Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2020

VIETNAM'S ECONOMY

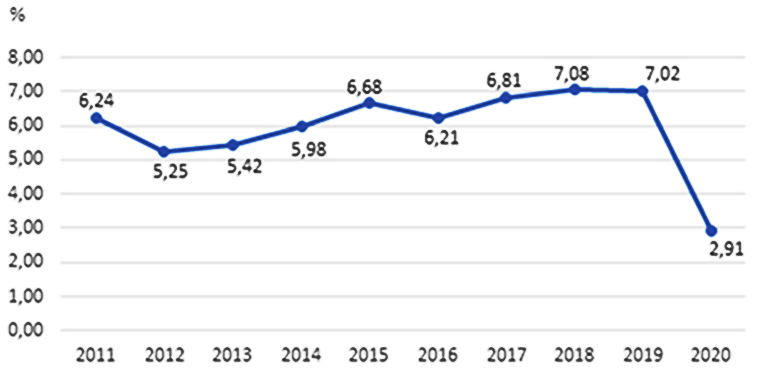

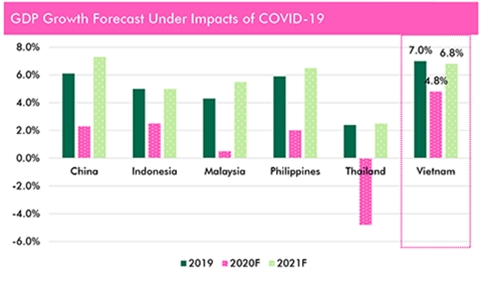

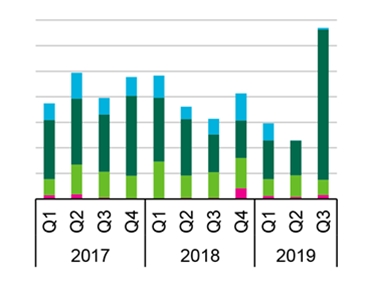

Vietnam General Statistics Office reports gross domestic product (GDP) in the fourth quarter of 2020 was estimated to increase by 4.48% over the same period last year, the lowest increase of the fourth quarter of each year in the period 2011-2020. General in 2020, GDP increased by 2.91% (in the first quarter, the second quarter, the third quarter and the fourth quarter increased by 3.68%; 0.39%; 2.69%; 4.48% respectively), although being the lowest increase of the period 2011-2020, but in the context of the COVID-19 pandemic happened complicatedly, negatively affecting all socio-economic fields, this is a great success for Vietnam with the growth rate in 2020 among the highest in the world. Some key socio-economic in 2020:

- Gross domestic product (GDP): + 2.91%

- Index of industrial production (IIP): + 3.4%

- Number of newly registered enterprises: 134,940 enterprises

- Retail sales of good and services: + 2.6%

- Investment: + 5.7%

- Total export of goods: + 6.5%

- Total import of goods: + 3.6%

- Trade surplus: 19.1 billion USD

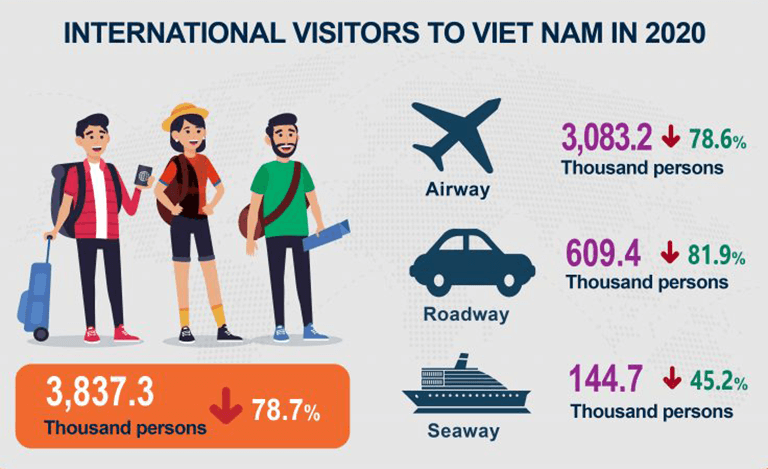

- International visitors to Vietnam: -78.7%

- Consumer price index: + 3.23%

- Core inflation: + 2.31%

OFFICE MARKET

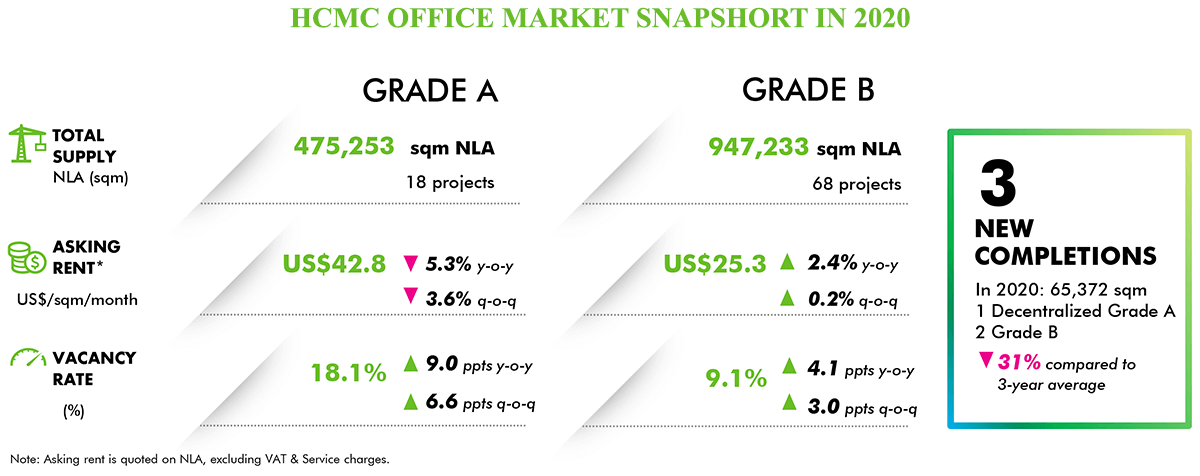

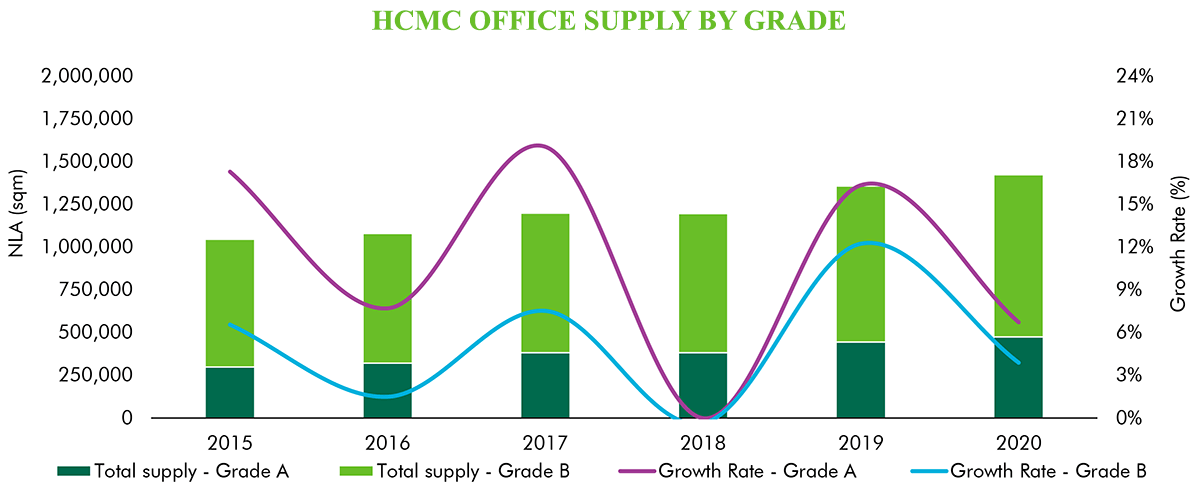

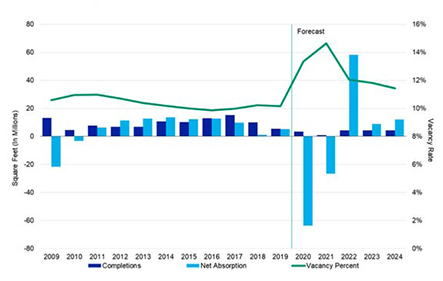

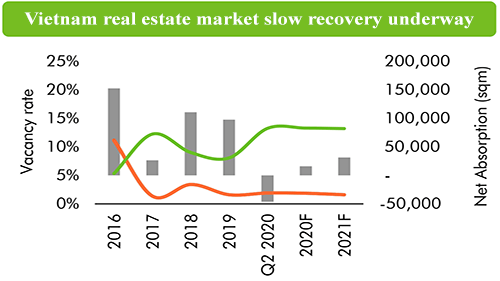

HCMC office market continued to go through a stagnation period in terms of performance due to COVID-19, which strongly affected many enterprises. In 2020, the market witnessed negative net absorption of -20,544 sqm NLA for both grades. Despite of the severity of COVID-19, HCMC office market still received three new office buildings in the reviewed year, with Friendship Tower (Grade B) in Q1 2020, UOA Tower (Decentralised Grade A) and Opal Tower (Grade B) in Q4, adding 65,372 sqm NLA to the current supply. The amount of new supply launched in 2020 is down by 31% compared to the average number of the past three years. As of Q4 2020, HCMC office supply reached 1,422,486 sqm NLA from 18 Grade A buildings and 68 Grade B buildings.

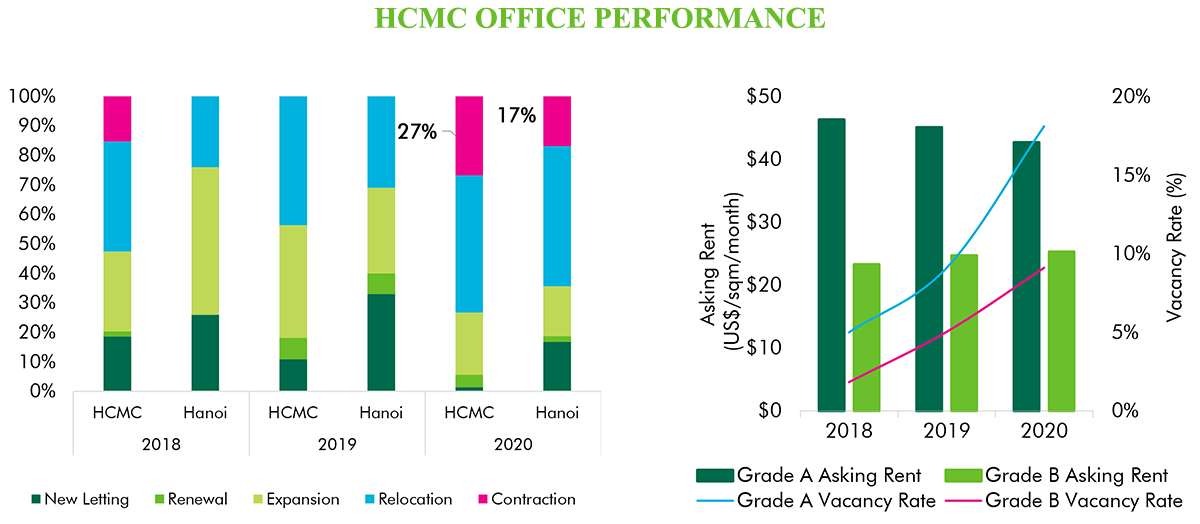

In 2020, Grade A vacancy was recorded at 18.1%, up 9.0 ppts y-o-y due to new supply launched to the market as well as many tenants in the reviewed year have contracted spaces either to exit the market or to relocate to cheaper options. Grade B vacancy also increased to 9.1%, up by 4.1 ppts y-o-y due to the introduction of Friendship Tower and Opal Office Tower. Additionally, some Grade B buildings in District 1 were recorded vacancy increase as some tenants scaled down spaces as well due to its currently high rental rate.

In the reviewed year, Grade A rent decreased by 5.3% y-o-y due the impact of UOA Tower, a new Decentralised Grade A building that offered an asking rent of US$23 psm pm, which is equal to half of the average asking rent of Grade A segment in the market. Landlords at some buildings also proactively adjusted asking rent downward to attract new tenants to back-up contracted spaces of old tenants. Some landlords maintained high asking rent but were more flexible in achieved rent, which allowing up to 20%-25% discount from the asking rent on top of flexible payment terms.

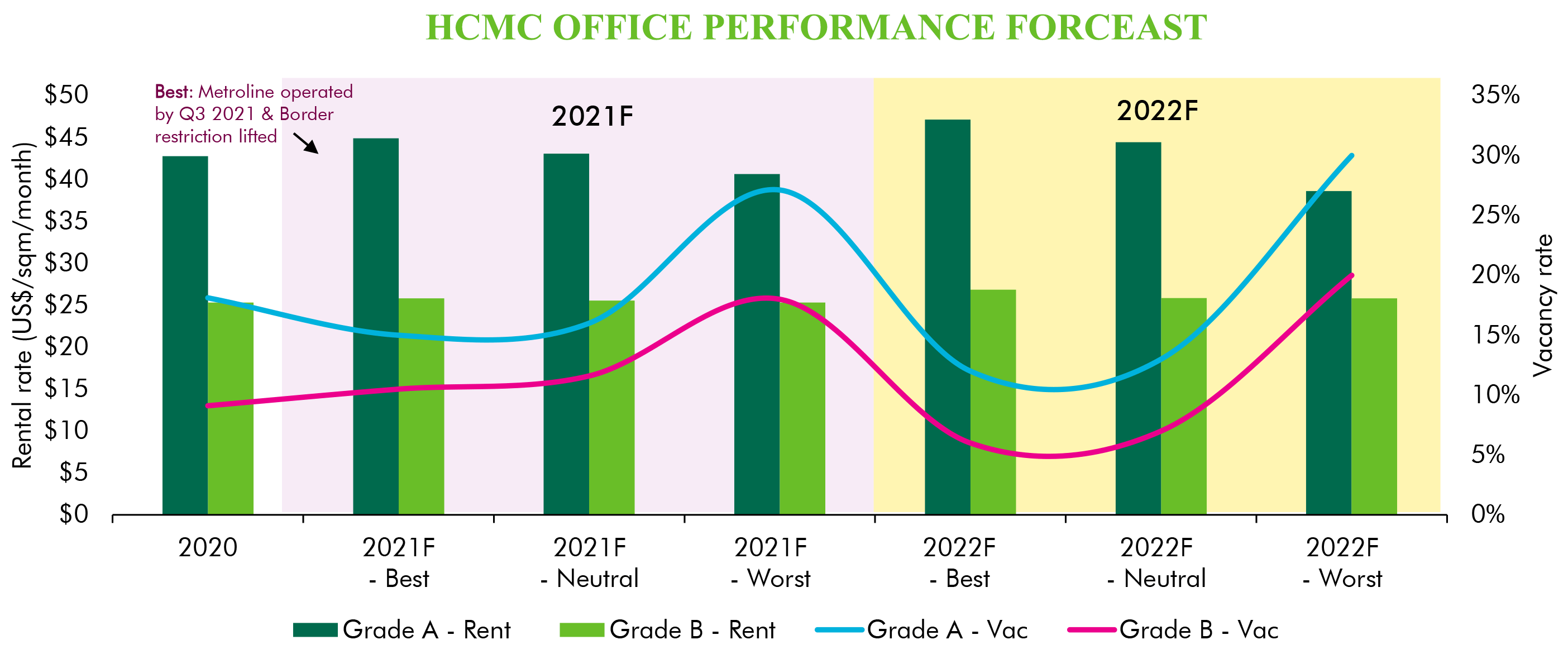

In 2021F and 2022F, the market is expected to have more than 150,000 sqm NLA from six new buildings of Pearl 5 Tower, Cobi Tower, The Graces, Saigon First House, Spirit of Saigon, and Etown 6. The pandemic is expected to be mitigated with the newly released vaccine and the market will start to recover in the next two years. Hence, although having more new supply, market performance is still projected to be positive. Rental rate of both grades will stay relatively stable with vacancy rates to gradually drop by years. Particularly, Grade A vacancy is forecasted to be 16% and 13% in 2021F and 2022F. Grade B vacancy is going to be 12% and 7% in the same projected years.

CONDOMINIUM, LANDED PROPERTY MARKET (READY-BUILT VILLA AND TOWNHOUSE)

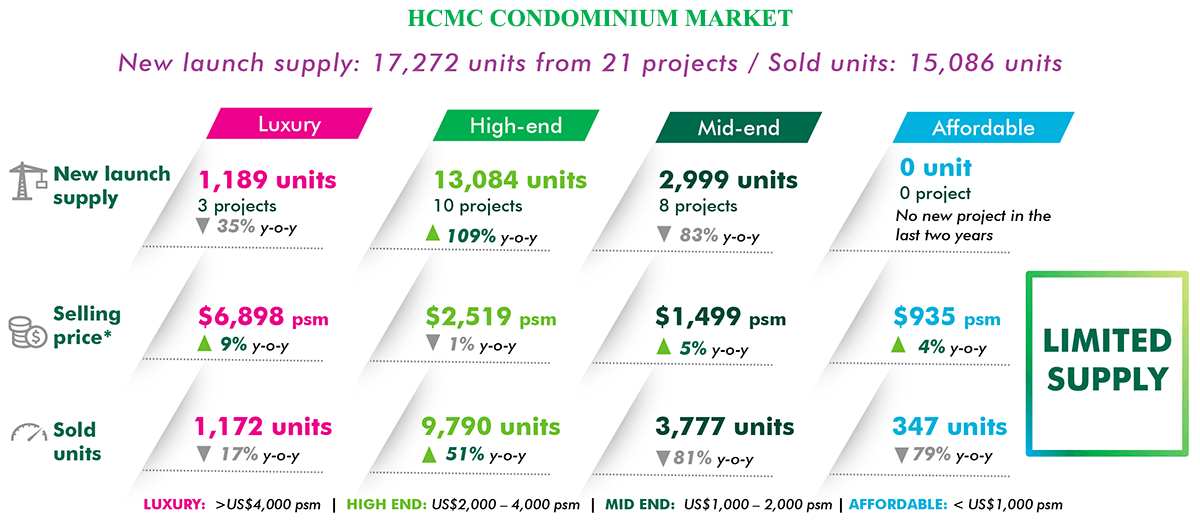

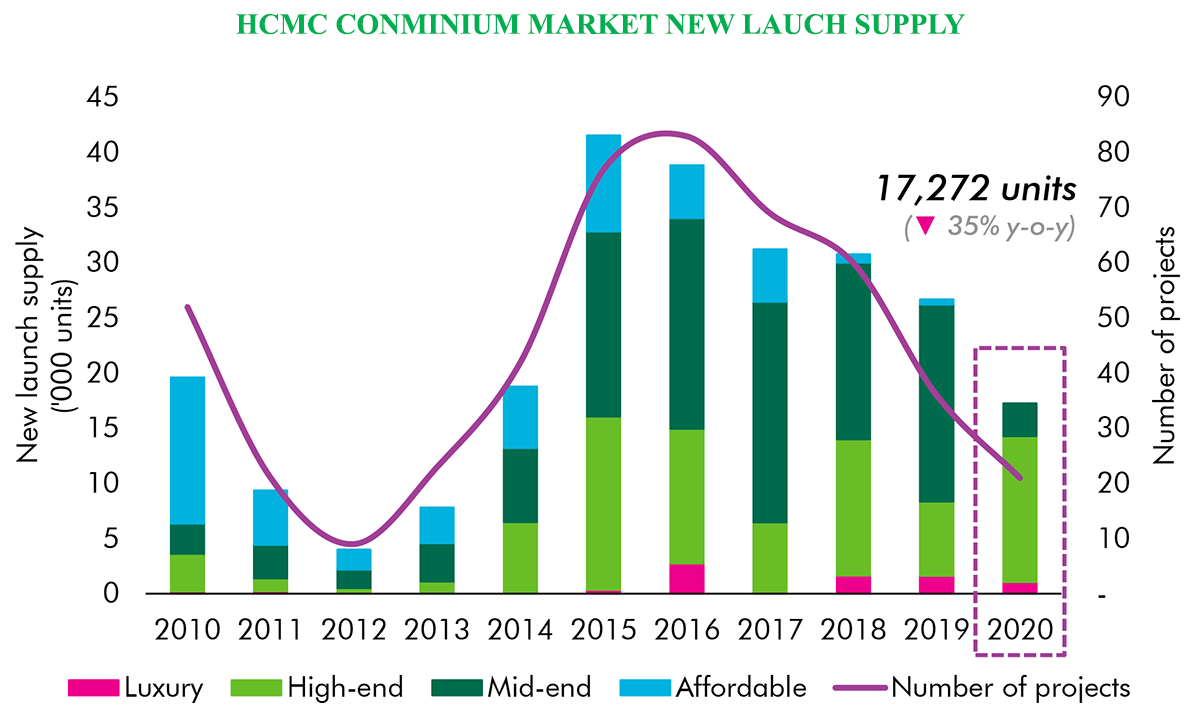

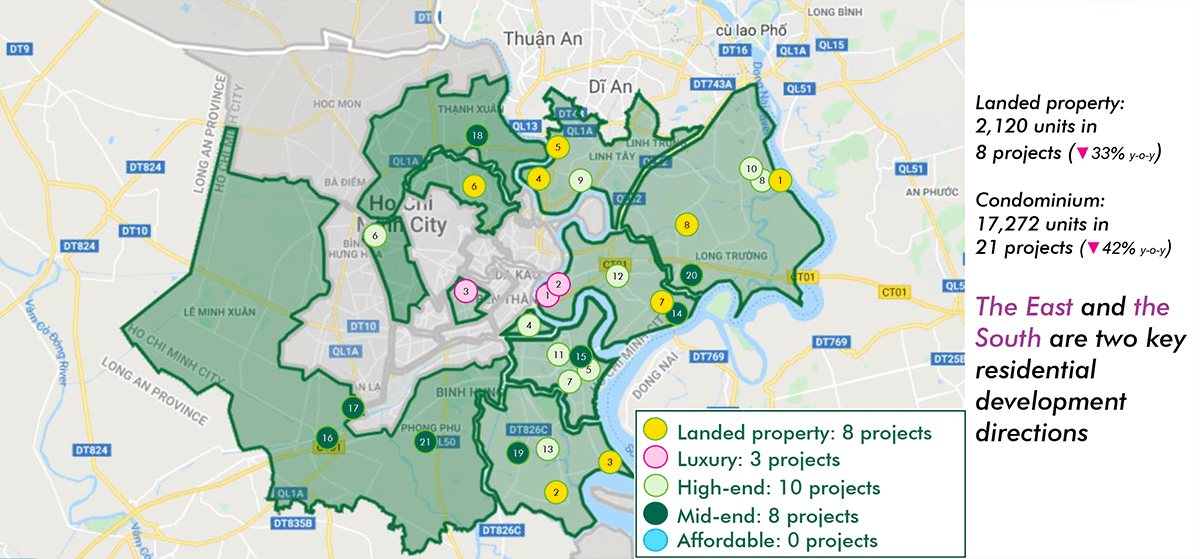

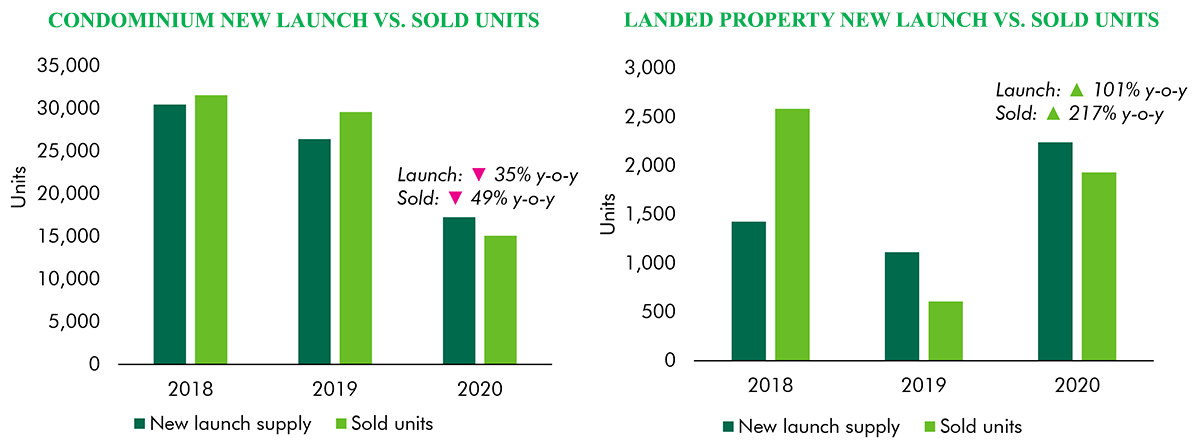

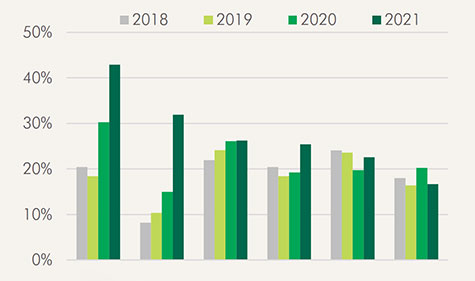

New launch supply by number of units in 2020 reached 17,272 units, a decrease of 35% y-o-y. This is the lowest number of supplies in the last six years. The market was on downward trend in five consequent years. A total of 21 projects were launch in 2020 compared to 36 projects in 2019. New launch supply in Q4 2019 were 6,696 units from six projects. In the context of limited supply, primary price increased significantly to new level, especially in suburban districts.

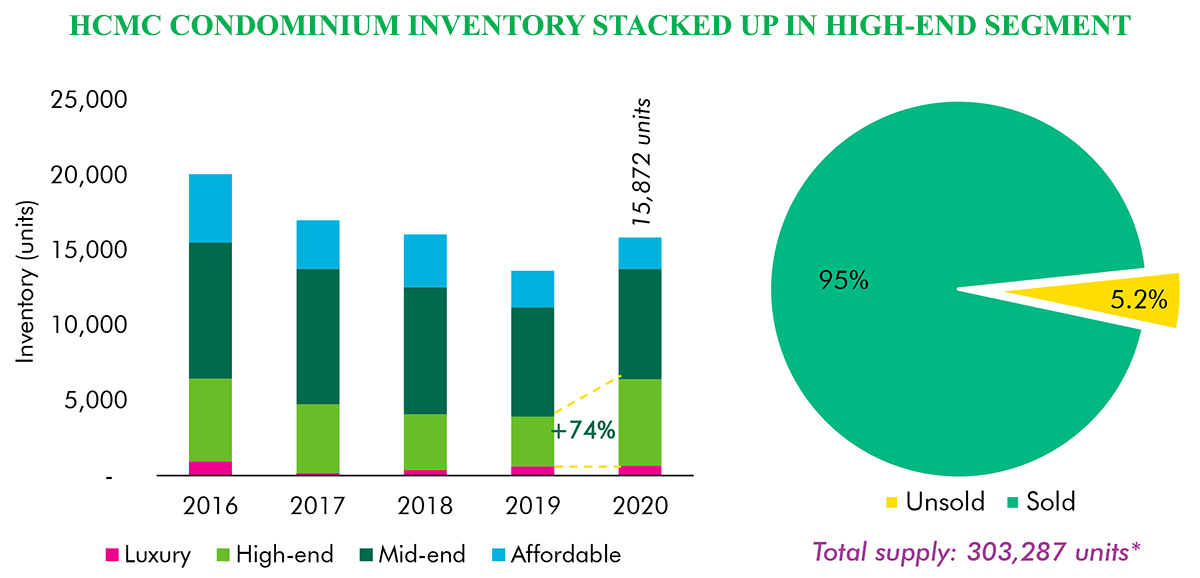

In terms of segment, there was no new affordable project while high-end segment recorded the highest proportion, 76% of total new launch supply, for the first time. Mid-end accounted for 17% and luxury segment accounted for 7% from two projects (The River and The Metropole).

In terms of location, the East area accounted for 91% of new launch supply by number of units and 43% by number of projects thanks to a township project in District 9. The official formation of Thu Duc city in 2021 is expected to transform the East area landscape and increase new launch supply. The South area accounted for 38% by number of projects and only 7% by number of units. No new supply in the Central and the North due to lack of land bank.

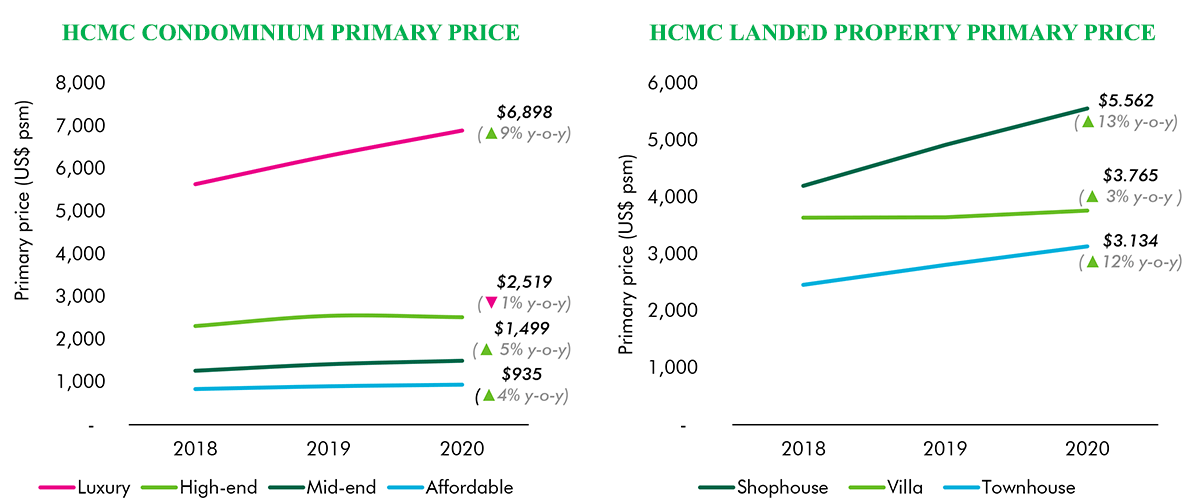

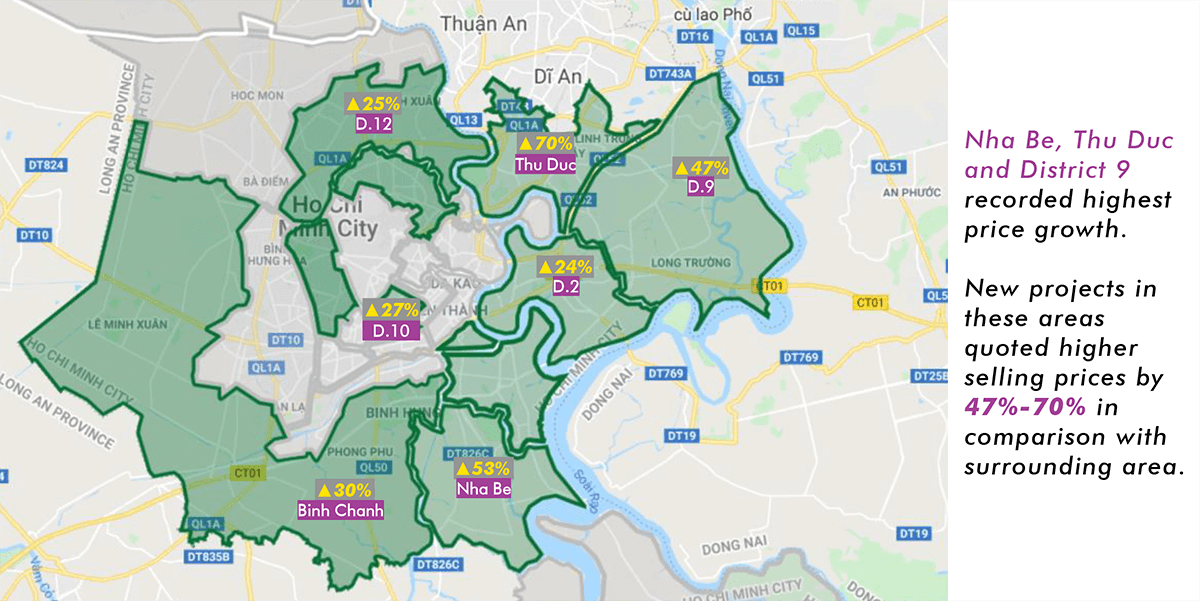

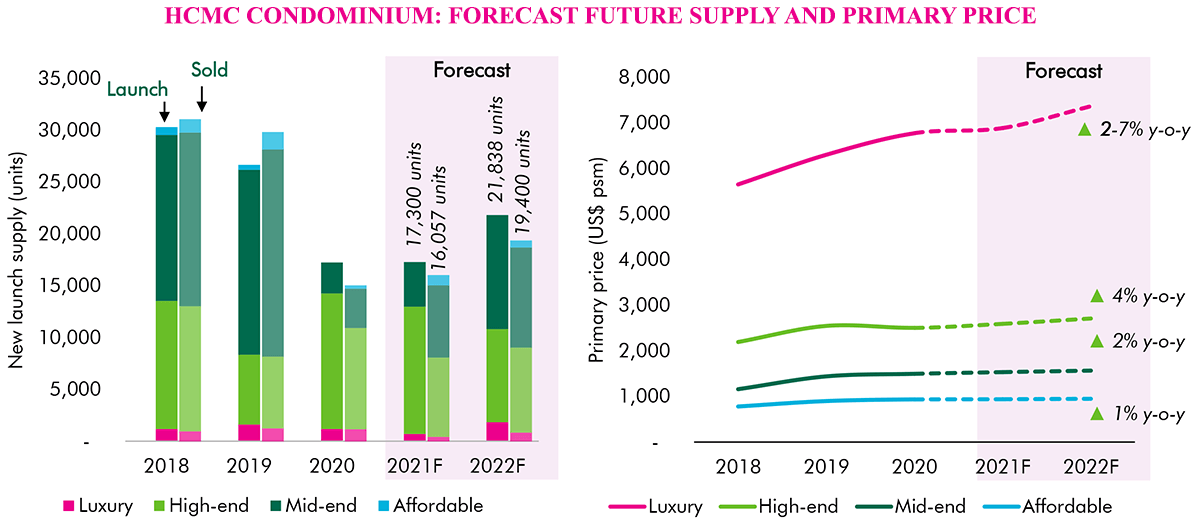

The average selling price for the primary market was at USD2,150 psm, up by 9% q-o-q and 13% y-o-y. Increases in primary price because of most of supply are high-end and luxury products. Furthermore, primary selling price of new launch supply in suburban districts increased by 20%-30% compared to current price levels in each location. Luxury primary price increased by 9% y-o-y which was the highest growth rate among four segments. High-end prices recorded a slightly reduction of 1% y-o-y because of new launched supplies in suburban districts had levelled up from mid-end to high-end segment. Average primary prices in mid-end and affordable increased by 5% and 4% y-o-y, respectively.

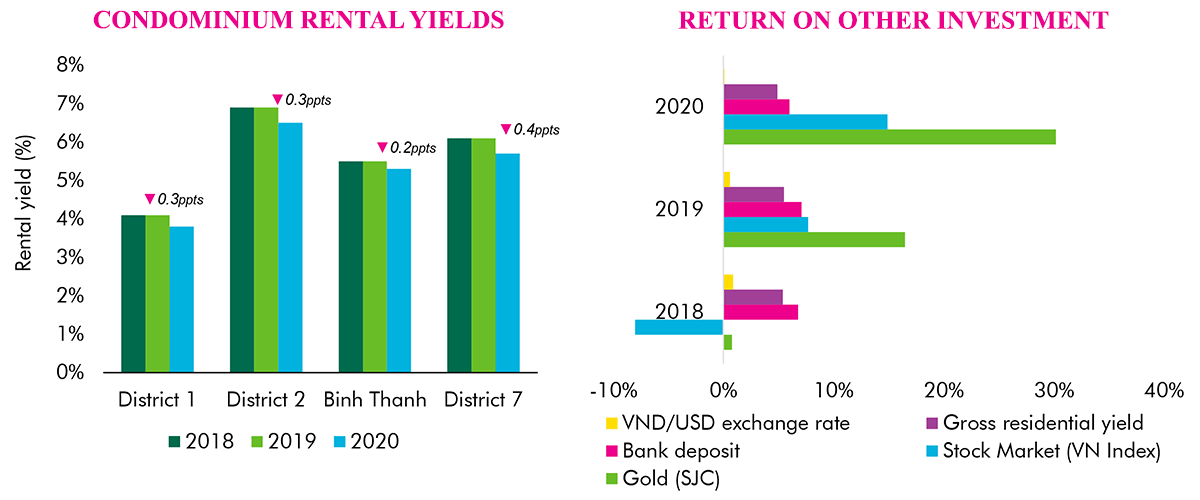

Sales performance was affected by high selling price and COVID-19. In terms of sold rate of newly launched project, only 75% of launched supply was sold which was lower than 90% in 2019. High-end inventory increased significantly by 74% y-o-y. Q4 2020 added 5,007 sold units to achieve a 2020 total of 15,086 sold units, a reduction of 49% y-o-y. Limited supply in primary market led to more active secondary market, especially in the East districts including District 2 (Thu Thiem, An Phu, Thanh My loi) and Binh Thanh District. Secondary selling prices in these locations increased by 30%-50% compared to launched prices.

In 2021, there will be no significant change in the market, however, the market will improve. It is expected to welcome approximately 17,500 units in suburban districts including subsequent phases of Vinhomes Grand Park, Masterise Centre Point (District 9) and first launching event of Masterise Lumière Riverside, Laimian City (District 2) in the East; AIO City (Binh Tan) in the West; Pi City (District 12) in The North; and the South area with subsequent phases of Sunshine City Saigon, Sunshine Diamond River (District 7) and Celesta Rise (Nha Be).

Primary prices will continue to increase with slower pace to absorb remaining units. Primary prices will increase by 1%-4% y-o-y in all segment except luxury segment. Luxury segment will increase by 2%-7% in 2021 and 2022 thanks to branded residence projects in District 1.

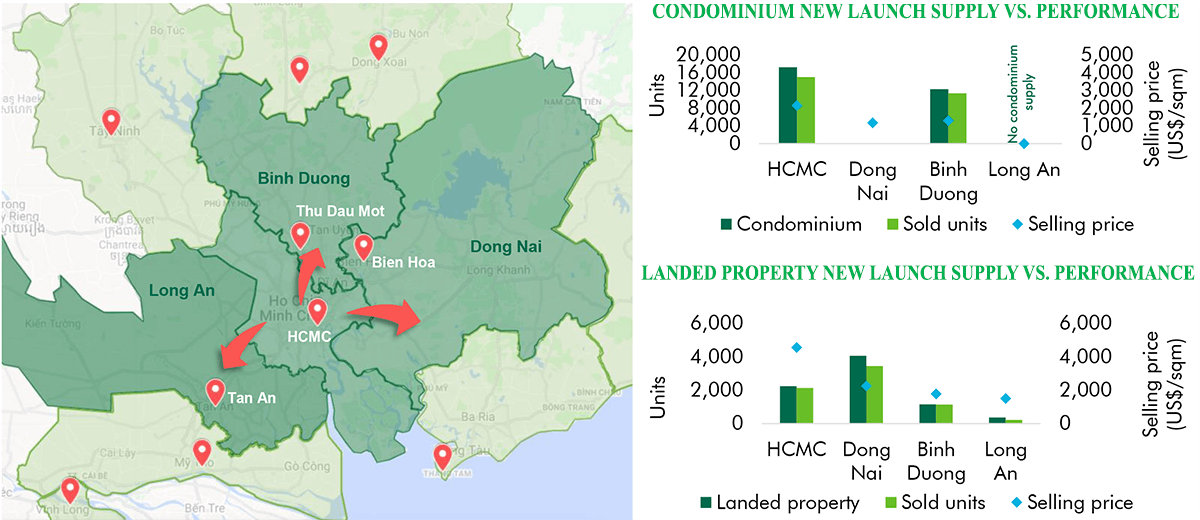

Taking a wider view to surrounding provincial markets, limited supply in HCMC will force buyers to look for investment opportunity in Binh Duong, Dong Nai and Long An. These markets are expected to grow further in 2021.

Condominium ranking criteria:

- Luxury: projects that have primary prices over US$4,000 psm

- High-end: projects that have primary prices from US$2,000 psm to US$4,000 psm

- Mid-end: projects that have primary prices from US$1,000 psm to US$2,000 psm

- Affordable: projects that have primary prices under US$1,000 psm

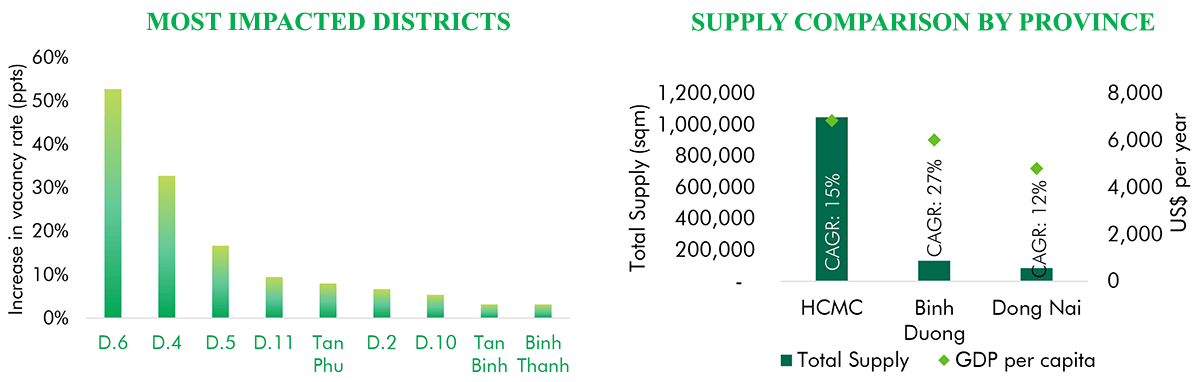

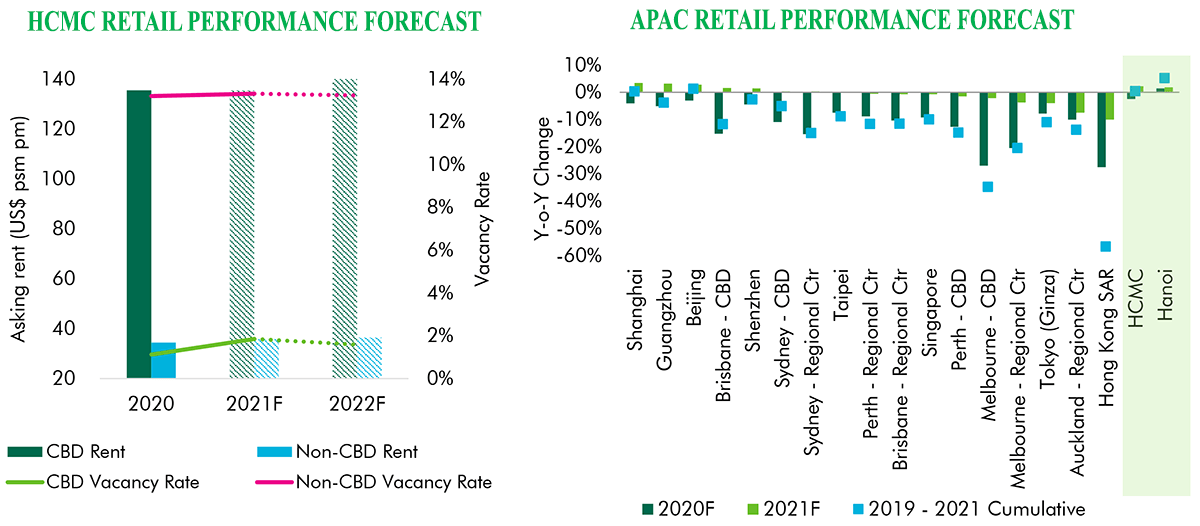

RETAIL MARKET

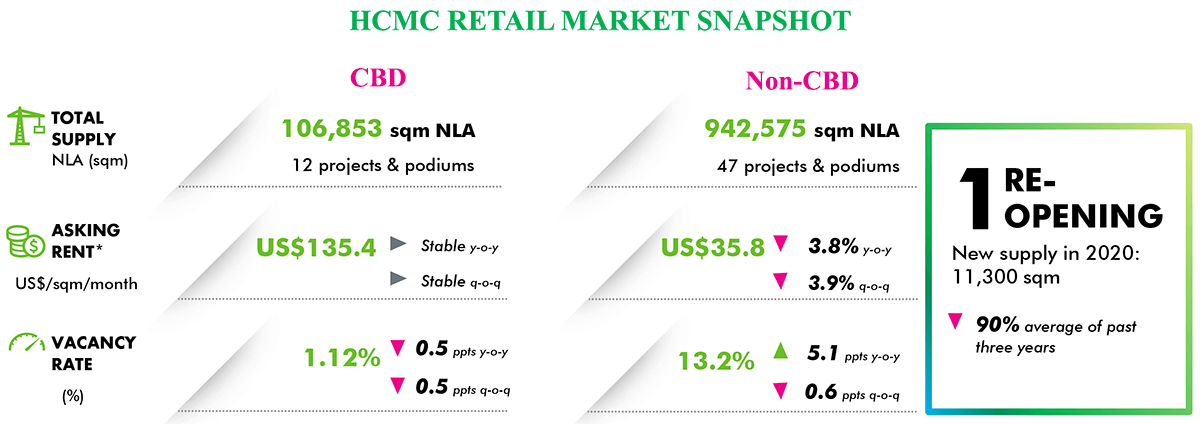

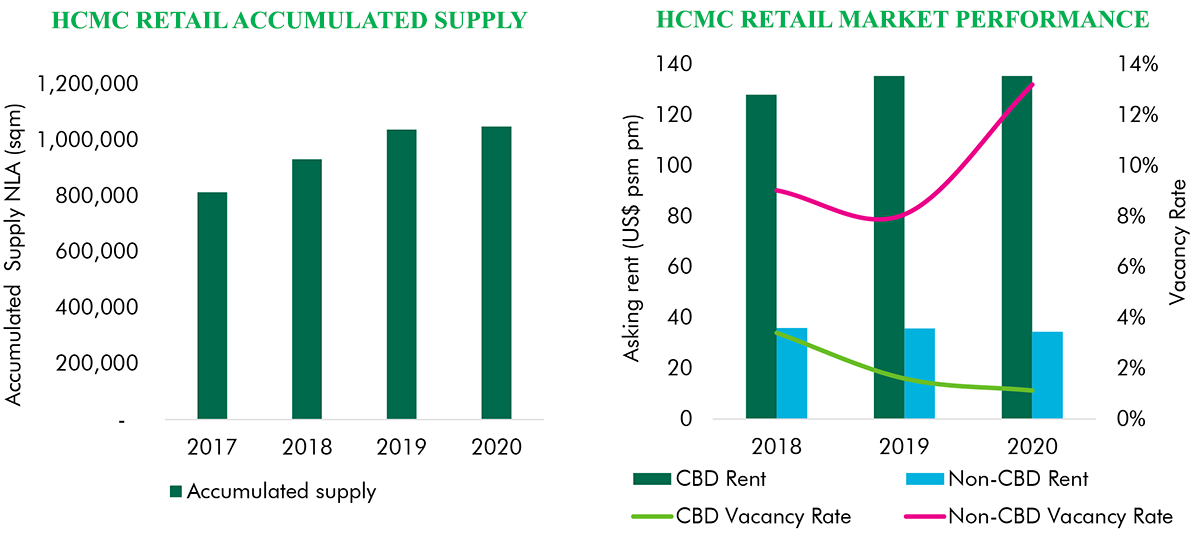

There was not any new project in 2020 for HCMC retail market. However, the department store project of Parkson in District 1 was re-open in Q4 2020 with two new anchor tenants which are MUJI and Kohnan, next to the flagship store of Uniqlo opened previously. Therefore, new NLA in 2020 is 11,300 sqm, which is 90% lower than average amount of new supply in the past three years. As of Q4 2020, total new NLA in the market is 1,049,023 sqm.

In Q4 2020, continuing the market recovery trend, vacancy rate improved in both CBD and non-CBD areas. Vacancy rate in the CBD was kept as low as 1.1% due to limited supply. Meanwhile, vacancy rate in the non-CBD was slightly down by 0.1 ppt q-o-q yet was up 5.1 ppts y-o-y and stood at 13.2% at the end of 2020.

In Q4 2020, shopping centres in the non-CBD started to decrease their asking rental rate, mostly by 3-5% q-o-q while there were some other projects had to drop their rate by 8-15%. However, these are projects that had had low level of traffic as well as vacancy rate of over 15% at pre-COVID area. Rental rate in the CBD was kept stable, meanwhile. As of Q4 2020, asking rent in CBD was US$135.5 psm pm, stable y-o-y and q-o-q. Asking rent in non-CBD was US$34.4 psm pm, down by 3.9% q-o-q and down by 3.8% y-o-y.

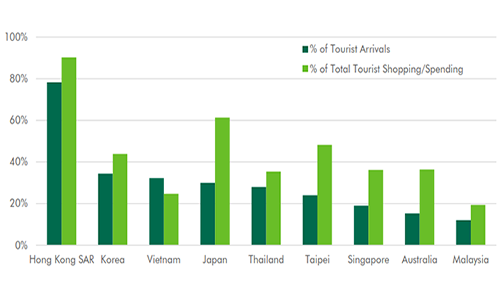

In 2021, the market will receive almost 60,000 sqm NLA from the re-opening of Union Square in District 1 and the new opening of Socar Shopping Mall in District 2. Rental rate and vacancy rate are expected to be stable in first half of 2021 before clearer signs of recovery in terms of leasing activities and market performance to be shown in the second half of the year. Top leading categories continue to be F&B, Fashion & Accessories while other categories such as Automotive, Home Décor and Furnishing, Luxury, etc. will further their expansion demand.

From 2022 onwards, most of future supply will be clustered in the East as well as the CBD area. The coming of Metroline No. 1 is expected to bring new level of rental rate in the CBD area. In the following five years, the market expects to have over 500,000 sqm of NLA coming online.

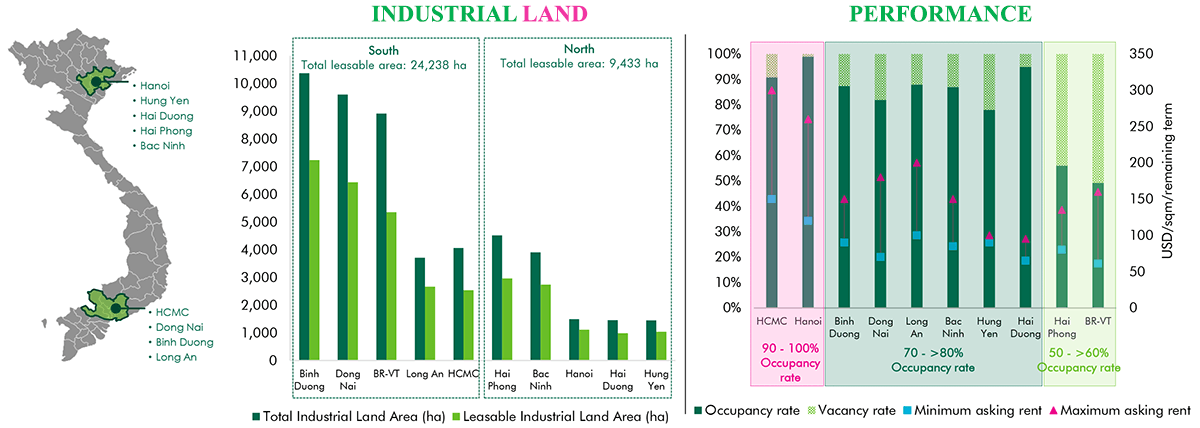

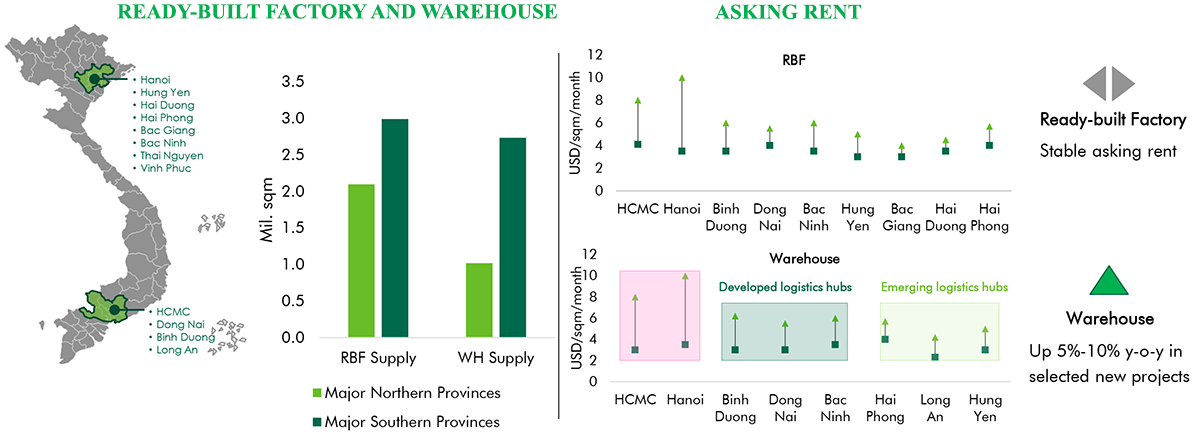

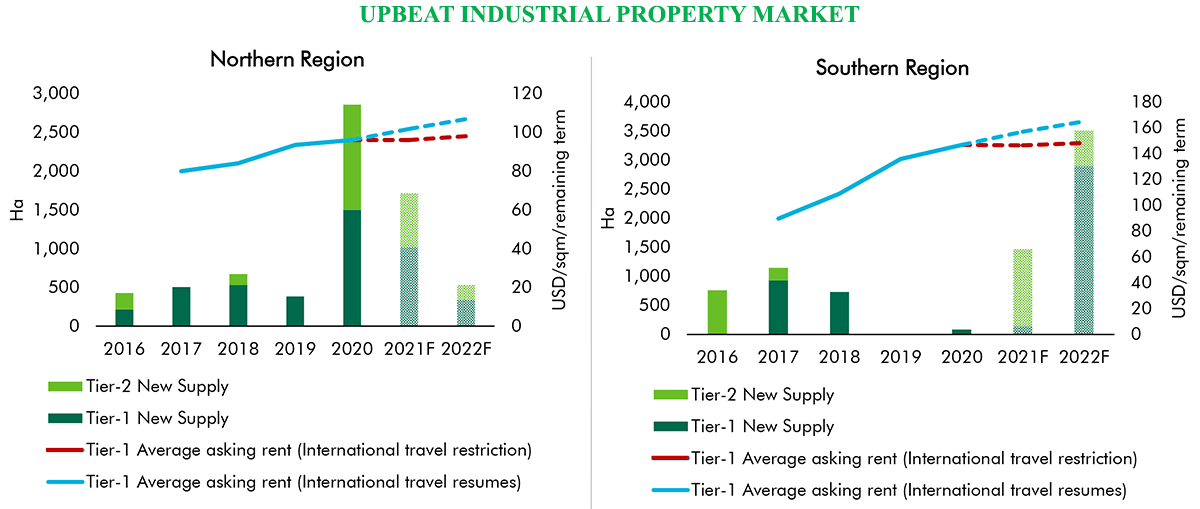

INDUSTRIAL REAL ESTATE MARKET

Ho Chi Minh City industrial market is the only real estate sector that witnessed positive progress in both rental rates and occupancy rates. As of Q4 2020, average occupancy rates of existing industrial parks in four key Southern industrial cities and provinces (HCMC, Binh Duong, Dong Nai and Long An) reached 87.0%, a 2.5 ppts increase y-o-y.

Due to the production movement from China as well as EVFTA, demand for industrial land is increasing across Vietnam. Asking rents in some industrial parks in Ho Chi Minh City, Binh Duong, Dong Nai and Long An increased from 20% to 30% y-o-y.

With its resilience during the pandemic, the industrial sector in Vietnam became an attractive opportunity for both international and local players. In 2020, despite the pandemic, international warehousing giants such as GLP, LOGOS, and JD.com entered and heavily invested in both Northern and Southern of Vietnam. Vingroup, a major local real estate developer, recently joined the market with two new industrial parks expected to be ready in 2021.

Related news

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2019

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2019

Vietnam’s Economic Backdrop Quarterly Reports | Q2 2019