Ho Chi Minh City benefits from prime office market cost

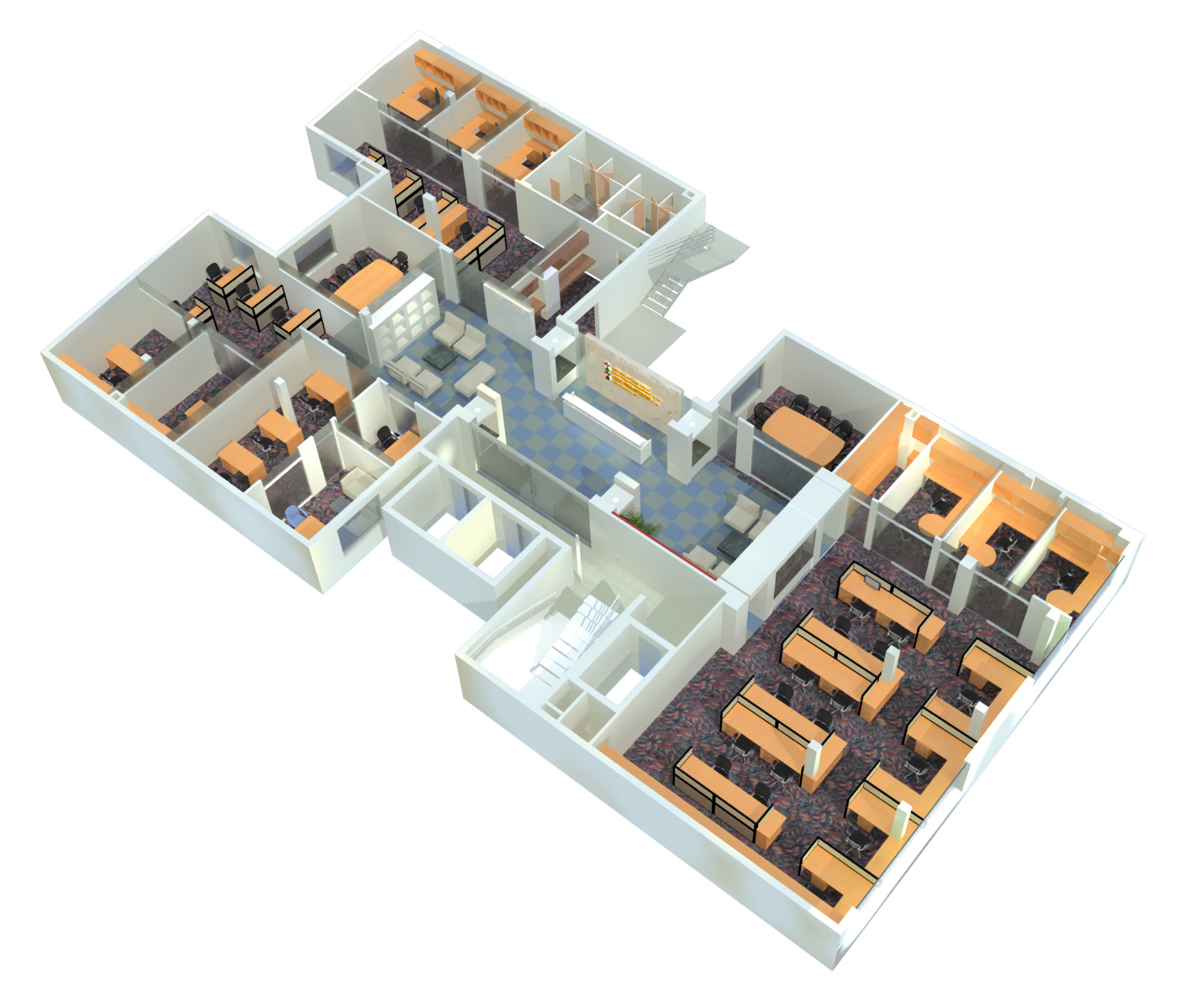

The office for lease prices in Ho Chi Minh City, Vietnam is US$ 37.6/Sqm and US$ 51.8/Sqm, Being considerably lower than Taiwan, Sydney, Singapore, Seoul, Shanghai, Thailand and HongKong certainly help confirm competitive advantage in the eyes of global occupiers. However, with low vacancy rates in many Grade A buildings and limited new supply of prime office space, rents are likely to increase over the next 2 - 3 years.

Besides, co-working office space is a recently emerging trend and similar to the early stages of this concept in HongKong. It’s still fairly small here. But growing co-operation between international developers and local co-working office providers is expected to raise the scale and quality in shared office space, which will help facilitate and nurture growth in the sub-segment.

In addition, quarterly snapshot of occupancy costs for prime office space throughout the world was also presented in the SPOC Index. HongKong is still the world’s most expensive prime office market for occupiers.

Asian markets were less volatile but continued to take 6 of the top 10 positions in the index, making the region the most expensive for global businesses.

No discernible uniformity across the region was seen. Singapore, Seoul and Tokyo all witnessed increases in occupancy costs while Shanghai and Mumbai saw decreases. In general, the impact of exchange rate volatility on recorded occupancy costs for the region was relatively low compared to the previous quarters.

Song Chau Group.

Related news

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2019

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2019