Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2019

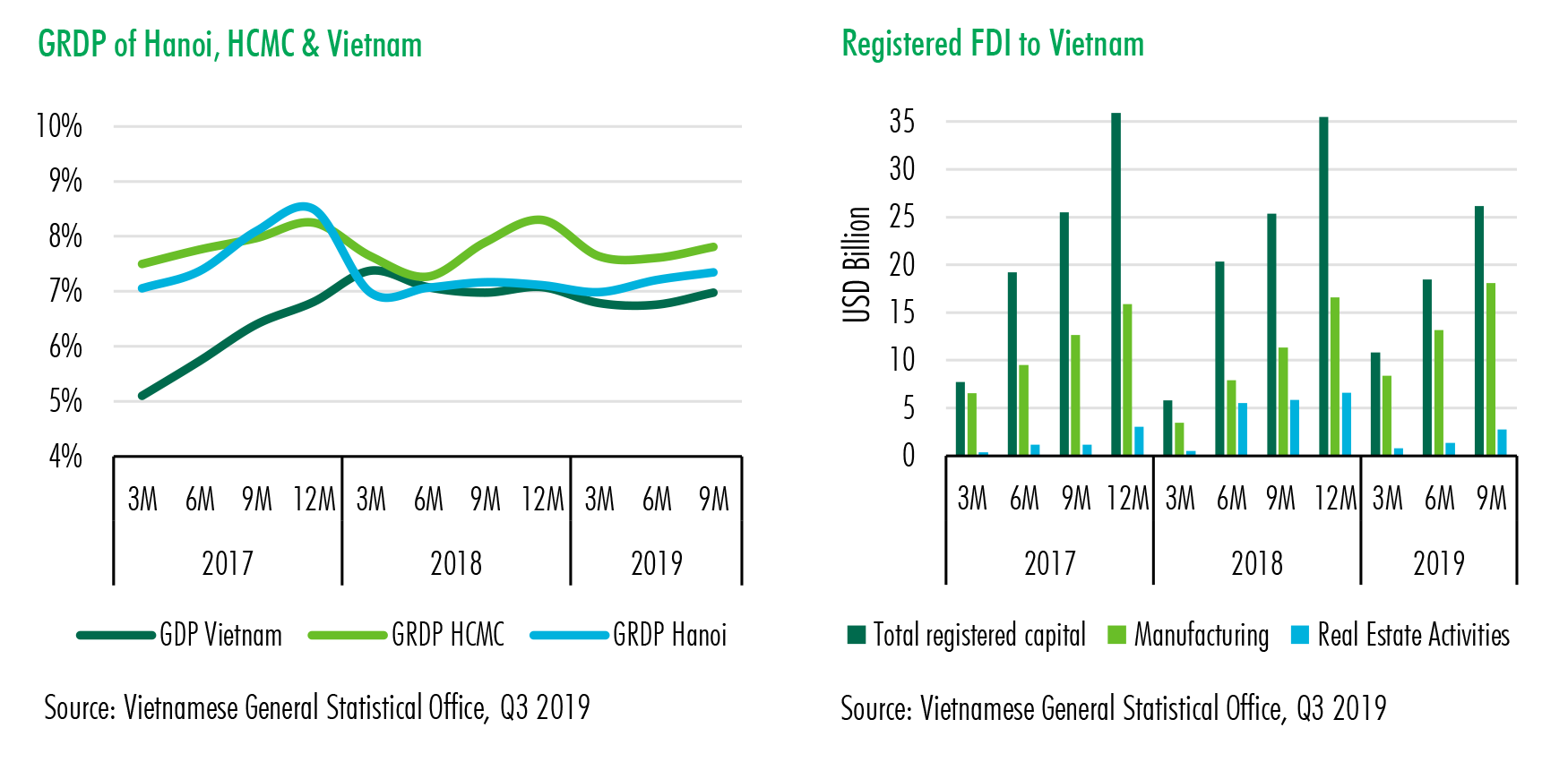

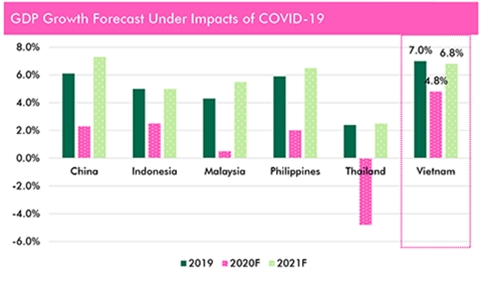

Vietnam’s economy

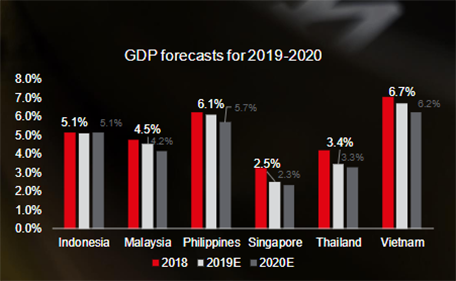

Vietnam’s GDP in 9M 2019 was estimated to grow significantly at 6.98% y-o-y, which was supported by strong growth in exports and manufacturing amid diversification push from global manufacturing firms. Average CPI in 9M 2019 increased by 2.5% y-o-y, well within the government’s annual target of below 4%.

Office Market

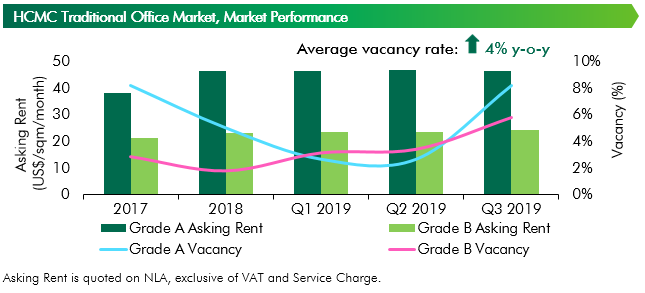

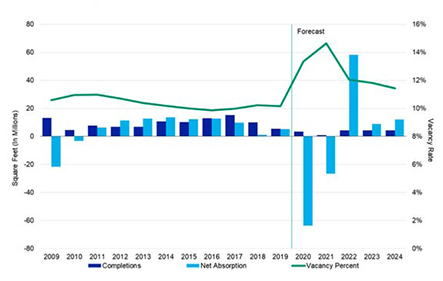

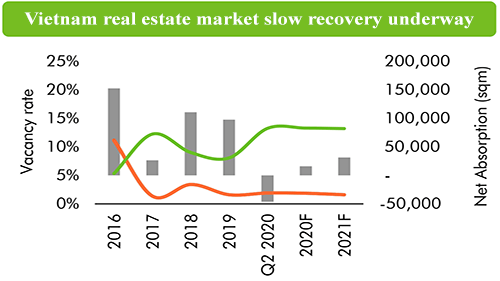

HCMC office market welcomed three new office buildings of both Grade A and B in Q3 2019, an addition of 82,666 sqm NLA, which increased the total market supply to more than 1,300,000 S.qm NLA. Up to this point, Lim Tower 3 was the first new Grade A office building launched to the market since Q4 2017. As of Q3 2019, Grade A stock reached 414,113 S.qm NLA from 16 buildings while Grade B supply increased up to 894,201 S.qm NLA from 65 buildings.

Abundant new supply has curbed the rental growth rate, especially for Grade A segment. In Q3 2019 the average rent of Grade A was recorded at US$46.6 psm pm, much higher compared to the average rental rate of the market (approximately US$27 psm pm for both Grade A & B), showing a slight decrease of 0.3% q-o-q and an increase of only 2.4% y-o-y.

Looking back at our forecast from the beginning of the year about the market trend of fringe CBD and decentralized-Grade B offices preference, in quarter 3, Grade B rental rate continued to increase by 2.7% q-o-q and up by 5% y-o-y despite of a large influx of new supply into this segment. In addition to the comparative advantage in terms of rental rate (compared to their Grade A counterparts), recently added Grade B offices also enjoyed high construction quality and favourable locations even though most of them are in the fringe-CBD and decentralized areas.

A large addition of new office space caused vacancy rates of both segments to increase. Grade A vacancy hit 8.2%, an increase of 5.6 ppts q-o-q and 4 ppts y-o-y while that for Grade B reached 5.8%, up by 1.5 ppts q-o-q and 4 ppts y-o-y.

From Q4 2019 to the end of 2020, HCMC’s office market is expected to welcome more than 190,000 S.qm NLA from 10 buildings, which consist of 2 Grade A projects – UOA Tower and Friendship Tower, and 8 Grade B buildings – Phu My Hung Tower, DHA, Viettel Tower B, Opal Office Building, CII Building, 257 Dien Bien Phu Tower, Cobi Tower 2 and The 67 Tower. As such, Grade A vacancy rates by the end of 2019 and 2020 are expected to reach 10% and 14%, respectively. On the other hand, vacancy rates of Grade B in the same periods are projected to increase to 6.6% and 7.4%, respectively.

In terms of rental growth, Grade A rent is expected to remain relatively flat in 2020 with growth rate of only 0.6% y-o-y, which is affected by the decentralized Grade A offices’ rents coming online in 2020. On the contrary, with more room for rental growth, Grade B rent is expected to increase more in the next few years despite the intensified competition. Particularly, from the end of 2019 to 2020, Grade B rent is forecasted to increase with an annual growth rate of 2%.

Flexible workspace

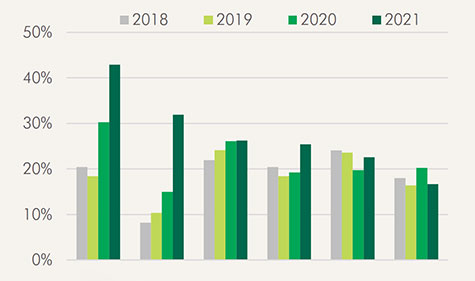

Technology sector has made big strides when surpassing Flexible Workspace in the number of major transactions closed in Q3 2019 with 21%, followed by 17% of Flexible Workspace. These occupiers tend to absorb large space of more than 500 S.qm and up to 8,000 S.qm.

In the future, Technology and Flexible Workspace will continue to dominate the office demand in HCMC thanks to the boom in new start-ups and the thriving of technology industry of Vietnam in recent years. Additionally, while the office market will be more competitive with many new buildings, occupiers will benefit from more diversified options as well as gaining advantages and negotiation power over landlords.

Retail market

There is not any new retail property opened in Q3 2019. In the review quarter, Parkson C.T Plaza (Tan Binh District) changed ownership, renovated and was renamed to Menas Mall. Currently, the third and fourth floor of the mall were closed for fitting out. Also in the same review quarter, Parkson Saigontourist was still under renovation and planned to re-open in 2020. As a result, only Parkson Hung Vuong Plaza was still in operation while the other Parkson projects were either closed or going through significant changes. As of Q3 2019, HCMC has a total of 57 retail projects with total NLA of 1,043,000 S.qm.

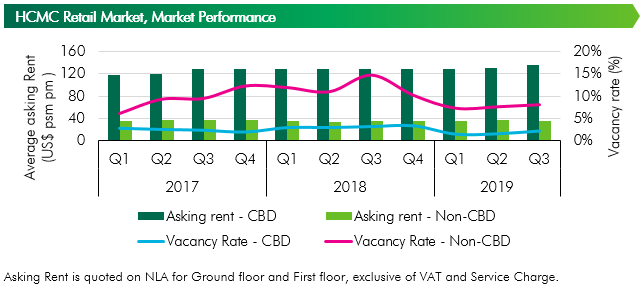

As of Q3 2019, rental rate was US$135.5 psm pm in the CBD and US$35.8 psm pm in the non-CBD. Average rental rate in the CBD increased by 3.7% q-o-q while that in the non-CBD decreased by 0.9% q-o-q. On annual basis, non-CBD rental rate increased slightly by 0.2% and CBD rental rate increased by 5.8%. Vacancy rate increased in both areas, by 0.6 ppts in the CBD and by 0.5 ppts in the non-CBD, compared to previous quarter. By retail format, occupancy rate did not have any change in Department store and Retail podium format. In shopping centre format, renovation and tenant mix revision in some projects had temporarily picked up the overall vacancy rate; however, vacancy rates in these projects were expected to improve in coming quarters.

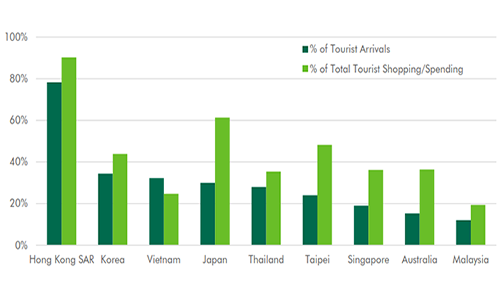

Although the number of new international brands entering the market in Q3 2019 was limited, retail market in both HCMC and Vietnam was still considered attractive to international retailers and developers, thanks to the country’s growth of young population and changes in their shopping behaviours. In the review quarter, a Japanese entity, Stripe International, acquired Vascara brand, two years after its acquisition of NEM brand. Also, Amazon officially established office in Vietnam, aiming to support small and medium enterprises, besides individuals who participated in online commerce. According to Insider Retail Asia, BGF, a Korean retail group, would enter Vietnam market in 2020 by opening a convenience store chain named CU. In terms of consumers’ behaviours, F&B, Fashion and Accessories, Entertainment, Convenience store and Beauty and Health continued to be among top attraction categories. In some shopping centres, renovation was under progress to target these changes in consumption trends.

In Q3 2019, we noticed some short-term delays at some under-construction projects, and as a result, total of 2019 new completion would be lower than previously estimated. In the last quarter of 2019, Crescent Mall Phase 2 (Crescent Hub) will be opened: the second phase has a total NLA of 16,000 sqm and will be connected to the 45,000 sqm Phase 1. In the new phase, the developer focused on F&B, Fashion & Accessories and Entertainment. In 2020, we estimate that 237,000 sqm of new NLA will be in operation; these NLA will come from eight projects across HCMC market. Vincom Mega Mall Grand Park, with 48,000 sqm of NLA will the biggest project to be opened in 2020; the project is the retail component of Vinhomes Grand Park, a 271 ha township by Vingroup in District 9.

Condominium market

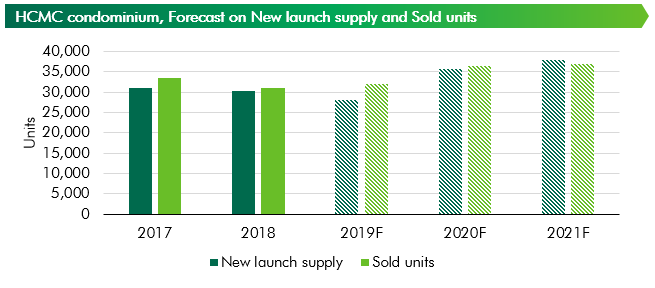

In Q3 2019, new launch supply in terms of unit showed a significant improvement compared to Q1 and Q2. However, new launch supply only came from ten projects, which did not show a recovery of the whole market. There were 13,072 units launched in Q3 2019, an increase of 217% q-o-q and 107% y-o-y. New launch supply in 9M 2019 reached 21,619 units, a decrease of 3% y-o-y. Most of the new supply was launched in July and September to avoid the “ghost month” in August. New launch projects generally achieved high sold rate, even though their primary price increased over 10% compared to old projects in the surrounding area.

In terms of segment, mid-end segment accounted for the highest proportion of new launch units in Q3 at 87%, followed by high-end at 10%. This proportion led to the most common selling price of around VND32-40 million per sqm which is equivalent to VND2.2-2.8 billion per two-bedroom unit. Q3 2019 recorded one new launch in luxury segment which is The Crest Residence with 240 units and launching price of around US$5,500 per sqm. There is no new launch supply in the affordable segment for the last two quarters.

Sales momentum continued to be positive in Q3 2019 with more than 90% of new launch units having been absorbed. In Q3 2019 there were 13,386 sold units, an increase of 191% q-o-q and 113% y-o-y. Most of the sold units in the review quarter were recorded from Vinhomes Grand Park project in District 9. This project was prepared for over a year before the first launch event with the highest number of new launch supply in one launching phase of nearly 10,000 units.

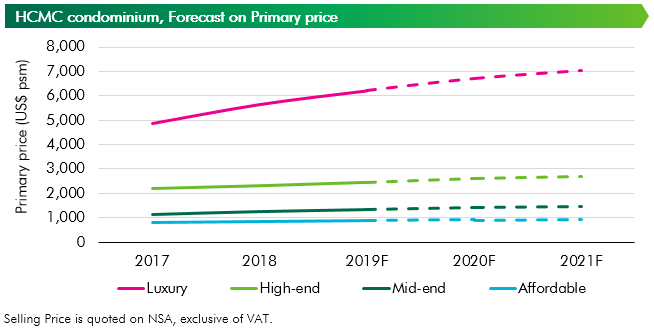

Thanks to the new wave of supply in mid-end segment, average price on the primary market was stable compared to the previous quarter and was recorded at US$1,852 psm, an increase of 15% y-o-y. Increases in primary price were observed across the market for both remaining stocks and new supply. In term of location, District 2 and District 9 recorded highest price escalation of 5%-10% y-o-y.

In the last quarter of 2019 and 2020, the market is expected to welcome 42,000 units from new projects in fringe districts: The West with AIO City, Akari City and D-Homme; and the South with subsequent phases of Eco Green Saigon, Sunshine City Saigon and new projects including Sunshine Diamond River, Lovera Vista.

Primary prices will increase slightly thanks to the new supply. Luxury segment is expected to have price increase of 10% y-o-y due to limited supply. Prices for high-end and mid-end segments will increase by 6% and 5% y-o-y, respectively, due to new supply and the high price level in 2019. Affordable segment will have a modest growth of 3% y-o-y.

In addition, the remaining issues including flooding, air pollution and traffic congestion had a negative impact on living quality in big cities. As a result, new township developments in the East and the West area that offer full range of facilities and good connectivity will receive high interest from the market.

Condominium ranking criteria:

- Luxury: projects that have primary prices over US$4,000 psm

- High-end: projects that have primary prices from US$2,000 psm to US$4,000 psm

- Mid-end: projects that have primary prices from US$1,000 psm to US$2,000 psm

- Affordable: projects that have primary prices under US$1,000 psm

(Selling price excludes VAT.)

Landed property (Ready-built Villa and Townhouse)

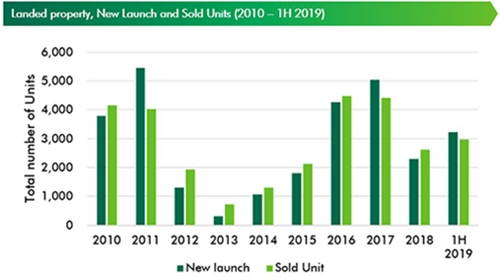

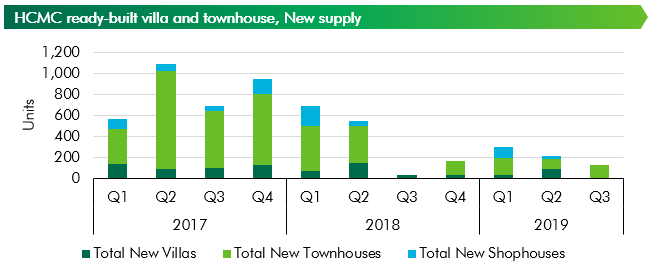

The shortage of new supply was recorded again in the third quarter of 2019 in the ready-built villa and townhouse segment despite high expectation for the launch of large-scale projects. Specifically, the whole market had 127 new townhouses launched from three projects located in Go Vap District (66 units), Tan Phu District (21 units) and District 12 (40 units). Growth of cumulative supply across the city was only 0.8% q-o-q, the lowest level in the last four consecutive quarters and the new supply decreased by 41% q-o-q. The primary asking price of newly launched units ranges from US$2,300 psm land and US$5,200 psm land (District 12 and Tan Phu District) to about US$10,000 psm land (Go Vap District). The projects launched in this quarter did not achieve high sold rate (only from 13% - 52%) although there were not many new supplies in the market. The reason may come from the reluctance to trade in the lunar-calendar July, while the new projects were developed on small scale by less reputable developers as well as the availability of more attractive investment options in neighbouring provinces of HCMC such as Dong Nai and Long An.

The market was expected to welcome large supply from both well-known Vietnamese and foreign developers at the end of the quarter. However, due to many unexpected reasons, these projects have been delayed until the end of 2019. This continues to make HCMC’s market less attractive when the new supply "dripped" and the asking price was levelled up significantly due to regular change of owner on the secondary market. In contrast, the market in the neighbouring provinces of HCMC, such as Dong Nai and Long An, in the past quarter has received much more interest with the introduction of large township projects. For example, in the bordering districts of Dong Nai province and HCMC, the new supply launched in the first nine months was about 24% higher than that of the whole HCMC. Ready-built villa and townhouse projects in the provinces focus on clean living environment and green landscape along with attractive prices and payment policies. Township projects that are expected to enjoy a boost in connecting to HCMC are attracting a lot of attention from buyers.

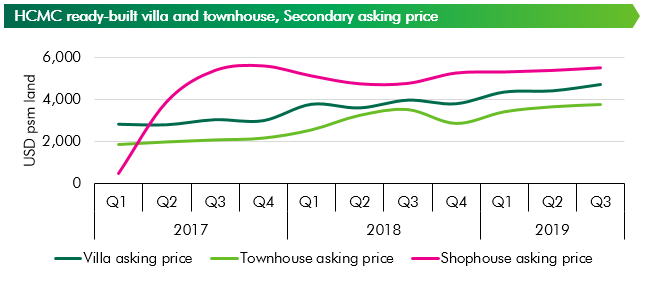

Regarding price movements from the beginning of the year until now, the secondary asking price has maintained a slight upward trend. Secondary asking price of ready-built townhouses has increased 3% q-o-q and 4.2% y-o-y on the transfer market. For shophouses, the secondary asking price increased by 2.3% q-o-q and 4.5% compared to the same period last year. Particularly, secondary asking price of ready-built villa achieved the best growth when it recorded 6.8% q-o-q and 20.1% y-o-y growth rate.

It is expected that new supply will prosper in the last three months of the year with about 500-600 units launched to attract buyers at the end of the year time. Cumulative supply growth in the year-end is expected to reach 3.1% q-o-q and 7.4% y-o-y with the total new supply in 2019 expected to be approximately 1,150 units. The eastern and southern areas will continue to lead the market with notable projects such as Verosa Park (Khang Dien), Vinhomes Grand Park (Vingroup), ZeitGeist Nha Be (GS E&C), Senturia An Phu (Tien Phuoc), Golf View Residence (Novaland). The upward trend of asking price is still upheld with an increase of 2-4% q-o-q and 10-20% y-o-y.

Song Chau Group.

Related news

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2019

Vietnam’s Economic Backdrop Quarterly Reports | Q2 2019