Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2019

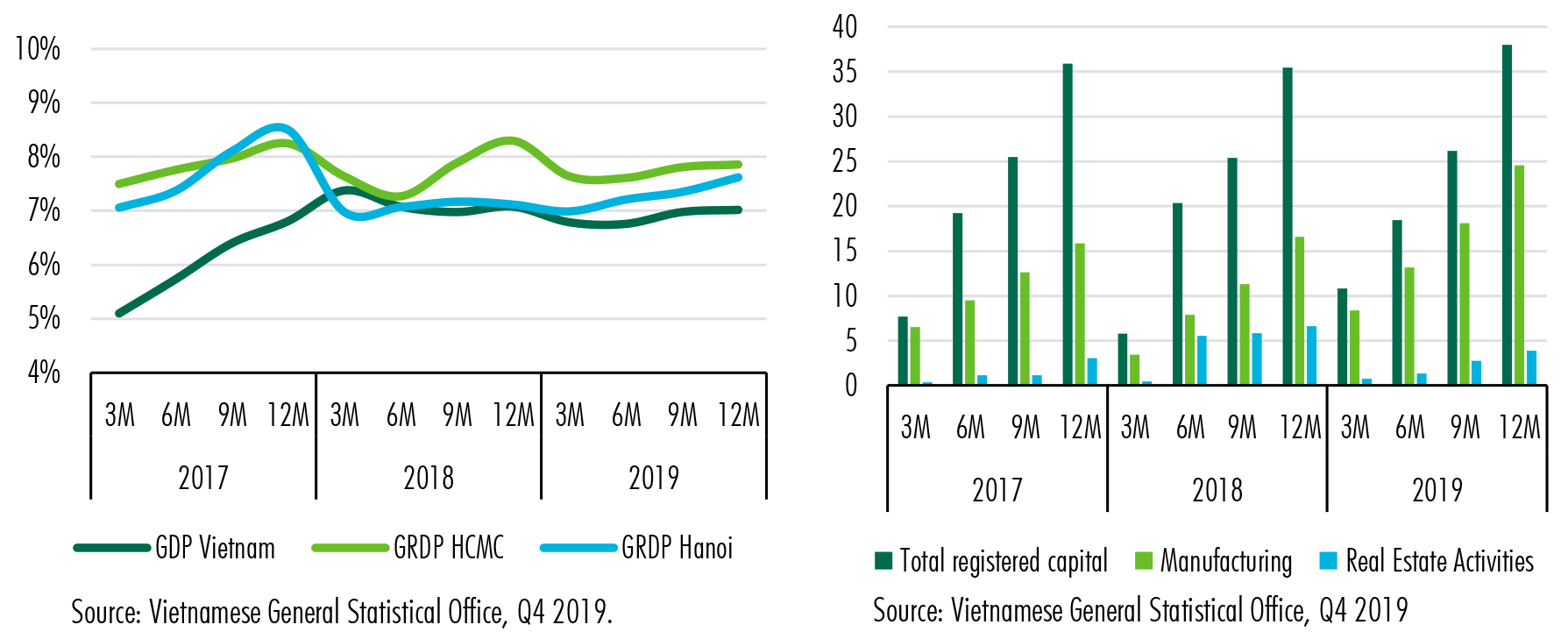

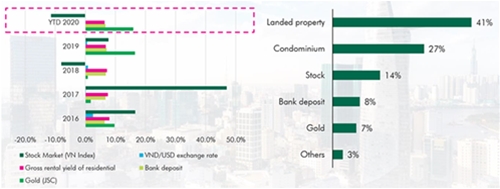

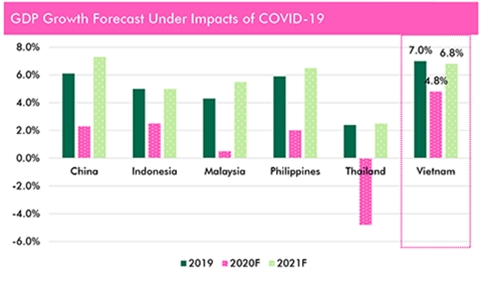

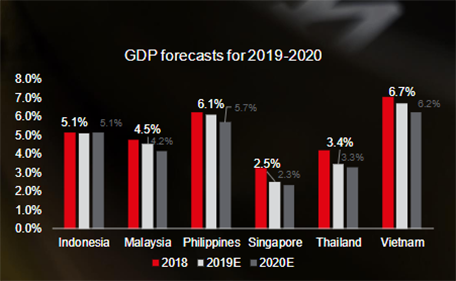

‘GDP’ Growth of Vietnam’s economy stayed strong: When global trade is deteriorating due to trade and geopolitical tensions, Vietnam has become a rising star with the 2019 real GDP growth rate (GDP at 2010 price) reaching 7.02%, higher than the government’s expectation at the beginning of the year. This high growth was driven by strong export activities (Total export values was US$263.5 billion and import value was US$253.5 billion), leading to the highest trade surplus since 2016 with US$9.9 billion.

‘CPI’ remained stable: Vietnam's average CPI inched up 2.79% y-o-y in 2019, which was the lowest in the past three years. The increase was mainly due to

The price of electricity was raised from March 20, 2019, along with the increase in electricity demand in hot weather;

Provinces lifted the price of health services according to Circular No. 13/2019 / TT-BYT dated July 5, 2019;

A number of provinces adjusted up tuition fee for the new school year, leading to the price index in this group up 6.73% yoy. Moreover, the increase in food prices including pork (11.79%), drinks and cigarettes (1.79%) and public transport services (3.02%), etc. were also contributing factors.

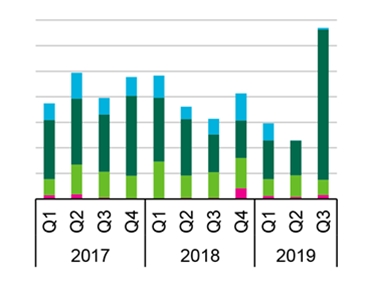

‘FDI’ Vietnam’s FDI registered new growth: Total FDI pledged to the country reached US$38.02 billion in 2019, an increase of 7.2% y-o-y. Specifically, the total newly registered capital reached US$16.75 billion, equivalent to 93.2% of the level recorded in the same period last year. FDI disbursement was recorded at US$20.38 billion in 2019, an increase of 6.7% y-o-y. Among the 19 invested industries, processing and manufacturing remained the most attractive sector, recording US$24.56 billion, accounting for 64.6% of the total capital. Real estate ranked second with US$3.88 billion, making up 10.2% of total capital, followed by whole sales and professional, scientific activities. South Korea took the lead among 125 markets investing in Vietnam in 2019, with a total of US$7.92 billion, accounting for 20.8% total capital. It was followed by Hong Kong SAR (China) and Singapore with US$7.87 and 4.5 billion respectively.

‘International arrivals’ In terms of tourism, Vietnam remained an attractive destination for tourists with more than 18 million international visitors in 2019, an increase of 16.2% y-o-y, according to the Vietnam National Administration of Tourism.

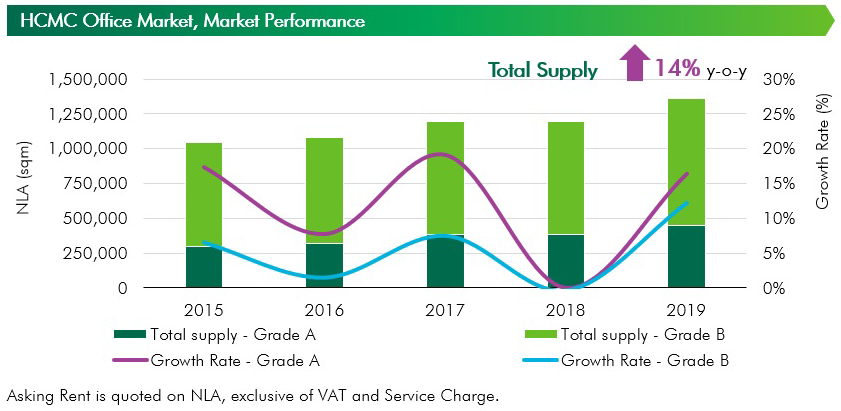

Office Market

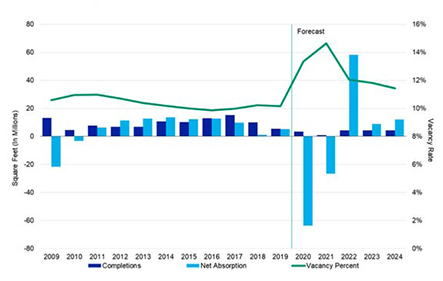

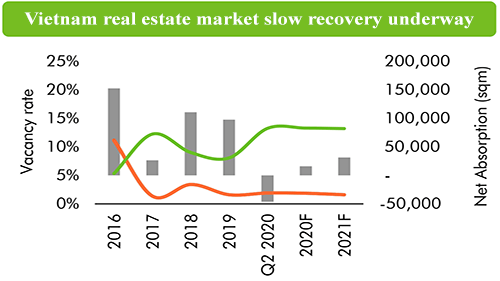

2019 saw major growth in HCMC office supply, welcoming a total of seven new office towers. Of the seven, two were Grade A buildings (Lim Tower 3 and Phu My Hung Tower) and the other five were Grade B buildings (Sonatus Building, Viettel Tower B, Etown 5, Sofic Tower, OneHub Saigon 1). By the end of 2019, total supply by NLA of the market stood at 1,357,114 sqm for both grade A and B segments. Grade A supply significantly increased by 16% y-o-y and that for Grade B was up by 12% y-o-y.

In Q4 2019, average rental rate of Grade A was recorded at US$45.15 psm pm, down 2.7% y-o-y. The slight drop was due to the influence decentralized Grade A offices, which offered asking rent equivalent to 50-60% of asking rent of Grade A in CBD. If leaving aside all decentralized Grade A office buildings, CBD - Grade A average rent remained relatively stable, recording an increase of 1% y-o-y.

On the contrary, Grade B rents continued to show greater growth than that of Grade A. In the reviewed quarter, Grade B average rent was recorded at US$24.73 psm pm, up 6.1% y-o-y thanks to high demand in this segment driven by many affordable and good-quality projects in the city. Though market performance in 2019, particularly for Grade A segment, was more moderate than that of 2018, rental growth of both Grade A & B still recorded an upward trend with an CAGR of 5.9% and 5.7%, respectively, over the past 5 years.

Generally, vacancy rate of both Grade A & B was still at a healthy level of less than 10%. CBD buildings remained the most sought-after spaces in the market with only 3% vacancy for Grade A segment and less than 1% for Grade B segment. However, since there were two large new Grade A buildings entering the market in 2019, vacancy rate of citywide-Grade A jumped to 9.1%, up 4.1 ppts y-o-y. On the other hand, citywide-Grade B vacancy rate was recorded at 5.0%, down 3.2 ppts y-o-y.

In terms of rental growth, CBD-Grade A rent is expected to keep increasing by a y-o-y rate of 1.4%, 3.5% and 6.5%, consecutively. On the contrary, with more room for rental growth, Grade B rent is expected to increase further in the next few years despite the intensified competition. Particularly, from 2020 to the end 2022, Grade B rent is forecasted to increase with an annual growth rate of 8%.

Flexible workspace

In 2019, Technology and Flexible Workspace continued to be major demand sources with 37% of the total major transactions closed. Not only local flexible workspace operators such as Up & Toong but also international operators like Compass Office, Regus are actively expanding their footprints in this emerging market. 2019 marked the booming era of tech firms with some major transactions such as Gameloft (3,300 sqm NLA at Pax Sky Ung Van Khiem) and DXC (8,000 sqm NLA at Etown 5). Moreover, large tech companies such as CMC, VNG and FPT even built their own office buildings to meet their demand for rapid expansion and minimize dependence on office landlords.

From 2020 to the end of 2022, HCMC’s office market is expected to welcome more than 350,000 sqm NLA if construction progress of future projects is on schedule. As such, CBD-Grade A vacancy rate from 2020 to 2022 is expected to reach 5.9%, 6.3% and 16.7%, respectively. On the other hand, vacancy rate of Grade B in the same periods is projected to hit 8.6%, 3.6% and 4.4%, respectively.

Condominium market

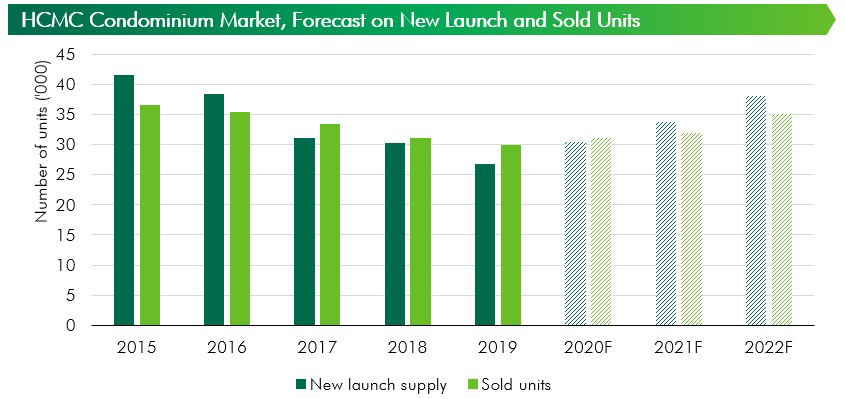

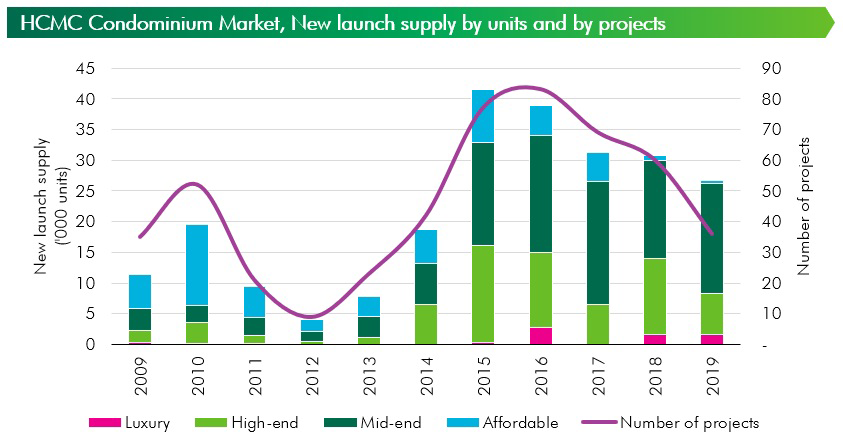

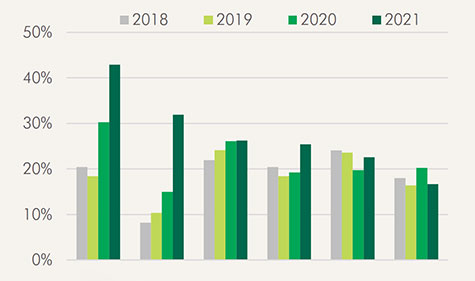

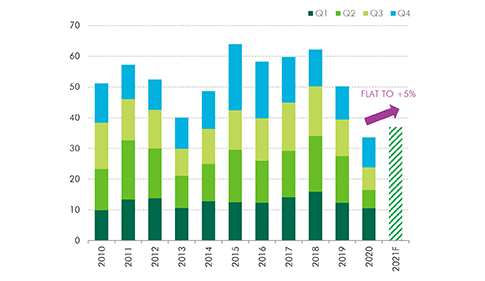

In 2019, condominium recorded a significant drop in new launch supply and a new pricing level across the market. There were many reasons that led to new launch supply reduction, however the main issue was slow licensing process for new projects and those seeking alterations. New launch supply by number of units in 2019 reached 26,692 units, a decrease of 13% y-o-y. This number decreased significantly by 40% in term of projects. A total of 36 projects were launch in 2019 compared to 60 projects in 2018. In Q4 2019, new launch supply recorded an improvement in number of launched projects which was 13 projects compared to approximately ten projects per quarter in the last three quarters. New launch supply in Q4 2019 were 5,073 units.

In terms of segment, mid-end segment accounted for the highest proportion of new launch units in 2019 at 67%. High-end segment ranked second with 25%, followed by luxury with 6%. There was only one new launch supply in the affordable segment in 2019, accounting for 2% of the annual new supply.

In terms of location, the East area accounted for 59% of new launch supply by number of units and 39% by number of projects thanks to a township project in District 9. The South area accounted for 33% by number of projects and only 27% by number of units. New supply in the North and West area was much lower than other areas due to lack of land bank in established residential cluster. New projects in these areas were in Binh Tan District and District 12.

Sales momentum continued to be positive in 2019 with more than 90% of new launch units having been absorbed. Furthermore, the inventory was absorbed gradually by 800 – 1,000 units per quarter in 2019. Q4 2019 added 5,952 sold units to achieve a 2019 total of 29,874 sold units, a reduction of 5% y-o-y solely due to lack of new supply. New launch projects generally achieved high sold rate, even though their primary price increased over 10% compared to old projects in the surrounding area.

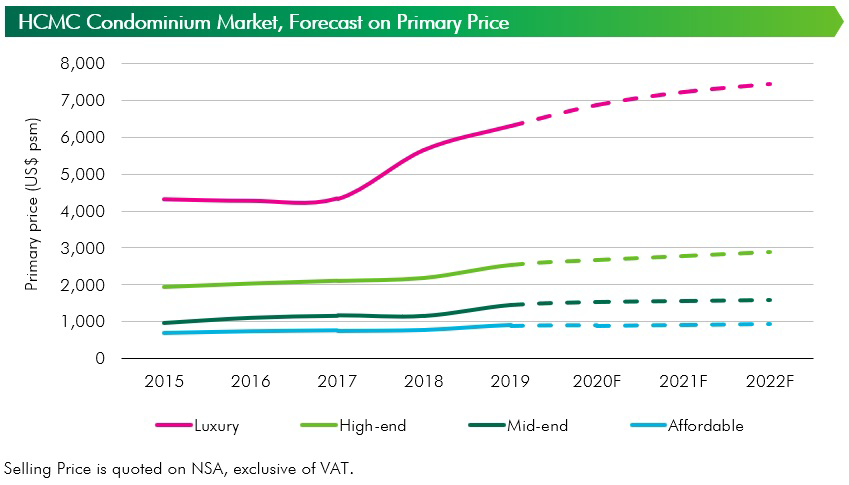

Thanks to limited supply and strong demand, average price on the primary market increased to a new level at US$1,902 psm, an increase of 10% y-o-y. Increases in primary price were observed across the market for both remaining stocks and new supply. The secondary market was more active compared to the previous year, with most dynamic areas being District 2 (Thu Thiem, An Phu, Thanh My Loi), Binh Thanh District and District 7.

In 2020, licensing issue will continue to pose as a hurdle to the market, so it is expected to welcome approximately 30,000 units. Some new projects in fringe districts which are planned to launch are Vinhomes Grand Park (District 9), AIO City (Binh Tan), West Gate Park (Binh Chanh), PiCity (District 12); and the South with subsequent phases of Eco Green Saigon, Sunshine City Saigon and Sunshine Diamond River in District 7.

Primary prices will continue to increase due to lack of supply. Luxury segment is expected to have price increase of 10% y-o-y. Prices for high-end and mid-end segments will increase 5% y-o-y, due to new supply and the high price level in 2019. Affordable segment will have a modest growth of 2% y-o-y.

The secondary market will be more active due to lack of supply in primary market and new pricing level across the market. End-users may find limited options on the primary market and may turn to secondary market which offers both completed projects and those with good construction progress.

In addition, the remaining issues including flooding, air pollution and traffic congestion which leave a negative impact on living quality in big cities. As a result, new township developments in the fringe areas that offer full range of facilities and good connectivity will receive high interest from the market. To catch this demand, developers have planned new township projects in suburban districts and neighbouring provinces. These projects offer fresh living environment for end-users as well as a good option for investors, especially in the context of limited supply in HCMC.

Condominium ranking criteria:

- Luxury: projects that have primary prices over US$4,000 psm

- High-end: projects that have primary prices from US$2,000 psm to US$4,000 psm

- Mid-end: projects that have primary prices from US$1,000 psm to US$2,000 psm

- Affordable: projects that have primary prices under US$1,000 psm

(Selling price excludes VAT.)

Landed property (Ready-built Villa and Townhouse)

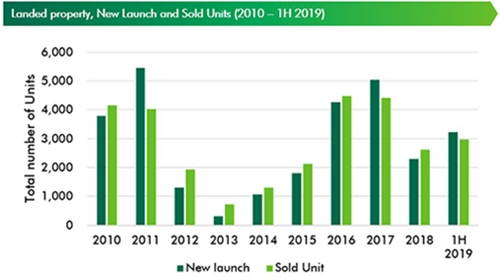

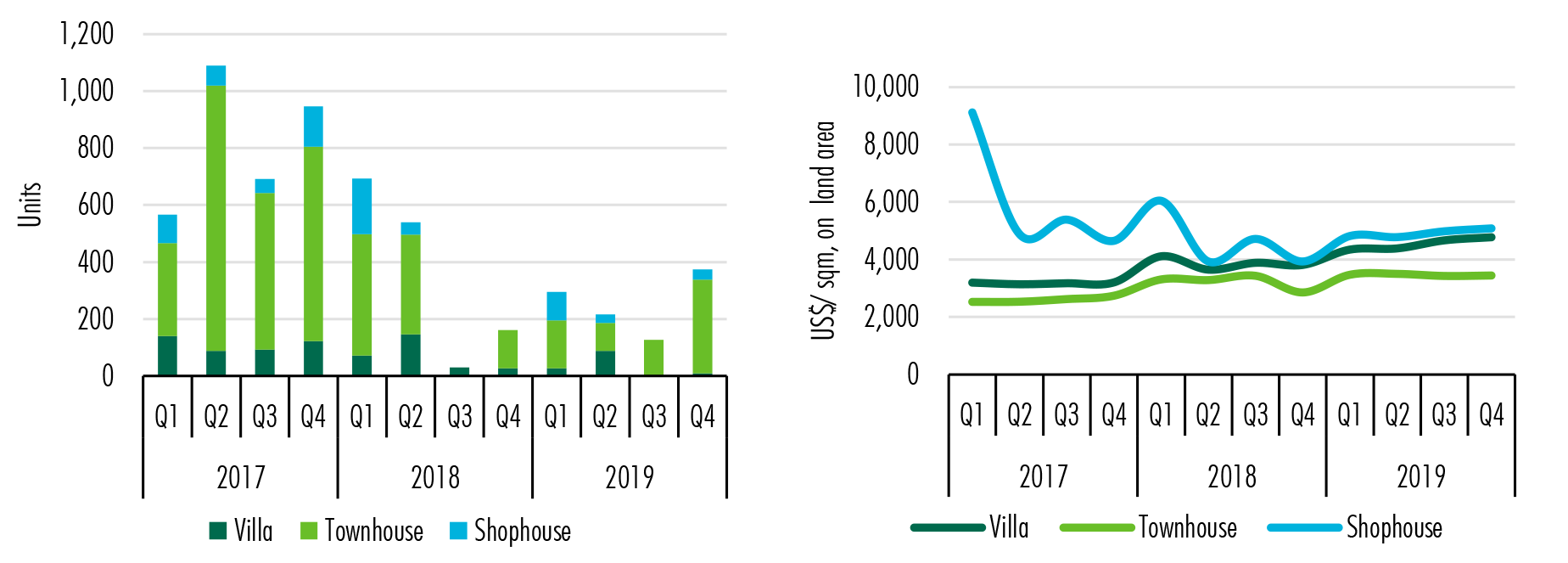

Ready-built villa and townhouse market of HCMC was expected to recovery in terms of supply in 2019 but the fact was that significant drop of new supply still occurred. In Q4 2019, HCMC’s market welcomed 375 new units from 7 projects in District 2, District 9, Binh chanh District and Thu Due District. Accordingly, new supply was significantly improved in the ending period of 2019 (up 195.3% q-o-q and 131.5% y-0- y). However, new supply of 2019 was only 1,014 units (decreased 28.9% y-o-y), which was the lowest amount of new supply in the last six years.

Supply of the primary market accounted for about 4% of total supply of HCMC’s market. Hence, supply in the primary market was very limited. Average primary asking price maintained strong price escalation in 2019. Accordingly, average asking price of villa and townhouse went up by 14.8% y-o-y and 12.3% y-o-y respectively. District 2 had the highest primary asking price of new projects. Products of very small-scale project with prime location such as Q2 Thao Dien (18 units) was sold out rapidly with asking price recorded from US$7,000 to 12,600 psm land. Overall, cumulative sold rate of HCMC was around 96% as of 2019.

In the secondary market, the asking price even showed stronger price escalation than the primary market. Secondary asking price of ready- built townhouse increased slightly 0.5% q-o-q and 20.5% y-o-y on citywide. Meanwhile, secondary asking price of ready-built villa grew 2.3% q-o-q but climbed up by 25.3% y-o-y. Southern region of HCMC, including Nha Be District and Binh chanh District, witnessed the highest growth of asking price in the re-sale market in reviewed quarter when positive news of infrastructure and expected launched of new township project such as Zeitgeist Nha Be (also known as GS Metro city) released in Q4 2019.

Retail market

By end of 2019, HCMC had over 1,050,000 sqm net leasable area, an increase of 13.5% y-o-y. Although the new supply was not significant, HCMC retail market was very active with the opening of new projects and expansion of existing projects. Giga Mall in Thu Duc District and TNL Plaza in District 4 opened by early this year. Aeon Mall Tan Phu and Crescent Mall in District 7 expanded additionally 36,000 sqm and 12,000 sqm respectively and Parkson Saigontourist Plaza in District 1 welcomed Uniqlo flagship store in Vietnam.

HCMC retail market is shifting gradually from small scale shopping malls to destination malls which focus on millennials and provide millennials with experience-based shopping. In these malls, presence of anchor tenants is required. Anchor tenants are usually big and draw high level of foot traffic. Anchor tenants in Ho Chi Minh City’s most popular shopping malls have traditionally been confined to cinemas, supermarkets but now welcomes fashion as new type of anchor tenants who take over 1,000 sqm of NLA, for example Zara, H&M and Uniqlo, the latest. This model spread outside for familiar modern retail markets such as HCMC and Hanoi; e.g.: H&M opened its first store in Da Nang City.

Investment in retail real estate is becoming more popular in the last few years. Recently, Masan Group’s acquired VinCommerce from Vingroup, six months after Vingroup acquired Shop&Go at part of the owner’s expansion plan in Vietnam.

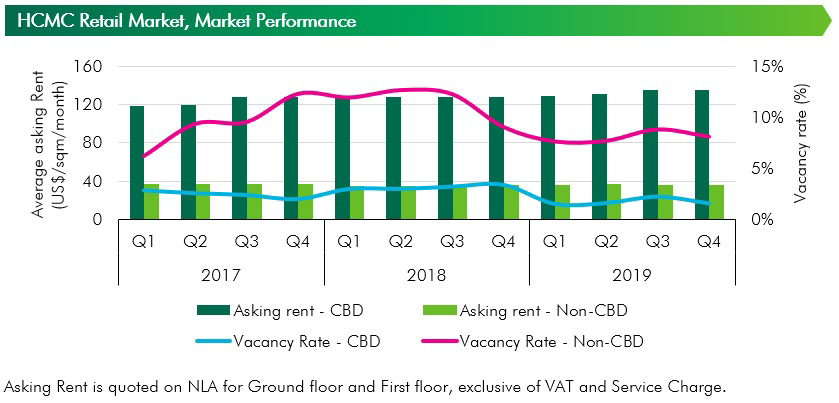

In the CBD area, vacancy rates have been maintained at a low level of less than 4% for two years and was 1.6% at the end of 2019, a decrease 1.8 percentage points (ppts) y-o-y. There has not any new project opened in the CBD area since Saigon Center’s opening in 2016. The lack of supply made rental rate increase by 10-20% at contracts renewals. On average, CBD rental rate increased by 5.8% y-o-y and reached US$135.5/sqm/month.

In the non-CBD area, new supply, which came online regularly on average of 110,000-125,000 sqm each year, has helped rental rate maintain the current level US$35.7/sqm/month. In the last two years, new projects, which usually had bigger scale and good development/operation, achieved high occupancy rates at opening. Despite of increasing supply, average vacancy rate in non-CBD decreased by 0.9 ppts y-o-y to 8.1% by Q4 2019. The decrease in vacant spaces were mainly due to some new tenants taking up large spaces such as Uniqlo (took 3,000 sqm in Parkson Saigontourist Plaza), ACE Home Centre (took 2,500 sqm in Van Hanh Mall) or Nguyen Kim, Sony, UFC (moving to Aeon Mall Tan Phu).

In the next three years, HCMC market will welcome more than 400,000 sqm NLA of new supply and majority of them are in the non-CBD area. In the CBD, The Spirit of Saigon’s construction was restarted in Q4 2019 and Parkson Saigontourist Plaza is expected to be re-opened in 2020; other projects do not have clear construction plans. Most of future supply will be clustered in the East, accounting for over 70% of new supply, followed by the West and the North. The Central and The North do not record new developments. Rental rate is expected to grow healthily in the next two years in both CBD and non-CBD areas while occupancy rate slightly decreases; yet still maintains at level of above 90%.

Looking forward to 2030, large retail formats will dominate the market, especially destination and lifestyle malls in township projects. Many street shops in CBD will be styled up as appearance will become an important factor to attract shoppers. Thu Thiem “New Urban Areas” will become a new entertainment and shopping hub of all Vietnam.

Song Chau Group.

Related news

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2019

Vietnam’s Economic Backdrop Quarterly Reports | Q2 2019