Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2021

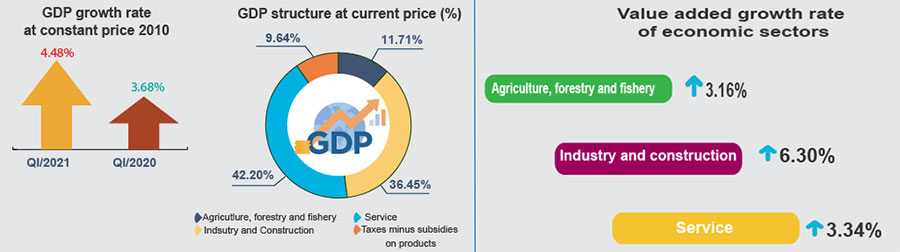

VIETNAM'S ECONOMY

Gross domestic product (GDP) in the first quarter of 2021 is estimated to increase by 4.48% over the same period last year, higher than the growth rate of 3.68% in the first quarter of 2020, showing the adaptability and resistance to and the trend of economic recovery is increasing.

First quarter committed FDI inscreased 18.5% year-on-year, while disbursed FDI was up 6.5% period last year.

- Gross domestic product (GDP): + 4.48%

- Index of industrial production (IIP): + 5.7%

- Number of newly established enterprises: 29.3 thousand enterprises

- Total retail sales of consumer goods and services: + 5.1%

- Realized investment capital: + 6.3%

- Total export turnover of goods: + 22%

- Total import turnover of goods: + 26.3%

- Trade surplus: 2.03 billion USD

- International visitors to Vietnam: -98.7%

- Average consumer price index (CPI): + 0.29%

- Core inflation: + 0.67%

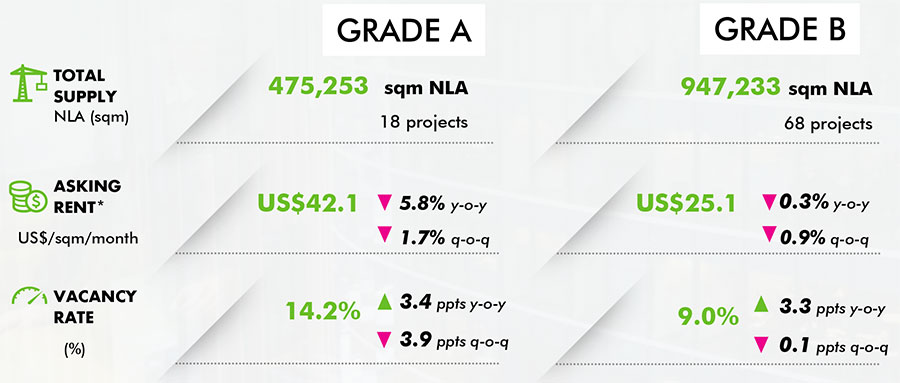

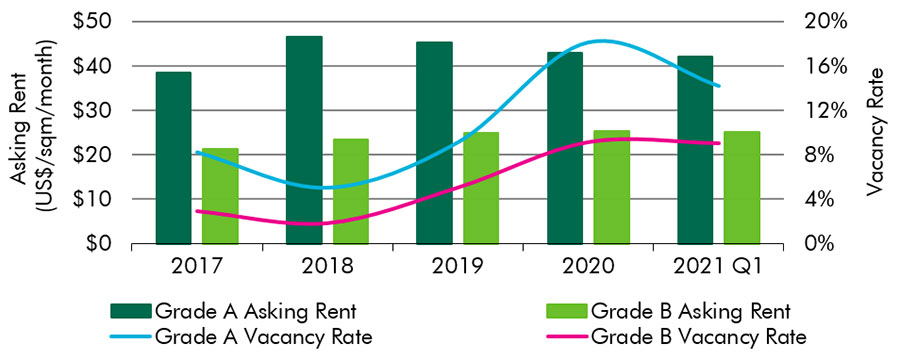

OFFICE MARKET

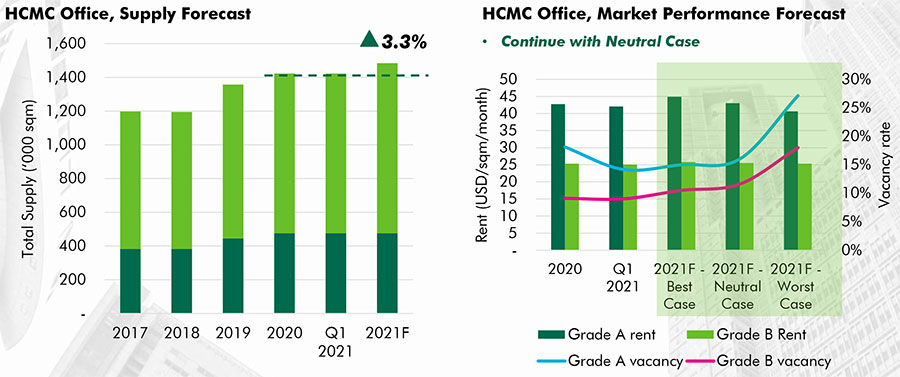

In Q1 2021, HCMC office market had no new supply. The existing supply remained at 2020 level which was 1,422,486 sqm NLA from 18 Grade A buildings and 68 Grade B buildings.

Total net absorption in the quarter was 19,655 sqn NLA, mostly from Grade A sectors, bringing the vacancy rate of Grade A sector down by 3.9 ppts q-o-q. The average vacancy rate for Grade A sector was 14.2% and for Grade B sector was 9.0%.

The rental rate of Grade A sector was at US$42.1/sqm/month and the rental rate of Grade B sector was at US$25.1/sqm/month. The decreasing trend has slowed down in both sectors. On average, the rental rate of Grade A sector decreased by 1.7% q-o-q. For Grade B sector, the average rent rate decreased by 0.9% q-o-q, also resulted from newly vacant spaces in the quarter.

HCMC forecast in 2021, we expect a new supply of 74,000 sqm NLA office from five Grade B buildings which were AP Tower, Pearl 5 Tower, Cobi Tower, The Graces and Saigon First House. Until 2022, we expect to have two new Grade A buildings coming online and next by 2023, over 333,000 sqm NLA from 19 new projects is scheduled to enter.

CONDOMINIUM MARKET

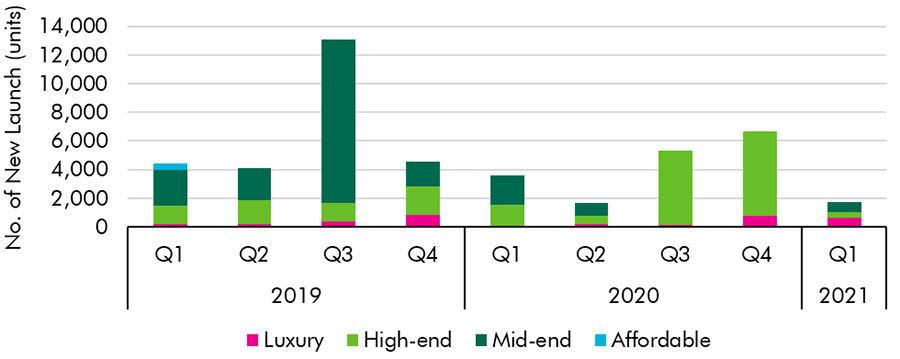

In Q1 2021, a total of 1,709 units were launched, a decrease of 74% q-o-q and 53% y-o-y. This is one of the lowest numbers of supplies per quarter in the last three years.

High-end and luxury projects continued to lead the market in terms of new launch supply while mid-end and affordable supplies were limited. Mid-end accounted for 41% of total supply compare to 55% - 60% in previous years. The luxury segment ranked second with 39% of the total new launch supply. High-end accounted for 20% and no new supply in the affordable segment.

In terms of location, the East area accounted for 47% of the new launch supply by total number of units, followed by The South with 36%. There were very limited supply in the West and The Central areas which accounted for 14% and 3%, respectively. The Central area has limited supply due to limited land banks and licensing issues.

The average selling price for the primary market was US$2,219 psm, up by 2.9% q-o-q and 14.6% y-o-y. The increase in primary price was due to most supplies have good locations. Also, these projects offered better handover conditions, better facilities and supporting payment terms.

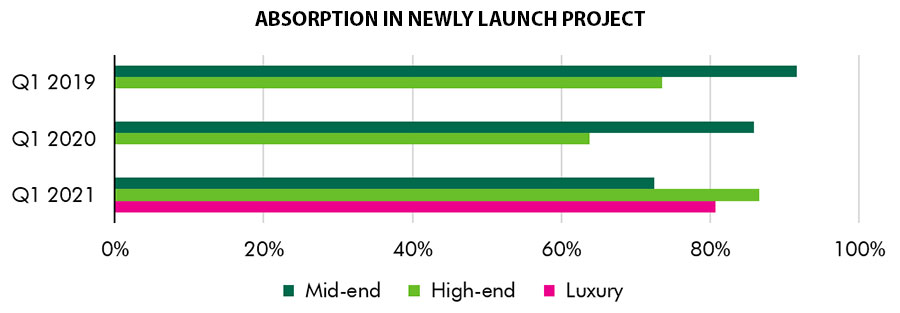

In Q1 2021, a total of 2,624 units were sold, a reduction of 48% q-o-q and 31% y-o-y. This number is much higher than the new launch supply in Q1 2020. Limited supply in the primary market was the main reason for the reduction in sold units. The absorption rate of newly launched projects was good which was 80% on average.

In 2021, there will be no significant change in the market, however, the market will improve. It is expected to welcome approximately an annual total of 17,500 units from new projects in suburban districts: District 9, District 12, Binh Tan District, and Nha Be rural district.

Primary prices will continue to increase at a slower pace so the market could absorb the remaining units. Primary prices will increase by 1% - 4% y-o-y in all segments except the luxury segment. The luxury segment will increase by 2% - 7% in 2021 and 2022 thanks to new branded residence projects (Grand Marina) in District 1. Sold units are expected to reach 15,700 units and 19,400 units in 2021 and 2022, respectively.

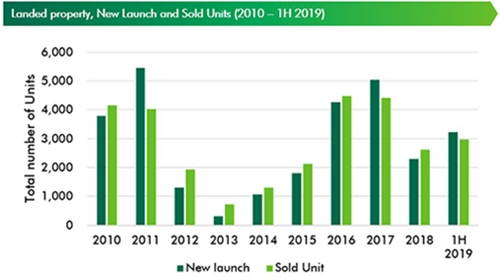

LANDED PROPERTY (READY-BUILT VILLA AND TOWNHOUSE)

Urban area

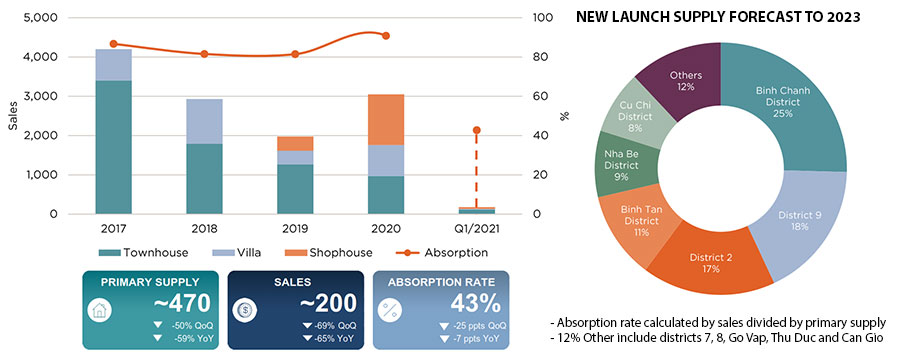

In Q1 2021 primary supply of over 470 dwellings was at its lowest level in 5 years, down -50% q-o-q and -59% y-o-y. One hundred and eighty units were from newly launched projects, with the remaining 63% representing unsold inventory.

Limited landed housing supply is expected to continue, with the HCMC Housing Plan to 2030 prioritizing high-rise development. In the last decade, low-rise products have accounted for less than 10% of new housing; this rate is targeted to continue decreasing from 2021 onwards.

In Q1 2021, total sales of 200 were down -69% q-o-q and -65% y-o-y. New launches accounted for 42% total sales; Townhouses dominated with 67% of sales.

Quarterly absorption of 43% was down -25 ppts q-o-q and -7 ppts y-o-y. Performance struggled under limited new supply and increasing proportions of inventory being either older or priced at over US$2,000,000.

First quarter Real Estate credit growth of 2.13% was higher than national average level of 2.04%, due to mortgage rates regularly being reduced by 0.3-2 ppts. Positive economic forecasts encourage brighter prospects for landed property. Last year, GDP growth of 3% made Vietnam the lead-performing Asian economy, with forecast annual growth of almost 7% over the next five years, according to the Ministry of Planning & Investment.

Vision suburbia

By 2023, nearly 9,200 new units are expected. Binh Chanh is scheduled to receive 25% of this new supply, followed by District 9 with 18%, and District 2 with 17 percent.

The announced pipeline generally aligns with HCMC Housing Planning to 2030. New low-rise projects are focused to Districts 7, 9, 12, Thu Due and Binh Tan; and suburban Districts, Binh Chanh, Nha Be, Can Gio, Cu Chi, and Hoc Mon. Any later projects in these large land-banked Districts are likely to be developed in tandem with infrastructure improvements.

RETAIL MARKET

In Q1 2021, there was not any new supply. Total supply was at 1,049,023 sqm NLA, similar to the level of previous quarter. According to General Statistics Office, total retail and services turnover in Q1 2021 is on a good recovery track.

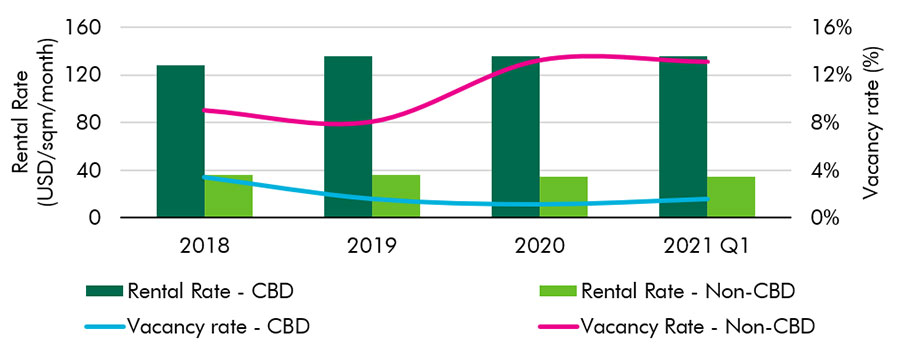

The rental rate in the CBD is stable in the quarter while the rental rate in the non-CBD slightly decreased by 0.7% q-o-q. In general, asking rent has recovered to the level before COVID-19 but most landlords now wait for more signs of market recovery before starting picking up rent again.

In terms of vacancy rate, the vacancy rate in the CBD slightly increased by 0.45 ppt yet the newly vacant spaces are expected to be filled soon in the next 1-2 quarters due to limited supply. In the non-CBD area, the vacancy rate decreased by 0.16 ppt q-o-q yet still 5 ppts higher than the previous year.

By 2025, the market is expected to welcome over 550,000 sqm of new retail NLA. However, the opening dates of most shopping centres are being postponed by impaired leasing demand.

Related news

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2019

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2019

Vietnam’s Economic Backdrop Quarterly Reports | Q2 2019