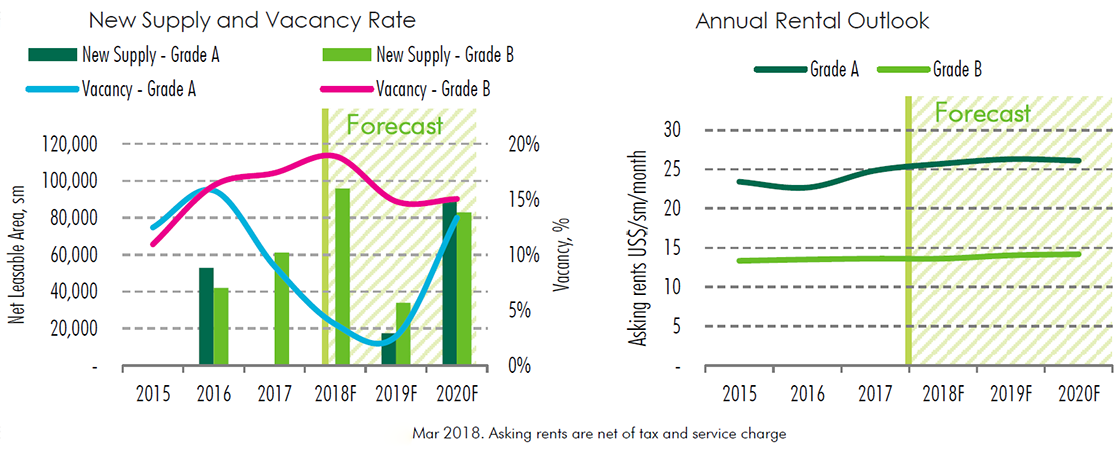

Hanoi's office rental recovery with new supply and occupancy rate 2018-2020

Looking ahead, total supply is expected to increase by between 4% -8% per annum in 2018–2019 before accelerating from 2020 onwards. Limited new supply will foster further improvement in Grade A performance, especially in 2018 when no new project is scheduled to be completed. Grade A’s rental growth can reach 3.5% y-o-y while occupancy rates will increase to 96% by the end of the year. Given limited Grade A supply over the past three years, especially in the CBD, existing tenants in Grade A buildings in the CBD tend to renew current contracts.

Grade B, a higher level of new completions, especially in the West, remains a major challenge for this asset class. In upcoming years, it is expected that the pricing range of Grade B will be larger. New buildings which have good locations, large floor plates and good management will command higher rents than the market average while others will have to rely on a competitive pricing strategy to sustain occupancy. Therefore, we anticipate that there will be no significant changes in Grade B rental rates in Hanoi in 2018.

Vietnam remains an attractive investment destination providing positive economic growth and lower labour costs in comparison with regional peers which boost the leasing demand from foreign tenants. Meanwhile, domestic demand remains strong especially for Grade B office space as the economy continues to expand.

Song Chau Group.

Related news

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2019

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2019