Condominium market new development stage | Especially in HCMC - Hanoi

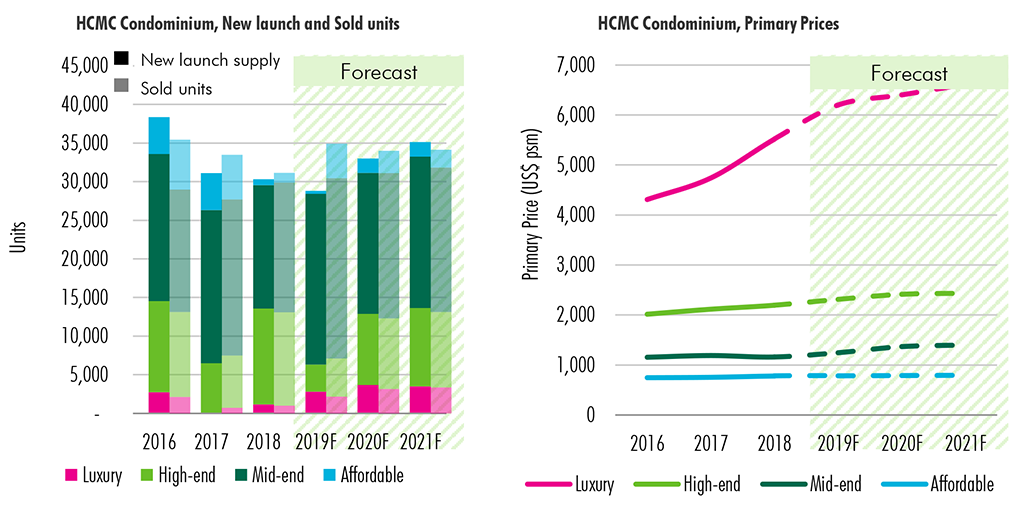

CONDOMINIUM IN HO CHI MINH CITY

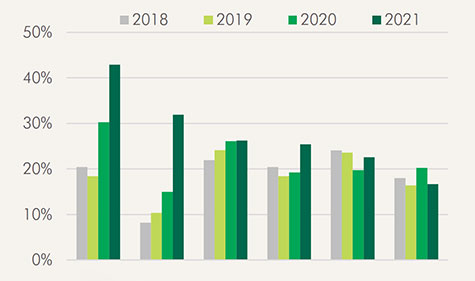

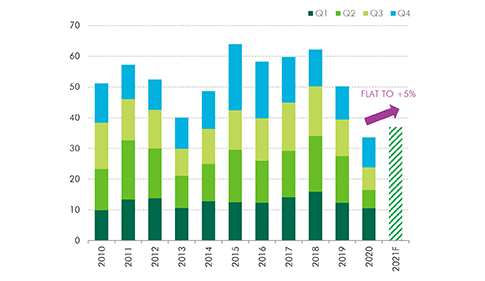

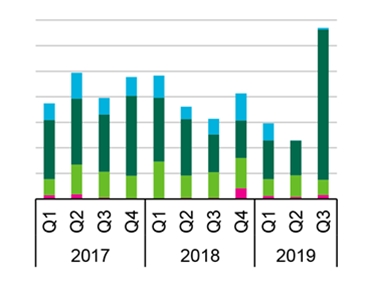

New launch in 2019 will be slightly lower than 2018 due to slow licensing process. By 2020, with the removal of restriction for condominium development in central area, new launch supply will reach 33,000 units. In 2021 together with the completion of Metro Line No. 1, the market is expected to have additional 35,000 units.

Mid-end segment is expected to reach 75% of 2019 new launch supply, the highest number since 2007, thanks to large scale projects in the East and the South. In 2020, launches of luxury and high-end segment are expected to increase by 35% y-o-y thanks to new projects in District 1 and Thu Thiem area. Affordable segment expects to maintain a stable growth rate.

Selling prices in mid-end and affordable segments are expected to post modest growth rates from 1%-3% due to high competition from a large volume of supply. High-end projects in District 2 and District 7 are expected to see higher selling prices, representing 5% y-o-y growth. For approved luxury projects in District 1 and District 3, selling prices are expected to increase from 5%-7% per year, due to scarcity of land bank in the city centre. This growth rates are similar to 2018 in most segments.

Secondary market will be more active in 2019 thanks to shortage of new supply, especially in District 1, 2 and Thu Thiem area. Projects in these areas can achieve up to 30% price growth compared with launched prices.

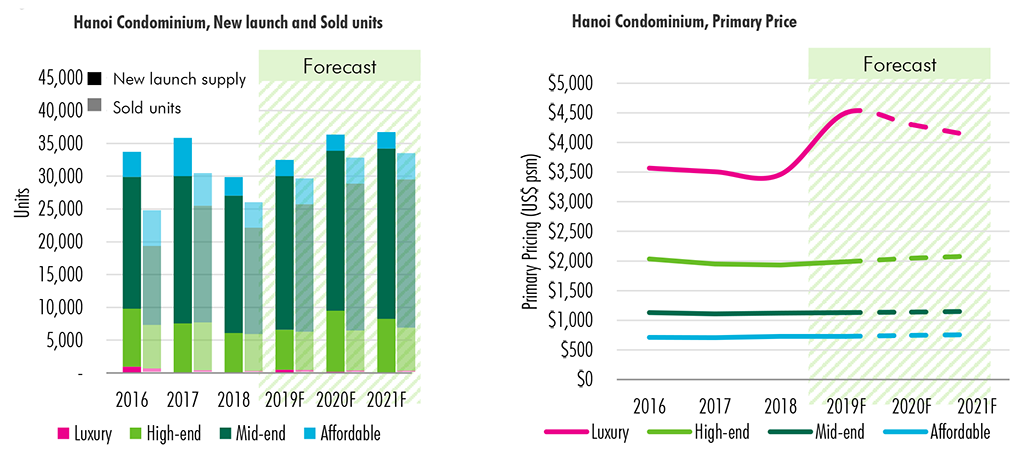

CONDOMINIUM IN HANOI

The level of new supply is expected to stay at above 32,000 units in 2019 –a relatively similar volume as seen from 2016 –2018. The mid-end segment still dominates the market with forecasted share to new supply of around 65 –70% pointing out that Hanoi market is end-users-oriented.

Sales performance, thus, is forecasted to reach 28,000 –30,000 units in 2019. While mid-end products are common in condominium market, recent progresses seen at prime sites in core districts and Tay Ho area signal the return of luxury after two years absent of new supply.

Luxury primary pricing is expected to reach around US$4,500 psm much higher in comparison with previous launch levels of US$3,5000 -$4,000. For high-end segment, it is expected that there will be more product upgrades and offerings from both local and international developers to meet the demand of investors and high-income end-users. Pricing growth of mid-end and affordable segments is predicted to be modest at around 1-2% in 2019 given strong pipeline from these segments.

Song Chau Group.

Related news

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2019

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2019