Because of the new wave of COVID-19, all shopping centres were forced to close starting from June 2021, except for necessary categories such as supermarket, pharmacy. However, the part-opening policy will be even more restricted in Q3 2021, given the rising number of new COVID-19 cases and more challenges in controlling the new virus variant.

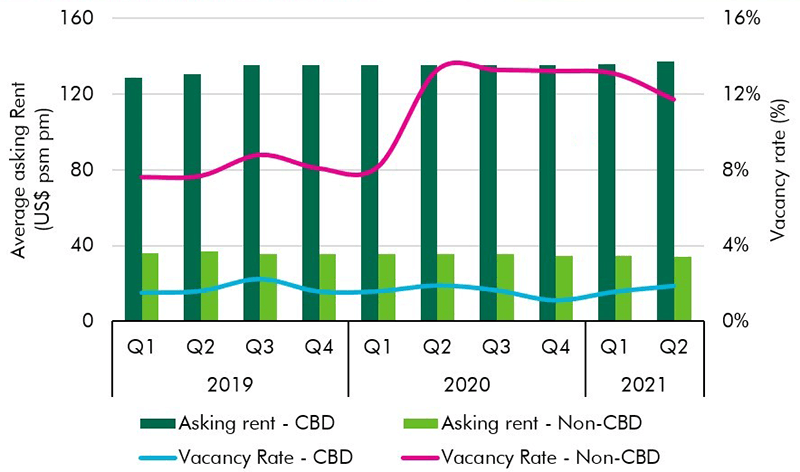

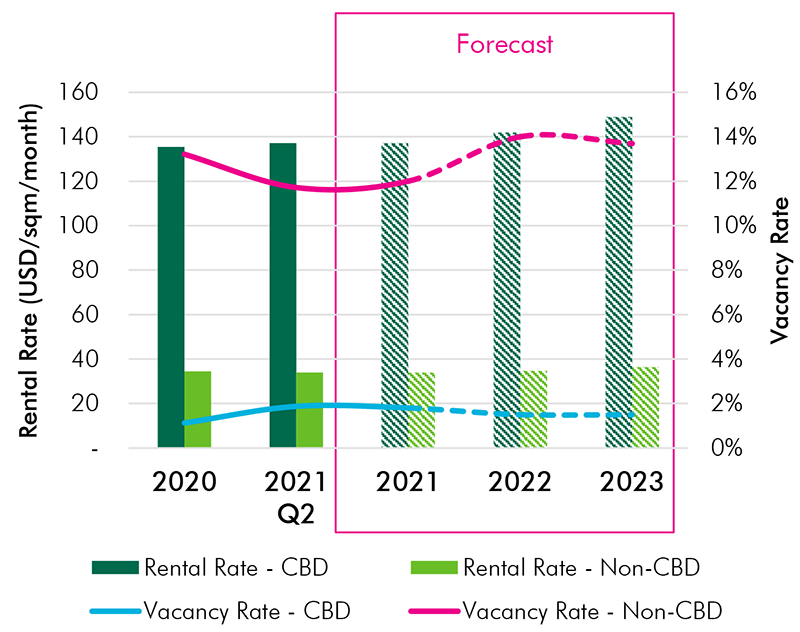

In Q2 2021, the vacancy rate in the non-CBD areas decreased by 1.4ppt q-o-q. As of Q2 2021, the vacancy rate for CBD and non-CBD areas were 1.87% (stable y-o-y) and 11.71% (down 1.7 ppts y-o-y), respectively. On June 2021, all shopping malls offer free rent and service charges for closed tenants; some landlords even offer 10%-50% rent reduction in May given the decrease in the number of footfall despite no forced closure, based on category. Some projects with vacant spaces that have not been filled for several quarters have lowered their asking rent.

As of Q2 2021, rental rate in the CBD is US$137.1 psm pm, up 1.1% q-o-q (and up 1.2% y-o-y) and rental rate in the non-CBD is US$ 33.9 psm pm, down 2.3% q-o-q (and down 5.2% y-o-y).

Big players continued to be active in the quarter. For example, Masan acquired 20% stake in Phuc Long to add to their new format of convenient store/coffee/banking combination. Nova F&B, an arm of Nova Group, continued partnering with Mango Tree after JUMBO, Crystal Jace Palace, Gloria Jean’s Coffee and others. These are activities in preparation that would benefit big players significantly once the pandemic is controlled and the economy revived. Smaller players, on the other hand, continued the struggle in waiting mode and streamline their operation to cut cost and shifting to an online platform, the trend which will continue more in the future; according to Euromonitor, online sales in Vietnam can grow double in five years.

The city is expected to have over 200,000 sqm of new retail spaces until 2023, both in CBD and non-CBD areas. In the short term, categories such as F&B, coffee chain, convenience store, health & beauty will continue to expand at retail podiums, opting more at residential blocks, before more shopping centres supply coming online. The market sentiment and consumer confidence is expected to recover rapidly once pandemic is thoroughly controlled as well as more vaccination is carried on throughout the nation.

Related news

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2019

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2019

Vietnam’s Economic Backdrop Quarterly Reports | Q2 2019