HCMC retail market no new supply in the central business district

In the review quarter, HCMC retail market received a great number of enquiries from F&B and fashion clients, and some of their brands are teenagers’ favorites such as Founder Bak Kut Teh, Wayne’s Coffee, Eat Street, Dickies, Steve Madden, etc. With the golden population structure and rising disposable income, Vietnam market will expect to witness a rapid expansion of the F&B, fashion and health care industries in the next three to five years.

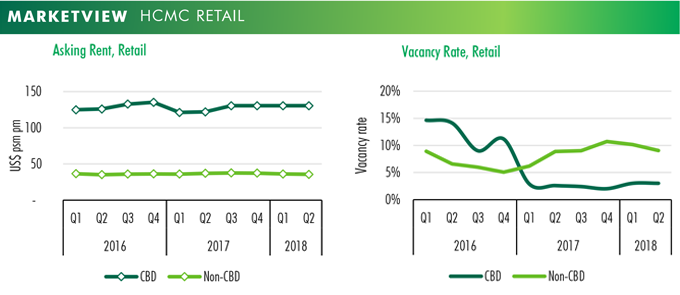

No significant changes in market performance. The asking rent for an area of 80-250 sq.m. on ground floors and first floors in the CBD area remained at US$127 per sq.m. per month, while that in non-CBD area decreased slightly by 4% y-o-y to US$36 per sq.m. per month.

With the golden population structure and rising disposable income, Vietnam market will expect to witness a rapid expansion of the F&B, fashion and health care industries in the next three to five years.

The gap between the asking rent in the CBD area and non-CBD area will widen in the next two years, when many retail podiums are expected to be handed-over and large-scale shopping centres will be located outside of the city center, where the population density is high and personal income is improving. Also, with the limited office supply in the CBD area and the difficulty in leasing retail podiums in non-CBD area, the combination of co-working space and retail podiums will become more popular.

Song Chau Group.

Related news

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2019

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2019