Hanoi receive new large retail supply commercial space for lease

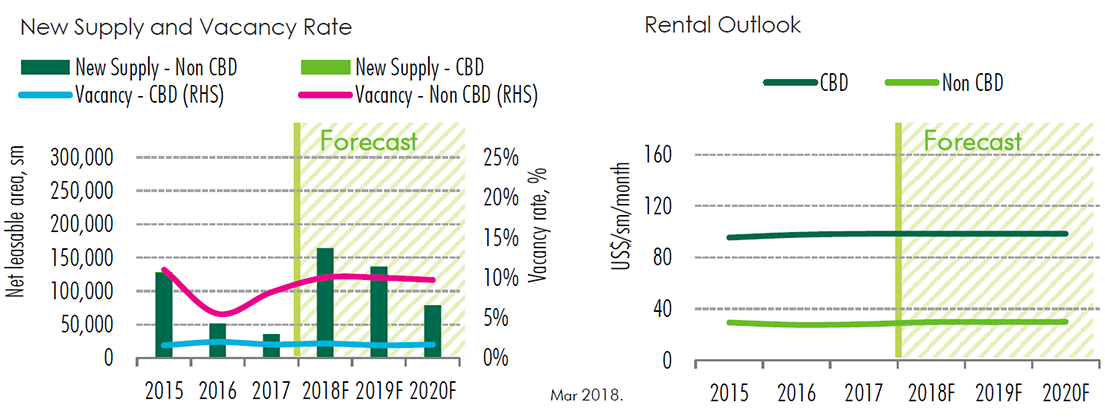

2018 is expected to be an active year in the Hanoi retail market with a total of 157,000 Sq. m coming from eight under-development projects. This is the largest number of new projects ever planned for a single year and is only surpassed by 2013 in terms of scale. Most of these new projects are located in fast developing residential areas with good connecting infrastructure and which are expected to be attractive to both retailers and consumers. Hence, despite this new supply causing pressure on the vacancy rate, the average market rent is still expected to remain relatively stable or even to slightly improve.

Significant new supply expected in non-CBD areas

Meanwhile, the majority of current supply is located in different clusters in Non-CBD areas, in residential areas or other areas with good access to population centres. In the next few years, the Hanoi retail market is likely to follow the expansion trend of residential and infrastructure developments. The areas along Ring Road 3 and the two under-construction metro lines including the West, South West, and South will be hot-spots with nearly 375,000 Sq.m of retail space coming online over the next three years. Significant projects include Aeon Mall Ha Dong in addition to several shopping centers by Vincom and FLC. The North of the city is also quickly evolving with a new project announced earlier this year to be developed by Lotte Group, a Korean developer.

Particularly, an Emerging CBD will soon to be formed in the western area of Hanoi. The area covering Cau Giay, Tu Liem, and Thanh Xuan district is currently the largest retail cluster in Non-CBD, accounted for 41% of total supply. It will continue to remain its position in the next few years with 83,300 Sq. m future supply in the pipeline.

In terms of format, malls as a component of residential complexes will continue to thrive, thanks to a high level of supply in the condominium market. Eight out of twelve future projects up to 2020 are retail podiums. This format has certain advantages such as having resident potential customers and increased traffic due to the residential component, providing added services and amenities and improving the image for the whole project. However, suitable scale, design and parking spaces will be key factors for successful malls.

Song Chau Group.

Related news

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2019

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2019