Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2020

VIETNAM'S ECONOMY

-

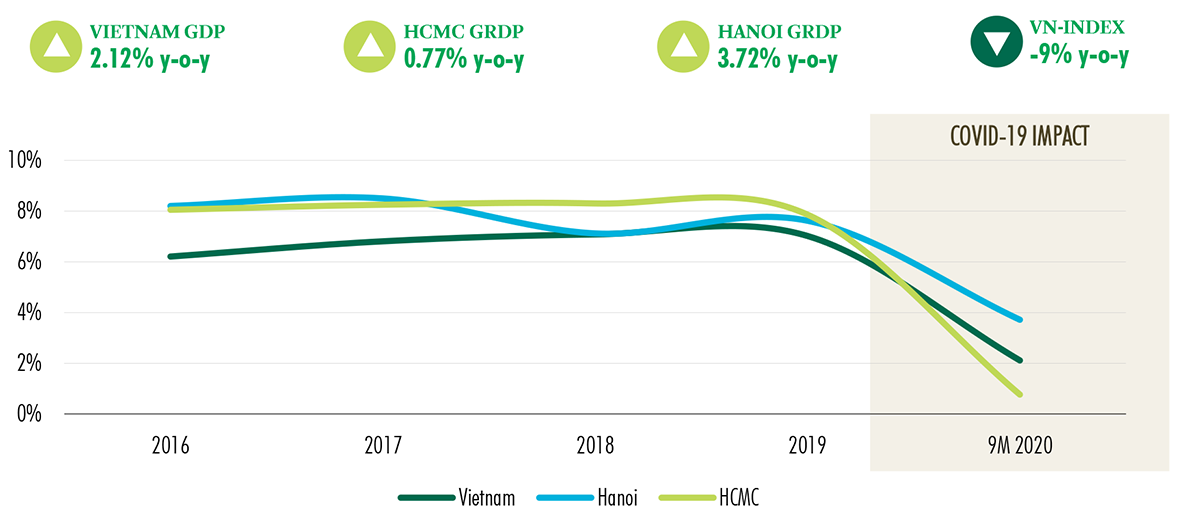

Vietnam's economic growth slow recovery underway: Vietnam General Statistics Office (GSO) reports that gross domestic product (GDP) grew by 2.12% year-on-year in the first nine months of 2020, the lowest nine-month growth since 2011. However, against the backdrop of COVID-19 continuing to negatively affect world markets, Vietnam’s efforts at pandemic containment continue to be exemplary, setting the scene for a strong economic recovery and further rapid development growth.

-

CPI affected by mixed factors: Q3 2020, CPI increased by 0.92% compared to the previous quarter and rose by 3.18% compared to the third quarter of 2019. Average core inflation of 9 months of 2020 grew by 2.59% compared to the same period of 2019. On average, in 9 months of 2020, the consumer price index increased by 3.85% over the same period last year. The average merchandise term of trade of 9 months of 2020 decreased by 0.72% as compared to the same period of 2019, reflecting unfavorable Vietnam goods export’s price to abroad compared to the price of imported goods from abroad to Vietnam.

-

Vietnam’s total import-export turnover increases: Total import and export turnover of 9 months in 2020 was estimated at 388.73 billion USD, with a export turnover of 202.86 billion USD, a rise of 4.2% over the same period last year, import turnover of 185.87 billion USD, reduce by 0.8% over the same period last year. The trade balance of goods in 9 months saw an estimated trade surplus of 16.99 billion USD.

-

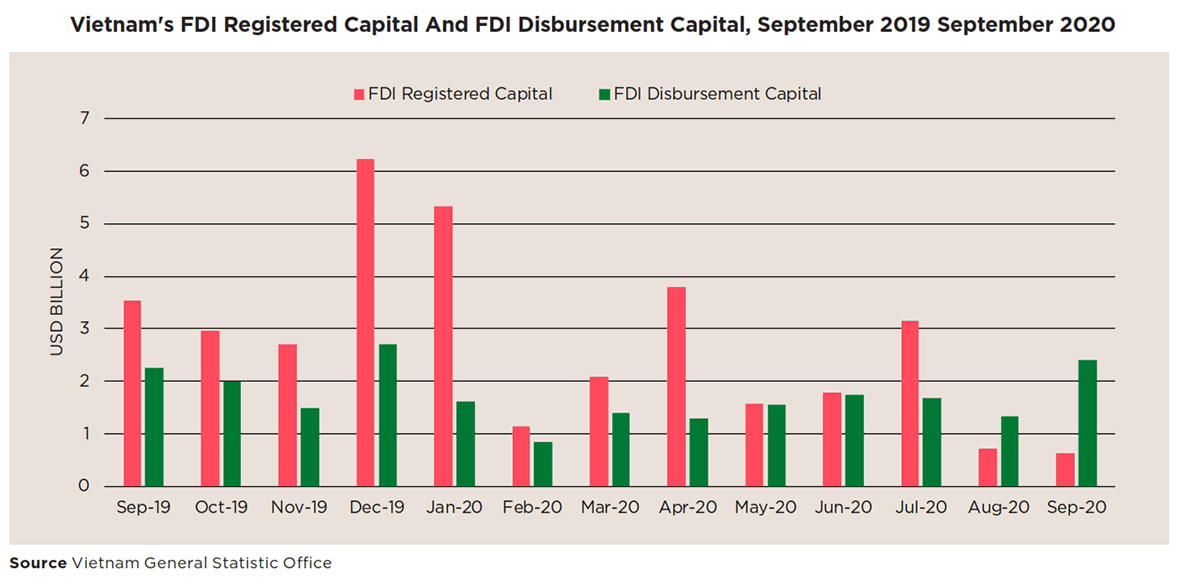

Vietnam’s FDI falls: Ministry of Planning and Investment data shows foreign direct investment (FDI) in the first nine months of 2020 fell by 18.9% year-on-year (YoY) to US$21.2 billion while FDI disbursement dropped -3.2% YoY to around US$13.76 billion. During the nine months, among the 111 countries and territories investing in Viet Nam, Singapore leads with US$6.77 billion, accounting for 32% of the total, South Korea was next with US$3.17 billion representing 15%, and China by investing US$1.87 billion or 8.8% of the total was third.

-

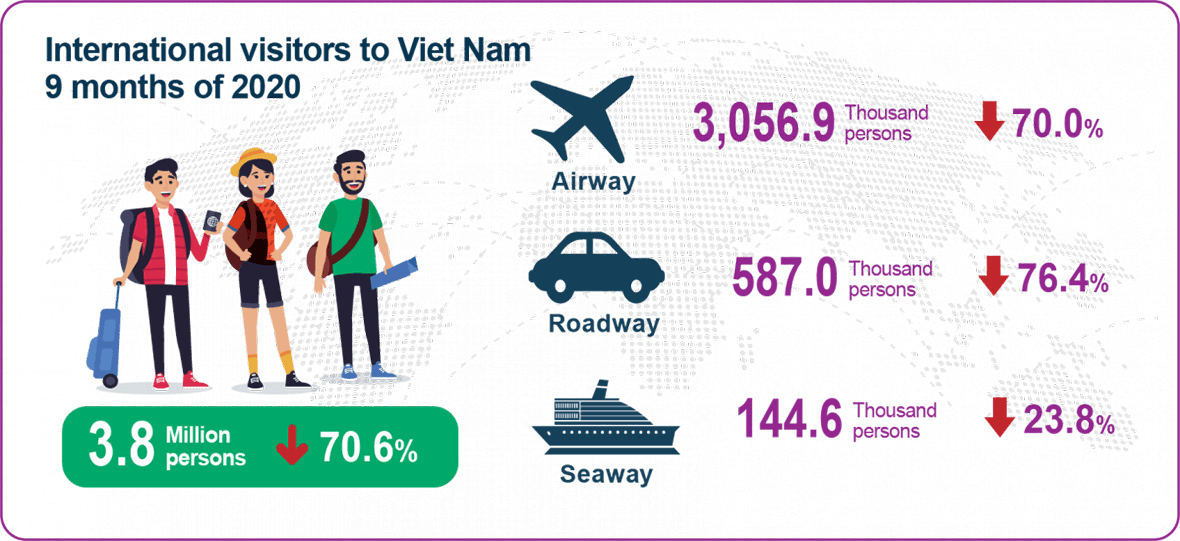

International arrivals: Viet Nam continues to implement measures to prevent and control the COVID-19 epidemic, so international visitors to Viet Nam in the third quarter of 2020 were mostly international experts and technicians working for projects in Viet Nam. For the nine months of 2020, international visitors arrival to our country reached 3,788.5 thousand, down 70.6% over to the same period last year, of which 97,3% were international visitors in the first quarter of 2020, the second quarter and third quarter only accounted for 1.5% and 1.2%.

OFFICE MARKET

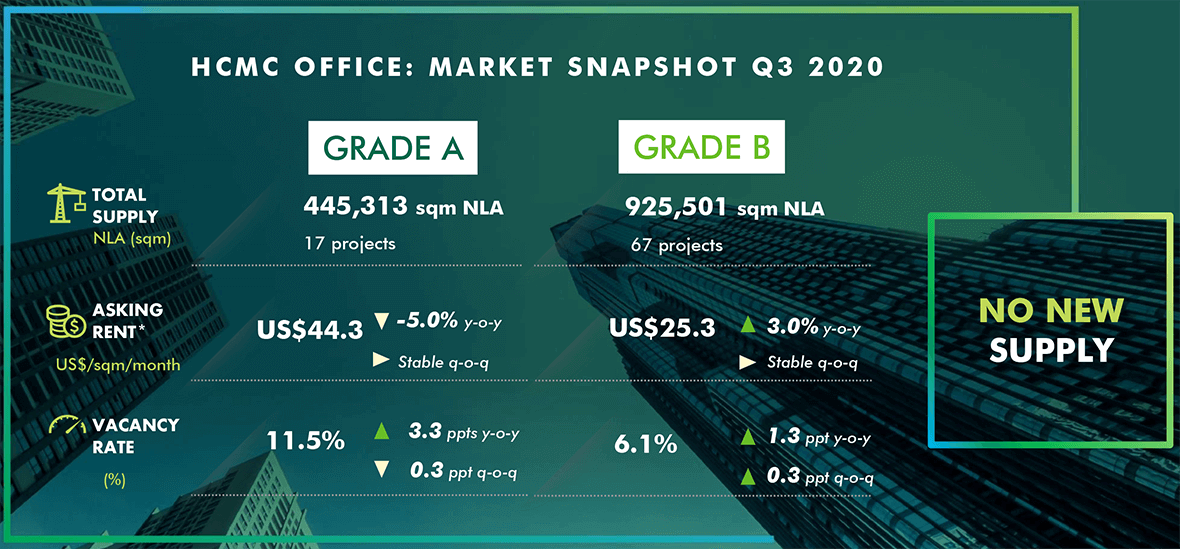

There was no new supply in Ho Chi Minh City office market in Q3 2020 (supply remained at 1,370,814 sqm NLA).

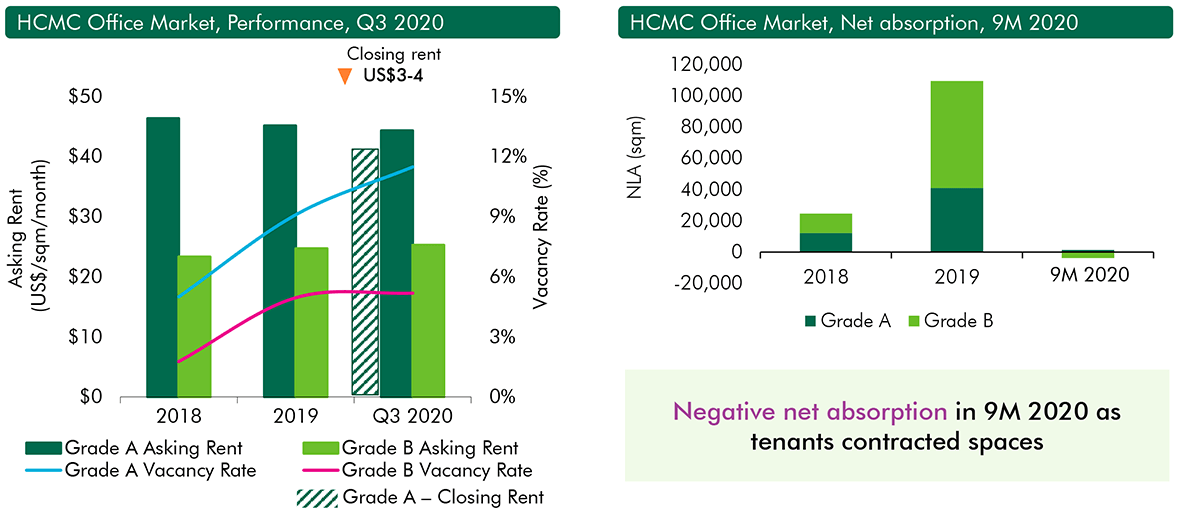

In Q3 2020, Grade A vacancy was recorded at 11.5%, up 3.3 ppts y-o-y and slightly down by 0.3 ppt q-o-q. Contracted space of Grade A by the end of Q2 2020 has been gradually absorbed in Q3 2020 by existing tenants at the given buildings through expansion and renewal of contracts.

Grade B vacancy remained unchanged compared to the last quarter but slightly increased by 1.3 ppts compared to the same period last year.

In the reviewed quarter, Grade A rent stayed relatively the same q-o-q but decreased by 5.0% y-o-y. Although staying unchanged q-o-q, landlords were still very flexible in payment terms and closing rents. Some landlords even offered closing rent of US$3 - 4 psm pm lower than the asking rent for new tenants.

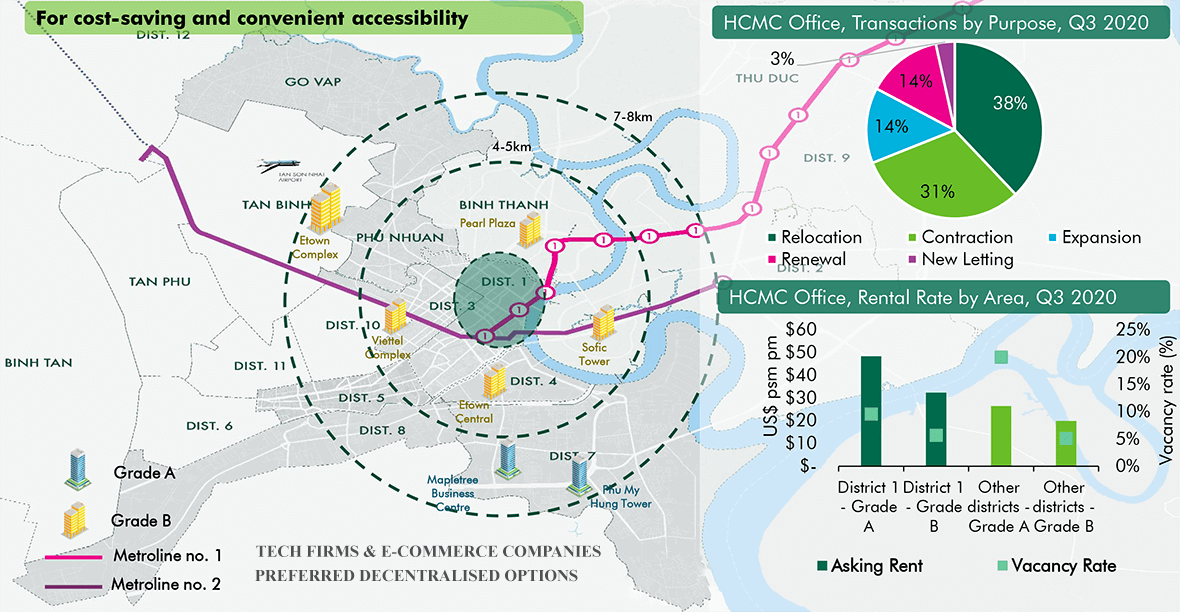

The construction of new office buildings in HCMC was still moving forward and about 80,000 sqm NLA is expected to complete by the end of this year. Most of the new additions will concentrate in the East (Binh Thanh) and the South (District 7). Landlords of these upcoming buildings have proactively decreased asking rents by US$1 to US$3 psm pm compared to Q4 2019 to attract tenants.

Unlike Insurance companies, which typically lease office space in the central area, those in Information Technology and Retail/ Trade/ E-commerce are usually more open to heading out to decentralised areas to seek cheaper options and better accessibility to the airport, warehouses or ports. By leasing spaces in decentralised areas within 3 – 7 km radius from the CBD, tenants can potentially save from US$10 – US$20 psm pm.

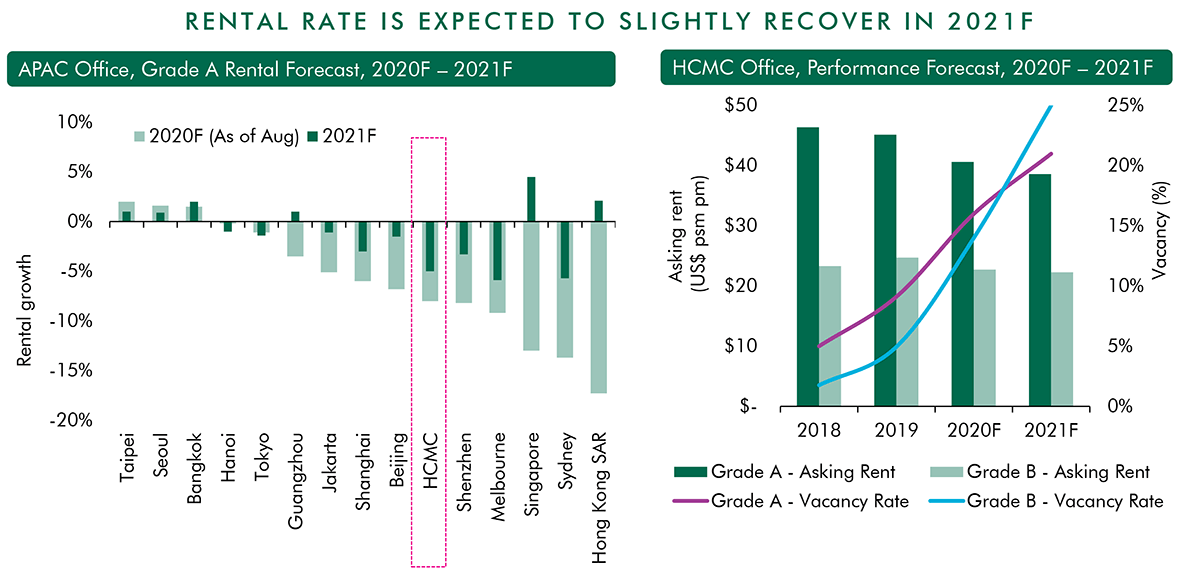

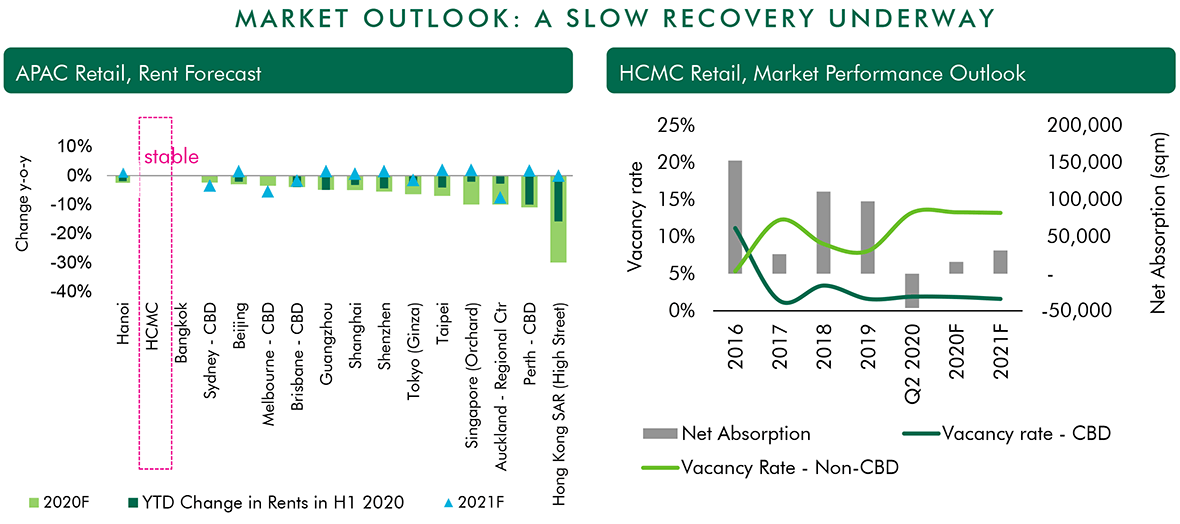

The office rental rate of HCMC is expected to drop by 8%-10% y-o-y and vacancy rate will increase by 7-9 ppts y-o-y by the end of 2020 due to new supply and the negative impact of COVID-19. If a vaccine for COVID-19 can be successfully released by December 2020, rental rate in 2021 is forecasted to be relatively stable. However, if a vaccine can only be released by June 2021, rental rate will continue to shrink further by 5% compared to that in 2020.

CONDOMINIUM MARKET

In Q3 2020, new launch supply volume improved compared to the previous quarter. However, for 9M 2020, new supply volume was still lower than the same period last year by 57%.

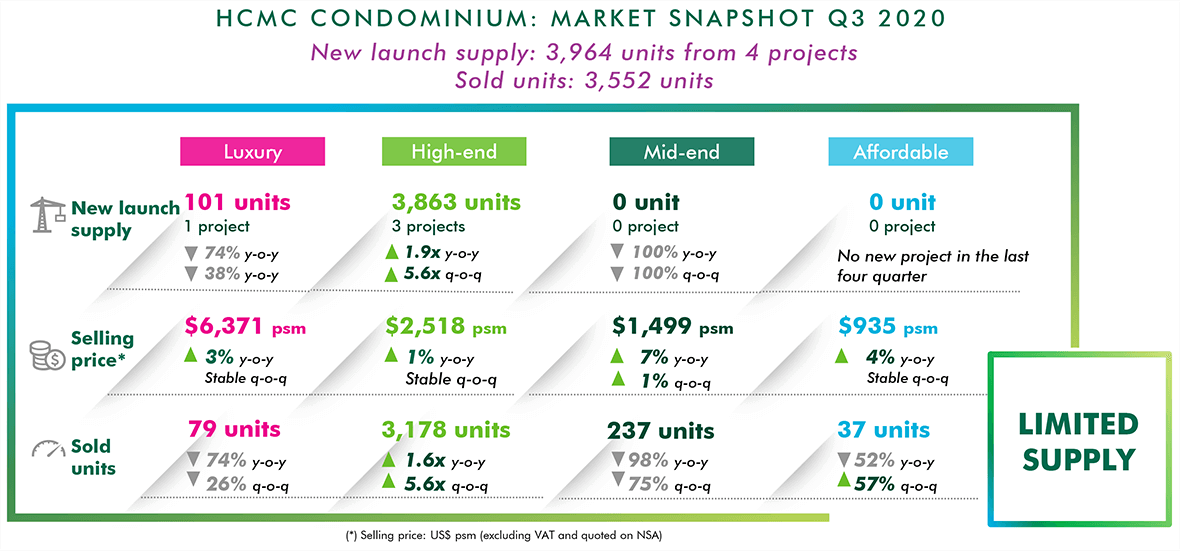

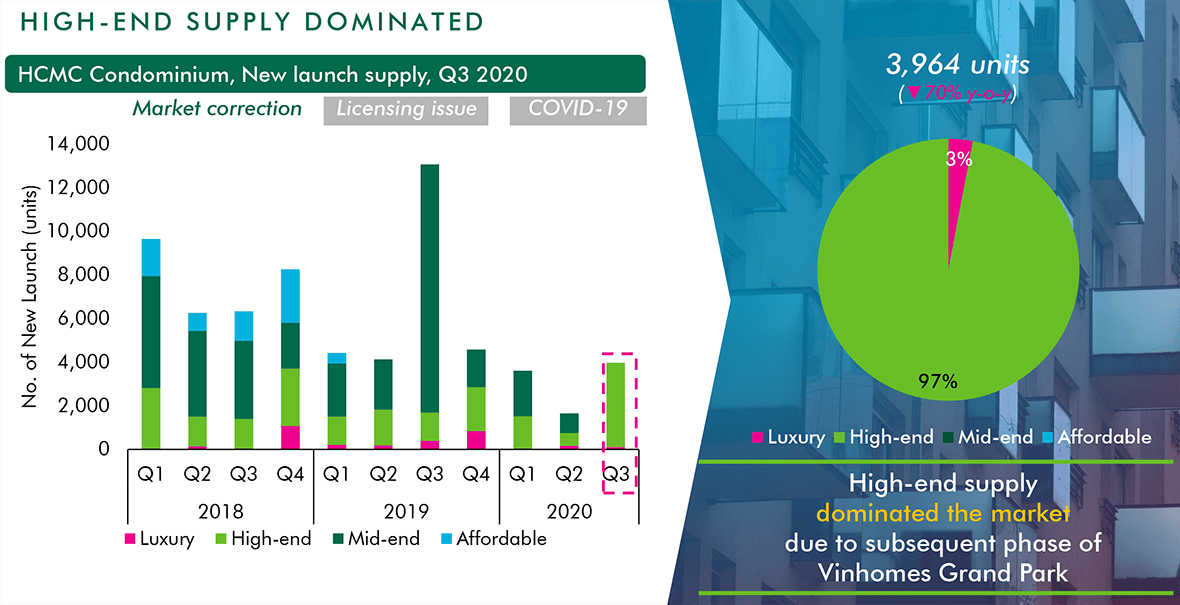

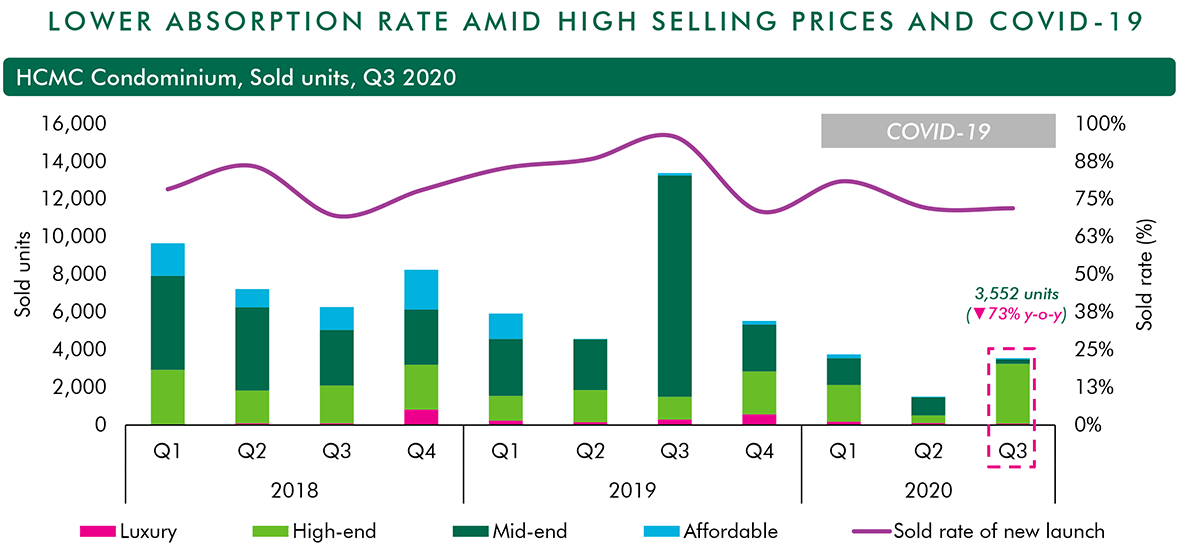

With the second wave of COVID-19 in Vietnam in August, there were only four projects launched in Q3 2020, equivalent to an additional 3,964 units (increase by 141% q-o-q and decrease 70% y-o-y). A total of 3,552 units were sold in Q3 2020 (increase by 125% q-o-q and decreased 73% y-o-y). Most of new launch supply (nearly 90%) came from the subsequent phase of Vinhomes Grand Park called The Origami. For the first nine months of 2020, there were 9,214 units launched from 17 projects.

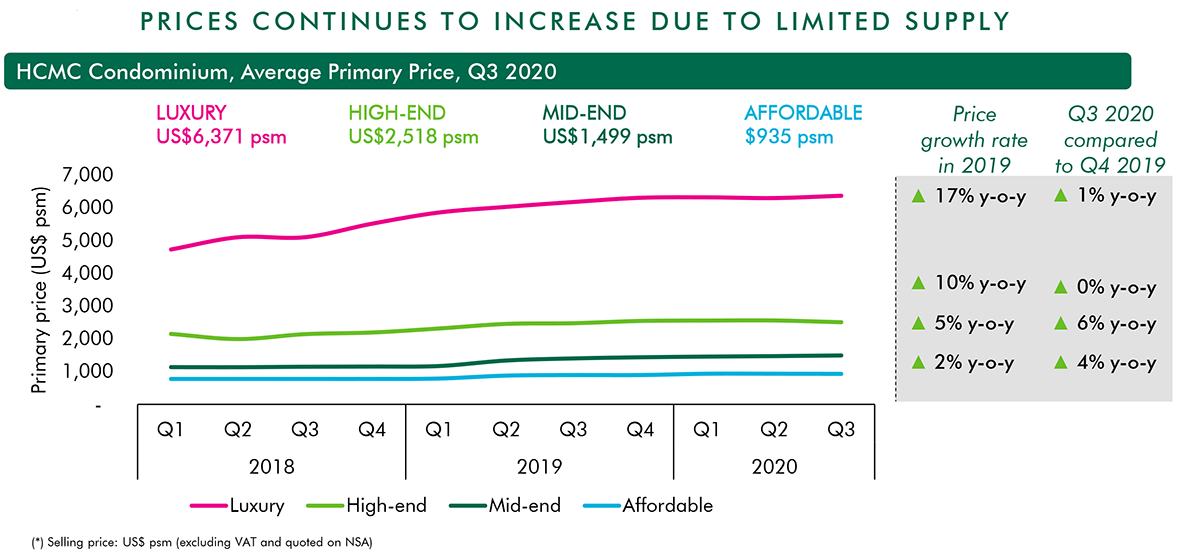

Condominium ranking criteria:

- Luxury: projects that have primary prices over US$4,000 psm

- High-end: projects that have primary prices from US$2,000 psm to US$4,000 psm

- Mid-end: projects that have primary prices from US$1,000 psm to US$2,000 psm

- Affordable: projects that have primary prices under US$1,000 psm

Sold rate in Q3 2020 reached 72% on average, while that for 2019 was 85%. Because of high selling price and the second wave of COVID-19, buying momentum diminished during this period.

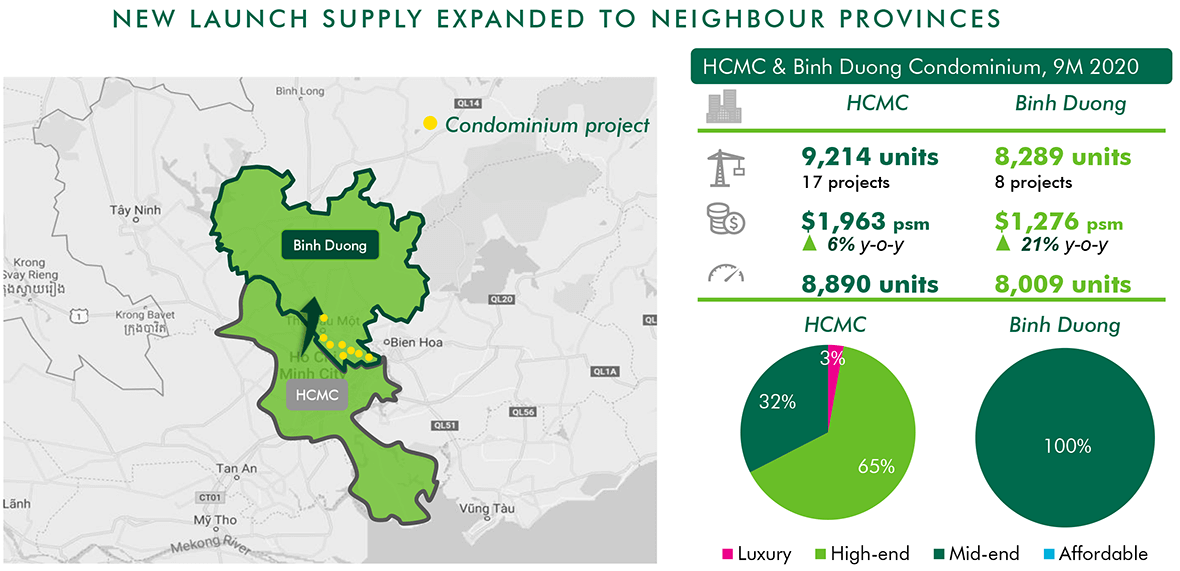

In the last nine months, while launch activities were quiet in HCMC, Binh Duong condominium market recorded strong growth in terms of new launch supply with 8,289 units from eight projects. Binh Duong market became more popular thanks to the close distance to HCMC and the recent establishment of its two new cities (Thuan An and Di An) in Q1 2020.

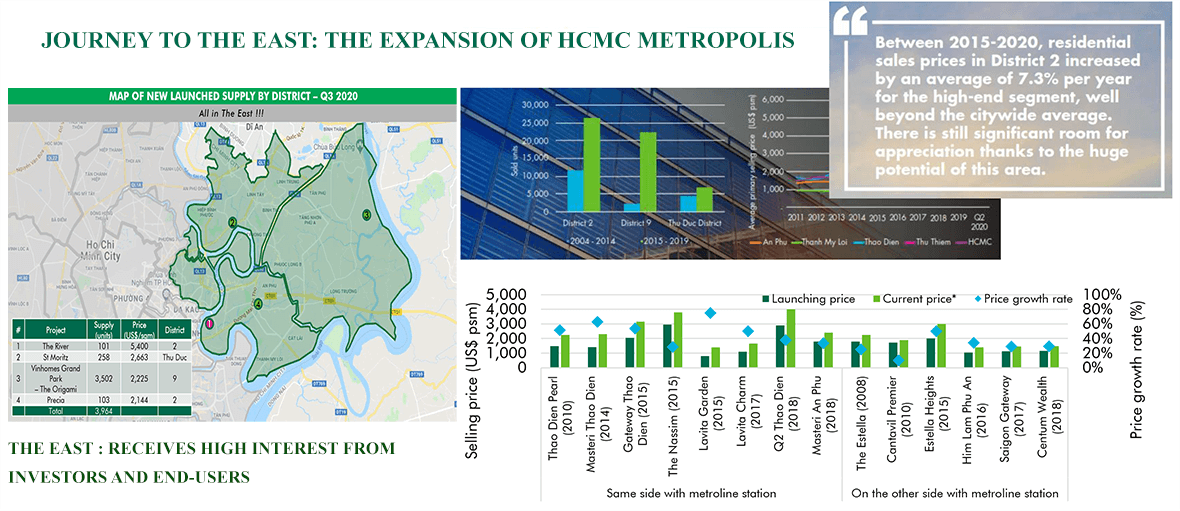

All new launch projects are located in an area that has been planned to be “The Eastern City” or “Thu Duc City” (Districts 2, 9 and Thu Duc). In terms of segmentation, the high-end segment dominated in terms of new launch supply and sold units, at 97% and 89% respectively.

The average selling price for the primary market was at USD1,966 psm, an increase of 1% q-o-q and 6% y-o-y. All new launch projects in the reviewed quarter were in the high-end and luxury segments. Prices across segments remained stable from the previous quarter and higher than the same period last year by 3%-5%.

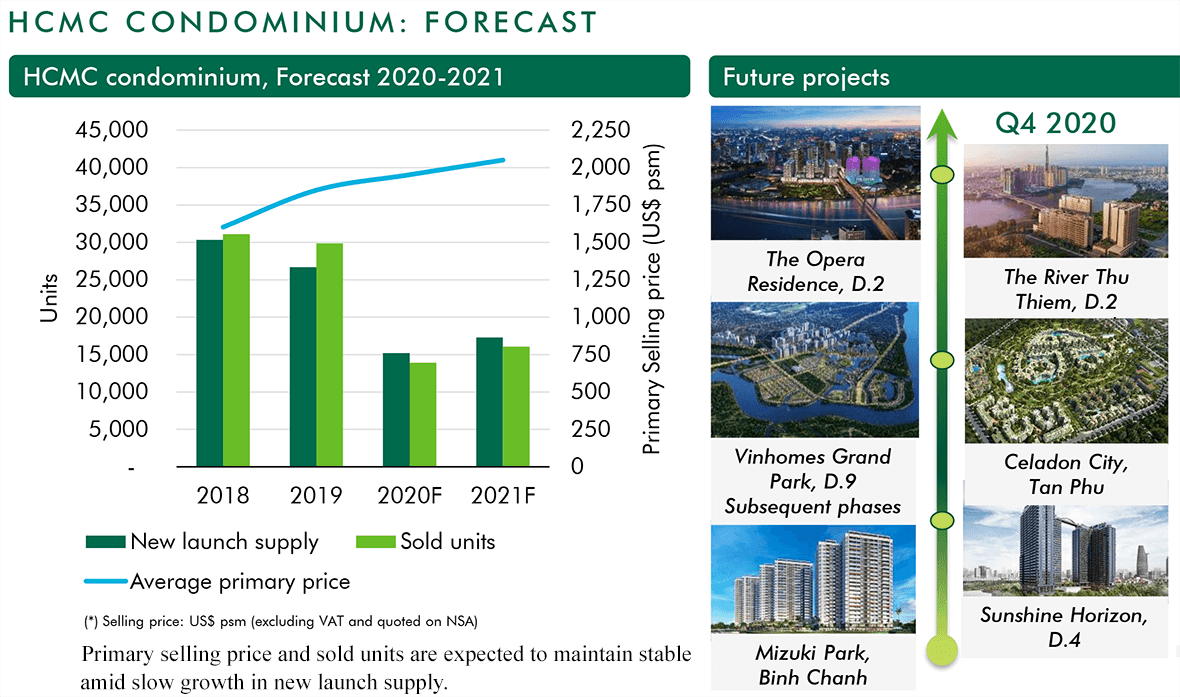

New launch supply is forecasted to improve in the last quarter of 2020 and achieve a total of 15,000 units in 2020, a decrease of 43% y-o-y. Mid-end and high-end segments will account for a high proportion of new launch supply. In terms of development direction, the East remains a hot spot in the real estate market, with many pipeline projects in District 2 and District 9.

In terms of price outlook, the average market wide selling price for 2020 is expected to increase 5% y-o-y, with high-end and luxury segments forecasted to have a modest growth rate of 3% y-o-y. Having had considerable price growth in H1 2020, mid-end segment’s average price in 2020 is expected to witness an increase of 5% y-o-y. The volume of sold units is forecasted to reach 14,000, a drop of 52% y-o-y, mainly because of COVID-19.

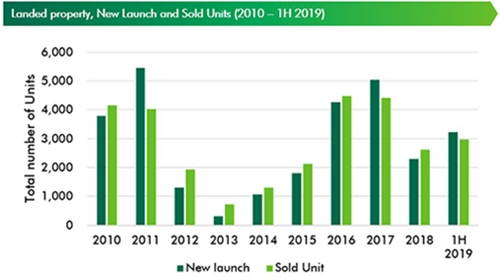

LANDED PROPERTY (READY-BUILT VILLA AND TOWNHOUSE)

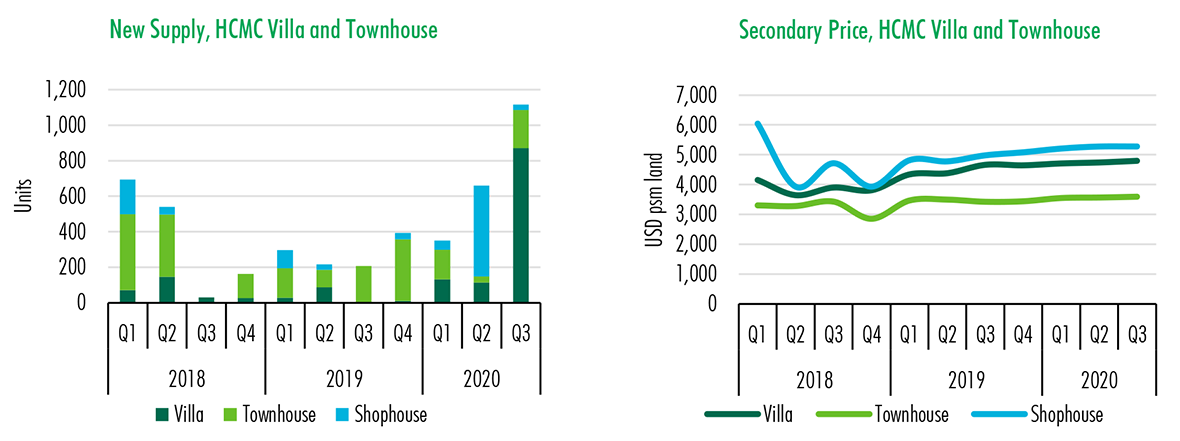

- New supply recovered increase: In Q3 2020, new supply recovered significantly in the context of increasing competition 1,116 new units were newly launched from four projects in District 9, Nha Be and Go Vap. New supply went up by 69.3% q-o-q and 4 times higher than last year. 76% newly launched supply in Q3 was from vinhomes Grand Park, a large township project in District 9.

- Absorption rate: New projects in Go Vap and Nha Be were well absorbed thanks to well-known developers. The average sold rate of primary market as of Q3 2020 was at 96.9%. Average primary price was US$2,939 per sqm land for townhouse (up 3.4% q-o-q and 9.6% y-o-y), US$3,620 per sqm land for villa (remain stable) and 5,079 per sqm land for shophouse (stable q-o-q and 8.9% y-o-y).

- Prices increased slightly: Selling price of HCMC ready-built villa and townhouse was still on upward trend despite prolonged impacts of the COVID-19 pandemic. However, price escalation rate has slowed down. Average secondary asking price of townhouse went up slightly by 0.7% q-o-q and 5.0% y-o-y. Villa also has lower price escalation rate in this quarter (up 1.2% q-o-q and 2.9% y-o-y). Asking price of shophouse remained stayed stable q-o-q and 6.0% higher compared to last year.

- Outlook market: Strong recovery of supply in Q3 is a positive signal to the HCMC market. Nevertheless, high selling price is the main barrier to majority of buyers while long payment terms and incentives are key factors to attract investors in this critical time. In such context, there were increasing interests in township projects in neighboring provinces to HCMC, such as Long An, Dong Nai and Binh Duong.

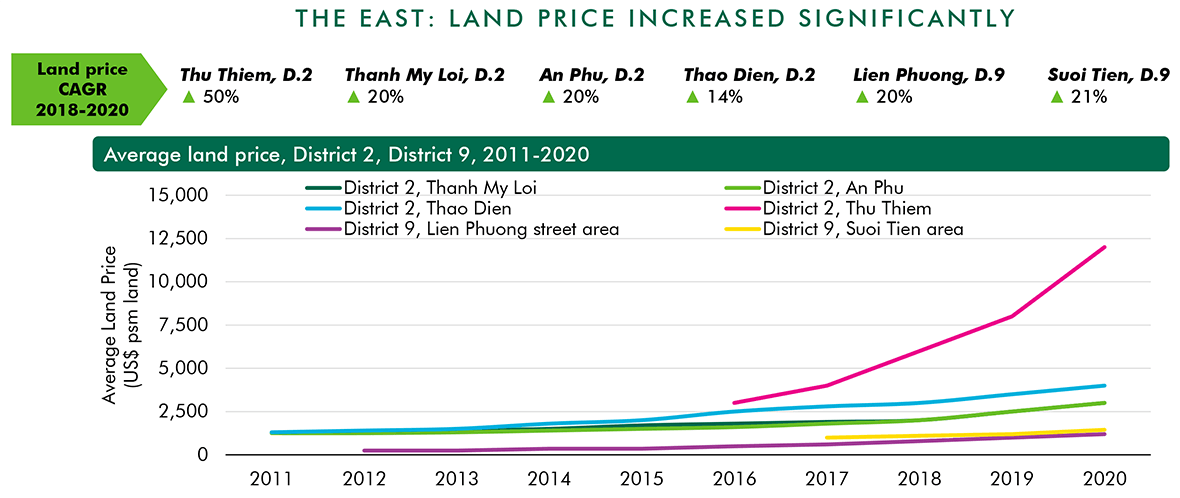

LAND PRICE

RETAIL MARKET

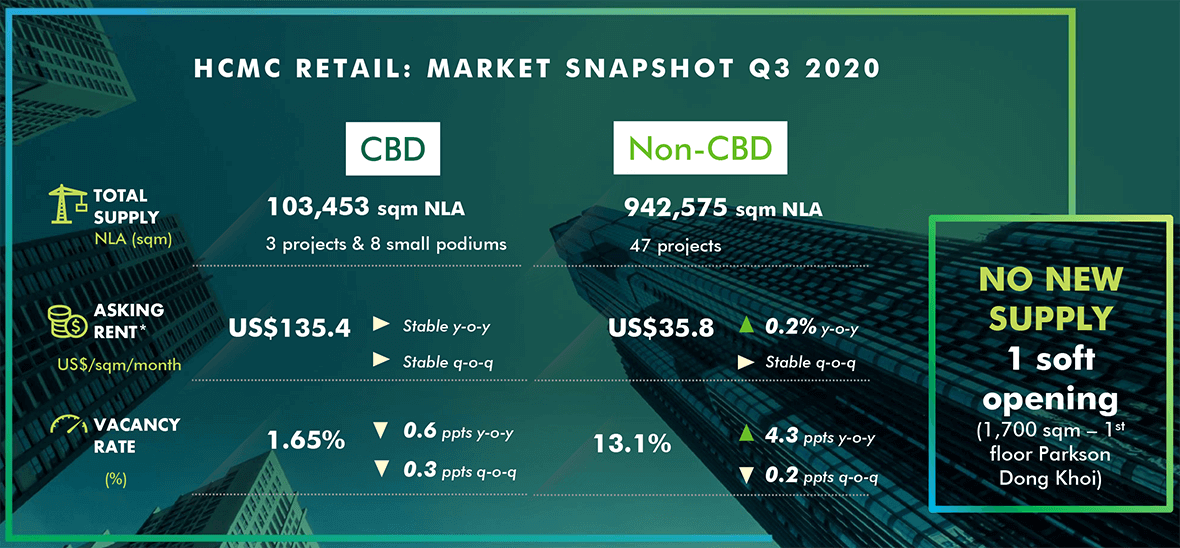

Up to Q3 2020, there has been no new project in HCMC in 2020, with total supply of modern retail space in the market remaining at 1,046,028 sqm.

In Q3 2020, the Parkson department store in District 1 had a soft opening for its first floor of total 1,700 sqm, after quarters of renovation. At this department store, besides Uniqlo’s flagship store, another Japanese brand, MUJI, has also opened its pop-up store and planned to have an expansion of another 2,000 sqm in upper floors in Q4 2020.

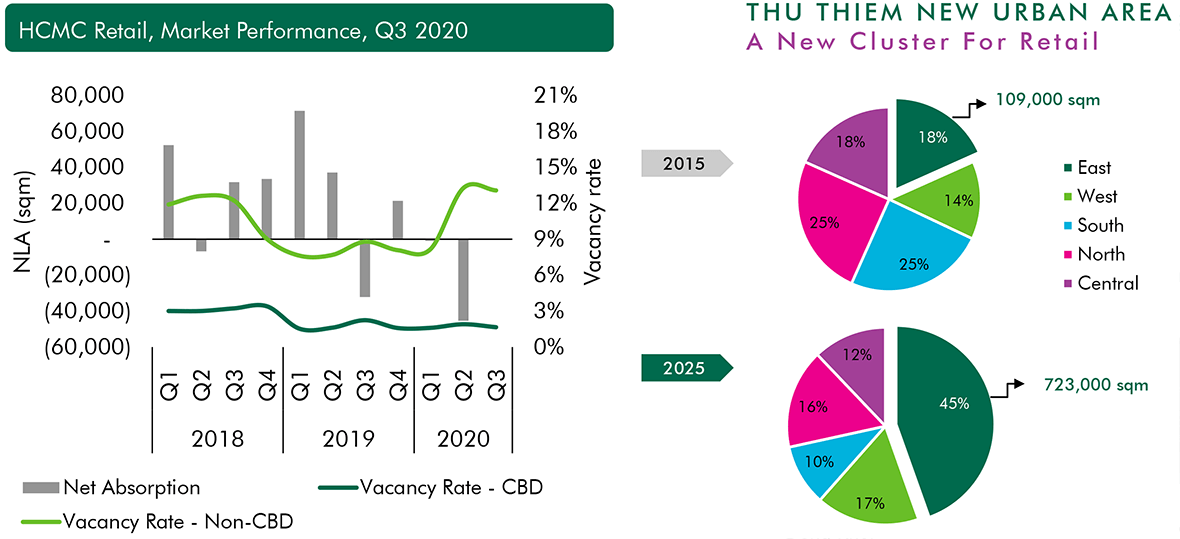

Average vacancy rate was higher than Q3 2019 due to contractions of some tenants, mainly in local fashion and accessories and F&B categories. However, in Q3 2020, some of the vacant spaces have been filled. Projects of good location and construction quality as well as high standard of management have been able to quickly find new tenants. Some brands that debut/expanded in the CBD areas were Hugo Boss, Sandro (at Saigon Centre), Watson, Giordanno (Vincom Center Dong Khoi).

In the non-CBD areas, there are several big spaces about to be taken up by retail chains such as Haidilao at Vincom Center Landmark 81, Parkson Hung Vuong, Nowzone; Uniqlo at Van Hanh Mall in Q1 2021, etc. Vacancy rate, as a result, had a slight improvement compared to previous quarter, going down by 0.3 ppt and 0.2 ppt for CBD and non-CBD areas, respectively (vacancy rates were1.65% and 13.1% for the two areas).

Most common incentives included reducing 100% of service charge, reducing 10-30% of base rent depending on categories, or even free of rent during mandatory close-up as observed in Aeon Mall Binh Tan.

As of Q3 2020, average asking rents in Ground floor and First floor were US$35.8 psm pm for the non-CBD areas and US$135.4 psm pm for the CBD areas, which almost stayed flat compared to last year’s level.

In 2021, the market expects to have only one new opening which is Socar Shopping Mall in District 2. In 2022-2024, there are 430,000 sqm of new supply either under construction or under planning. Some projects of notable scale in the non-CBD areas are Vincom Megamall Grand Park (District 9, 48,000 sqm), Elite Mall (District 8, 42,000 sqm).

Expectation about the operation of Metro Line No. 1 in 2022 will have significant impact on the rental rates of retail spaces in areas near to the future metro stations. In addition, Ho Chi Minh City’s plan on extension of its pedestrian street network, if materialized, will attract the expansion of more brands and bring about major shifts in tenant mix in the CBD area.

INDUSTRIAL REAL ESTATE MARKET

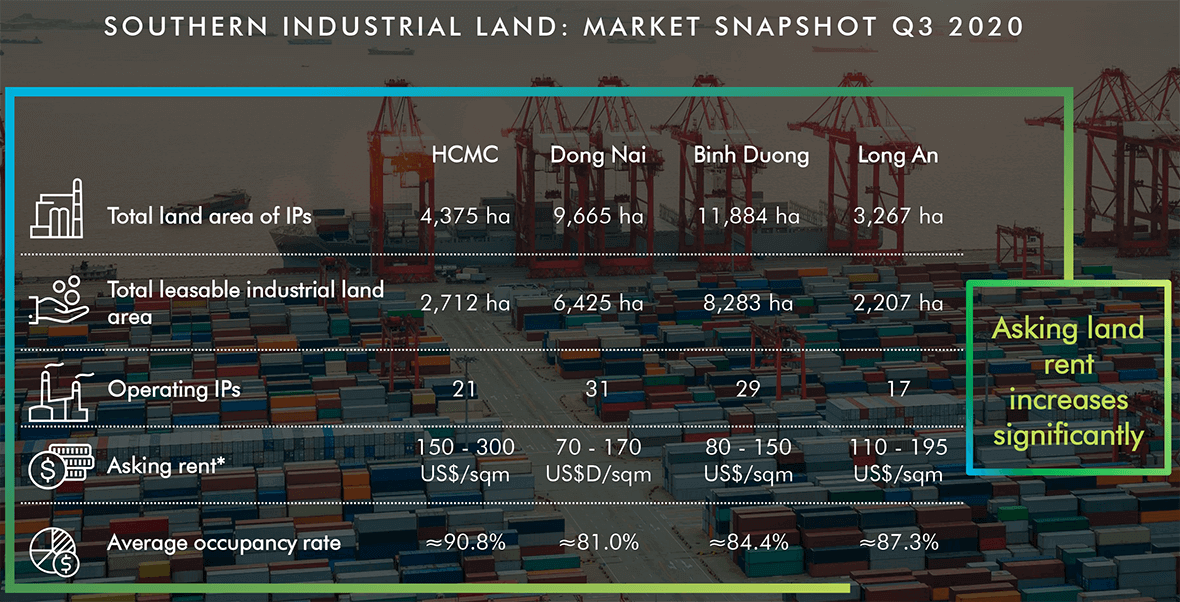

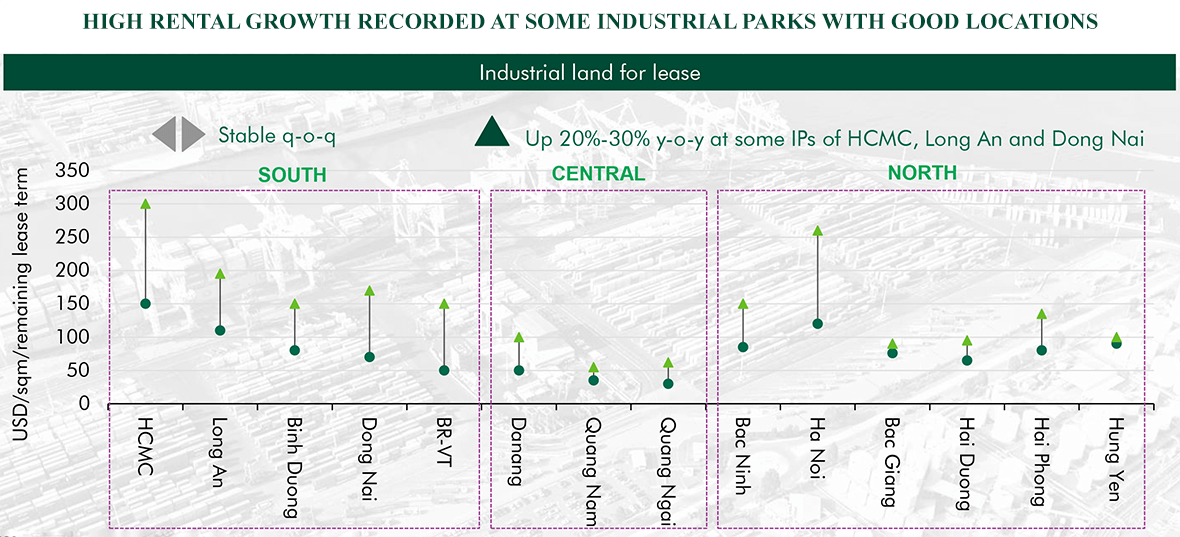

In the past two years, the industrial real estate sector in Vietnam witnessed a positive progression with growth observed in both rental rates and occupancy rates. The average occupancy rate of industrial parks in the four key southern industrial cities and provinces was about 84.5%. In particular, operating industrial parks in Binh Duong, Dong Nai and Long An have achieved an average occupancy rate of over 80%. Especially in HCMC, the occupancy rate has reached over 90%.

As of Q3 2020, the number of new industrial parks offering land for lease in the southern industrial region is also very limited. The market welcomed four new industrial parks in the first 9 months of 2020, in which HCMC has 1, Long An province has 2 and Dong Nai has 1 industrial park. The total natural land area of new industrial parks reaches 1,373.8 ha with an expected supply of industrial land for lease at 906 ha.

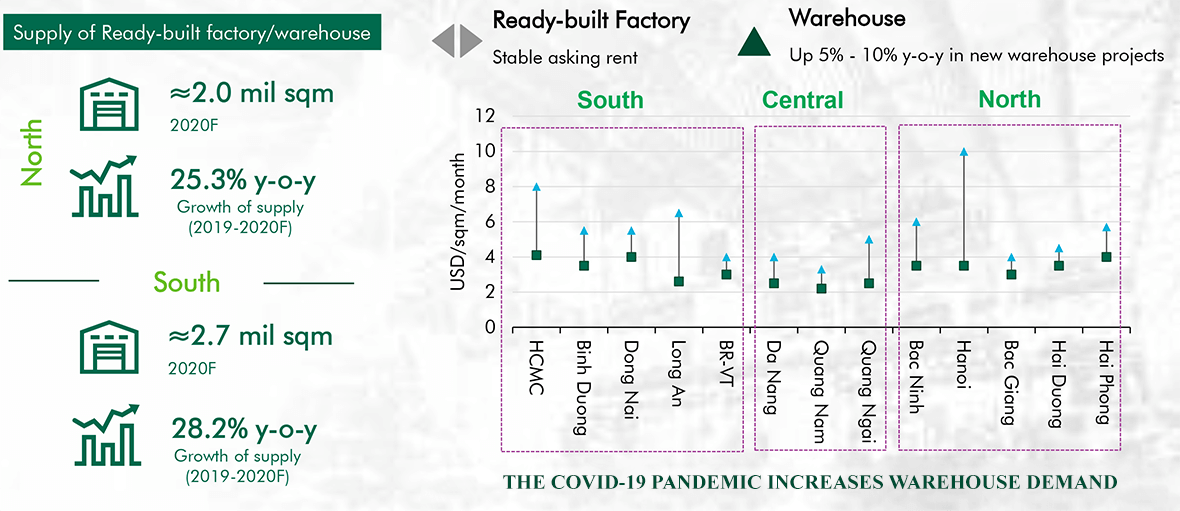

Ready-built factory rent remained stable in the first nine months of 2020 and compared to the same period last year due to ample new supply and delayed leasing activity due to cancelation of site visits by foreign tenants. Ready-built factory supply continues to grow rapidly in the key southern industrial cities and provinces. It is expected that by the end of 2020, the total area of ready-built factories for lease will reach nearly 2.7 million sqm (up 28.2% y-o-y) in major southern industrial areas.

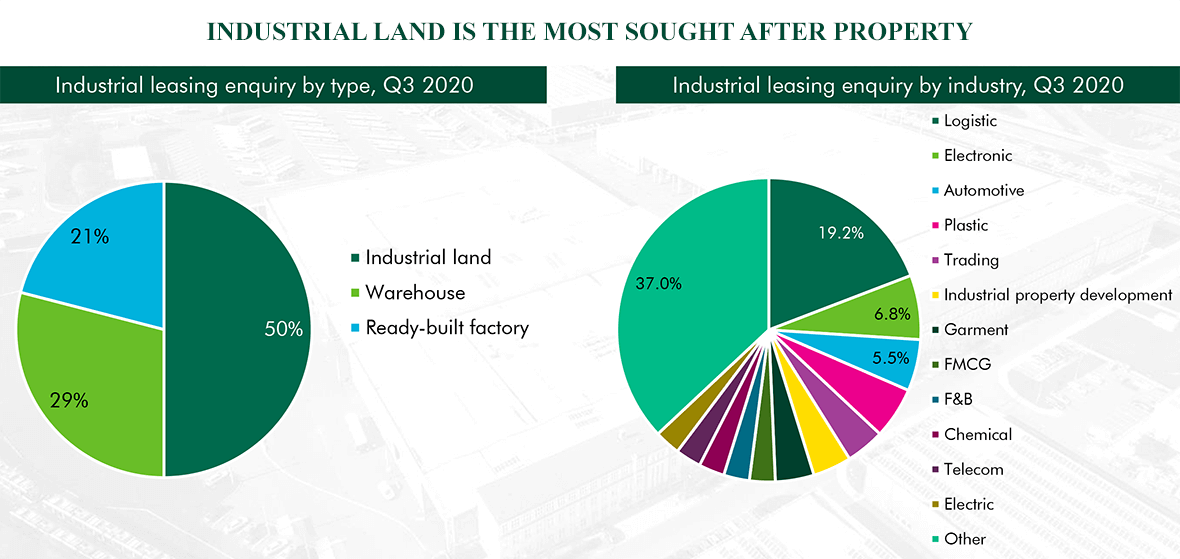

A spotlight of the southern industrial real estate market in the first three quarters of the year was the need to expand storage space and distribution networks of e-commerce and logistics companies.

In addition, the need to find land banks for developing logistics facilities also increased significantly from foreign investors. This trend is forecasted to continue to dominate demand of ready-built warehouse market as well as industrial land for logistics development in the near future. Besides, temperature-controlled storage spaces (cold or cool storage) are also considered a new development trend in the logistics industry as the fresh food distribution and sales network expands significantly both via online channels and physical stores or supermarkets. In prime locations with limited industrial land supply, high-rise warehouses have also begun to emerge to create larger storage space for the needs of e-commerce companies.

Expansion of existing factories and new construction of manufacturing facilities in the context of accelerated relocation strategy will be the main source of demand in the coming time. While industrial land rent has reached a high level in well-located industrial parks, tenants have to seek for new land supply in areas which are further from existing industrial hubs.

In addition, industrial real estate developers are making changes in product development to adapt to the new situation. Outstanding features are application of modern technology to management and operation of the facility, providing service packages including legal, human resources to help customers save time and costs during project implementation. This is gradually creating a new model of industrial real estate development in Vietnam which intergrate industrial property provision and investment as well as management support services.

Related news

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2019

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2019

Vietnam’s Economic Backdrop Quarterly Reports | Q2 2019