Hanoi Real Estate Market Quarterly Reports | Q1 2019

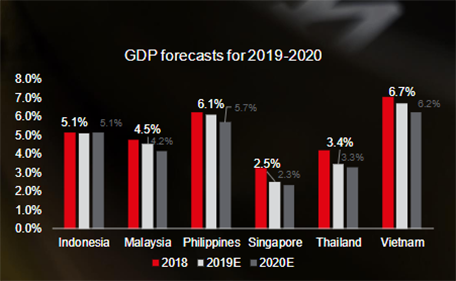

Vietnam economy

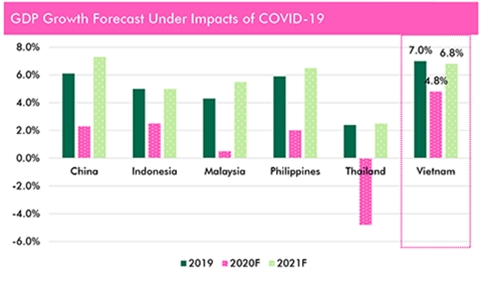

After strong economic growth in 2018, Vietnam’s Q1 GDP increased by 6.79%, lower than the 7.38% growth of Q1 2018, but still higher than that from 2009 – 2017. Albeit lower growth, this is still positive for Vietnam economy, considering the slowdown of the global economy and various world’s issues. The main drivers for achieving such growth were manufacturing and processing industries, which expanded 12.35% y-o-y. Following the Lunar New Year spending echo in February, CPI in February rose 2.64% compared to the same period last year. March posted a 0.21% reduction in CPI from previous month due to low consumption after Lunar New Year and the African swine fever. On average, CPI in the first quarter of 2019 rose 2.63% compared to 2018.

In Q1 2019, foreign direct investment is the brightest side of Vietnam economy. During the period, the total value of FDI, including newly registered capital, increased capital, and stake acquisitions reached US$10.8 billion, equivalent to 86.2% y-o-y increase. Hong Kong surpassed Japan and Singapore to become the largest foreign investor to Vietnam, contributing US$4.4 billion or 40% of total foreign direct investment recorded during the quarter. Manufacturing and processing remain the major attractive sector for FDI with a value of US$8.4 billion, about 77.7% of total FDI. Real estate continues to rank second most attractive investment field, with US$778 million – about 7.2% of total FDI. Hanoi continues to be the most attractive investment destination in Vietnam, with about US$4.2 billion investment – 38% of total FDI to Vietnam.

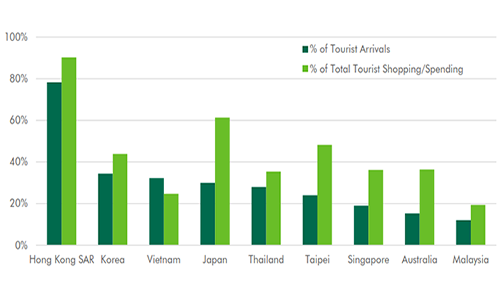

In the first three months of 2019, Vietnam welcomed 4.5 million of international tourist arrivals, up by 7% y-o-y. Asian tourists dominated the tourism market, with arrivals from South Korea, Taiwan, Thailand increasing by 24.1%, 26% and 49.3% y-o-y, respectively. China, with almost 1.3 million arrivals, remains the largest source market to Vietnam, but the amount was down by 5.6% y-o-y.

Office market

In the first quarter of 2019, one Grade A office entered the market, Thaiholdings Tower with 24,545 sq.m NLA, increasing Grade A stock in the CBD by 10%. This is the newest Grade A supply after three years without new supply and the newest office supply in the CBD-submarket. By the end of Q1 2019, total office space in Hanoi reached approximately 1.3 million sq.m, in which Grade A accounts for only one third of the total stock.

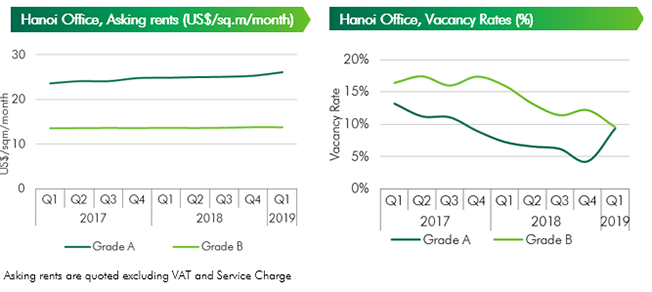

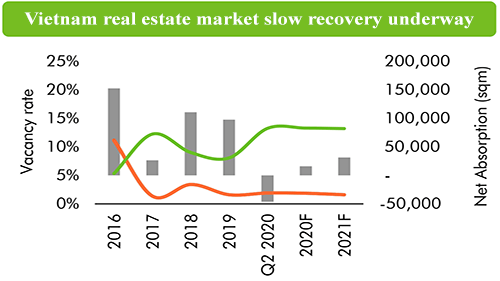

During the review period, Hanoi office market still saw relatively strong demand, primarily from local IT/Tech and flexible office providers as well as foreign insurance companies, with net absorption of 21,600 sq.m, up by 9% y-o-y. Vacancy rate for Grade A went up by 5.0 percentage point (ppts) compared to the previous quarter due to new supply, staying at 9.4%, while that of Grade B went down by 2.6 ppts q-o-q, reaching 9.6% - the lowest level over the past three years.

Asking rents of Grade A buildings in this quarter posted an increase of 3.2% q-o-q, achieving US$26.2/sq.m/month exclusive of VAT and service charge. Grade B buildings, on the other hand, saw rental rates to remain at a level similar to the previous quarter of US$13.8/sq.m/month.

Approximately 138,000 sq.m is expected to come on stream throughout 2019. It is also worth noting that about 62% of this expected supply is in the West submarket, which continues to strengthen its position as the largest office supply hub of Hanoi. From 2019 onwards, tenants will have even more options to consider given a quickly increasing volume of office supply to be introduced from both Grade A and B. Locations such as Midtown and West submarkets will continue to appear in the prioritized option lists of IT firms and Insurance/ Bank branches. Meanwhile, MNCs, Embassies and Financial sector companies will have new options in the CBD for their expansion or relocation plans. In terms of demand, on the back of strong economic fundamentals, the financial and IT/ Tech sectors remain in good shapes and stable demand drivers.

Condominium market

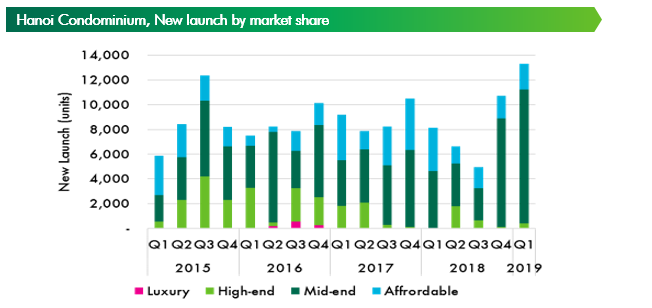

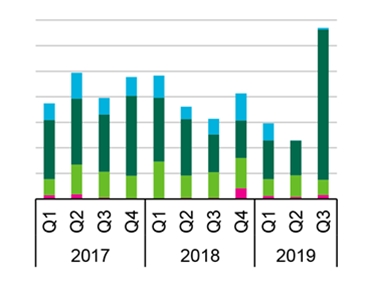

In Q1 2019, the Hanoi condominium market recorded one of the highest number of units launched in a quarter. A total of 11,822 units were launched from 26 projects, up by 46% as compared to Q1 2018. Notably, most of the units launched were from follow-on launches of mega projects such as Vinhomes Ocean Park "Gia Lam District" and Vinhomes Sportia "Nam Tu Liem District". In terms of location, the East leads the new launch supply covering 57% of total new launch in Q1 2019.

Despite Tet break, sales transactions remained strong during the quarter. An estimated 9,390 units were sold during the quarter, 36% higher than that of Q1 2018. Active sales and promotions activities by developers before and after Tet holiday supported sales performance during quarter. Mid-end segment maintained its highest share of total units sold making up 68% of total transactions recorded this quarter. The market has witnessed strong demand from both local and foreign investors for projects at locations close to industrial parks "The East" or expat communities West or Tay Ho district.

In terms of pricing, selling prices in the primary market in Q1 2019 averaged US$1,333 per sq.m., a slight increase of 1% y-o-y. The launch of luxury and high-end apartments at prime locations in the CBD and Tay Ho area in this quarter led to higher primary prices. Additionally, follow-on launches of certain projects also offered higher primary prices in comparison with previous towers.

Condominium ranking criteria:

- Luxury: projects that have primary prices over US$4,000/sqm

- High-end: projects that have primary prices from US$2,000/sqm to US$4,000/sqm

- Mid-end: projects that have primary prices from US$1,000/sqm to US$2,000/sqm

- Affordable: projects that have primary prices under US$1,000/sqm

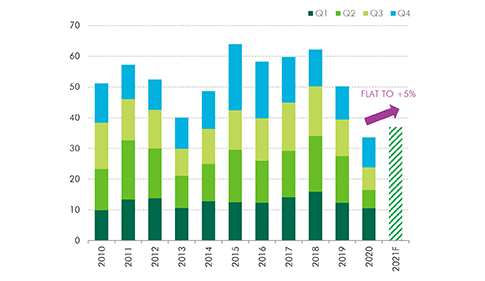

Moving forward, the level of new supply is expected to stay at above 32,000 units in 2019 – a relatively similar volume as seen during 2016 – 2018. Mid-end segment continues to dominate the market with forecasted share to new supply of around 65 – 70% pointing out that Hanoi market is end-users-oriented. Sales performance, thus, is forecasted to reach 28,000 – 30,000 units in 2019. In terms of primary pricing, average pricing level in 2019 is predicted to be slightly higher than that of 2018 given high proportions of mid-end and affordable in total new launch supply.

Landed property market

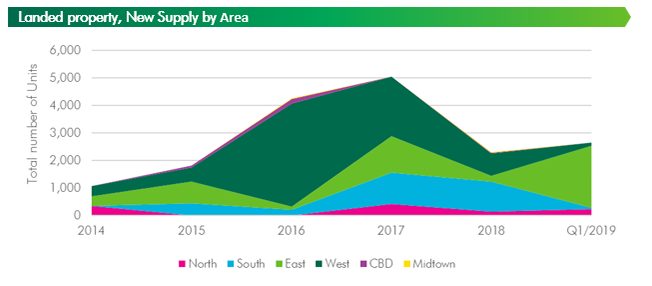

Q1 2019, contrary to the previous quarters, witnessed the increasing excitement of the landed property market in Hanoi with the introduction of five new projects. A total of 2,641 newly launched units were recorded, the highest level of new supply by quarter during the last three years. In terms of location, the market has been expanding further from traditional areas. While the West still accounts for the largest proportion of total supply, we are observing the formation of residential areas in suburban districts, especially in the East and the South. 86% of the new supply in the first quarter of 2019 is located in the East, while the West provides just a minimal proportion of 3.7%.

Impressive sales performance is achieved during the reviewed quarter despite the massive stock of new launches, which indicates the improving market sentiments for landed residential properties in Hanoi. Approximately 2,128 units were sold during the first quarter of 2019, an increase of 45% q-o-q.

In terms of market performance, secondary prices for villas in Q1 2019 averaged US$3,924 per sqm, with VAT and construction costs all included. This figure posted an increase of almost 3% comparing to the preceding quarter, and a moderate rise of 2% y-o-y. In line with the geographical diversification in the supply of Hanoi landed property, notable changes regarding villa secondary prices in emerging locations such as Ha Dong, Gia Lam, Hoai Duc and Long Bien were observed. Prices in such areas are seen to be following an upward trend given the entering of well-known developers with high-quality, comprehensive projects and the improvement of surrounding infrastructure.

Retail market

Hanoi Retail Market started 2019 with the launch of one new retail project, Sun Plaza Ancora, adding 16,100 sq.m NLA to the market. By the end of 2019, retail supply will grow by 21% compared to previous year, bringing total space to surpass one million sq.m. Midtown and the West will continue to dominate market supply as 126,700 sq.m will be added in 2019 in this area. On the other hand, residential developments and infrastructure improvements will lead to more retail supply in the South with two openings in 2019 – Hinode City and Sun Plaza Ancora.

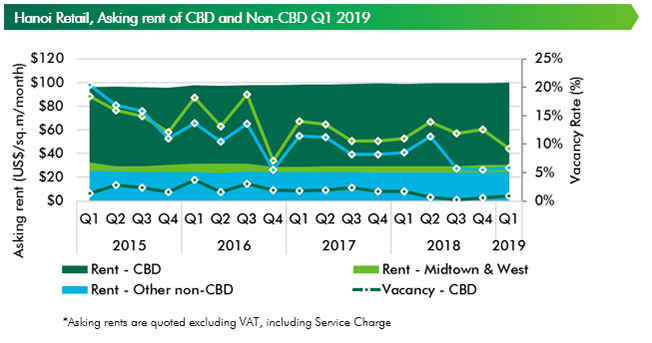

Slight pick up of ground floor rents was recorded in CBD the first quarter of 2019, reaching US$100/sq.m/month, up 1.1% y-o-y and 0.5% q-o-q. As no new supply in CBD is expected in 2019, average asking rents in this area will continue to post positive growth in the coming year while vacancy will continue to stay at level as low as 1%.

Ground floor rents in the largest retail supply area, Midtown and the West remained stable at US$30.4/sq.m/month in Q1 2019 as the market gradually absorbed new opennings in 2018. Vacancy in Midtown and the West decreased to 9.3% in Q1 2019, down 1.8 ppts y-o-y and 3.3% q-o-q. However, this area is most likely to see rent adjustment and increased pressure on vacancy by the end of 2019 with four future projects (nearly 70% of new supply) located in this area. Retail centers in Other non-CBD location saw rents up by 1.7% y-o-y to US$24.5 while vacancy up by 2 ppts y-o-y to 5.9% by end of Q1 2019 with the opening of Sun Plaza Ancora in January 2019.

Supermarket and convenience store in Hanoi continued to see the dorminance of one local player, Vingroup. The local conglomerate acquired Fivimart chain in 2018 and most recently acquired 87 stores of a convenience store chain, Shop&Go.

Amid the disruption of e-commerce, while F&B is gaining market share with impressive growth in Internet retailing, other retailers face the challenges of keeping track with changing consumers’ behaviors and shopping habits. In March 2019, online fashion arm of Central Group, Robins.vn, was announced suspended, following the closure of online website vuivui.com operated by Mobile World in December 2018.

Song Chau Group.

Related news

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2019

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2019