Ho Chi Minh City Office Market Quarterly Report | Q3 2017

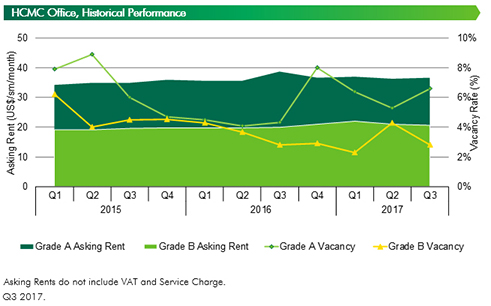

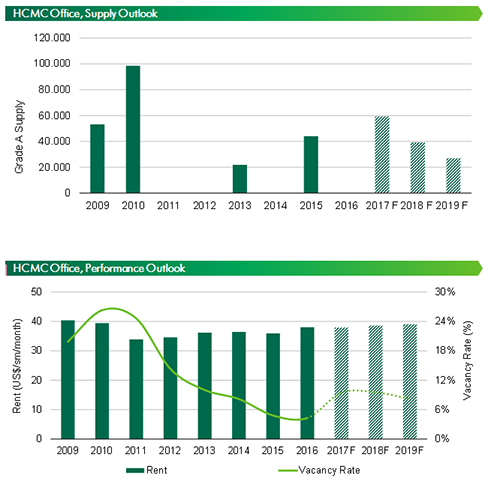

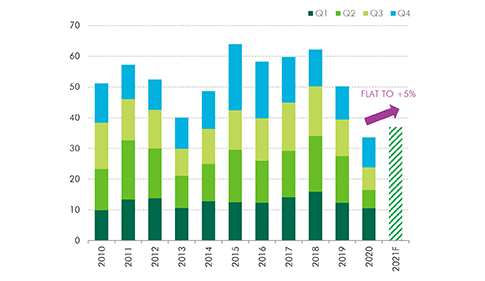

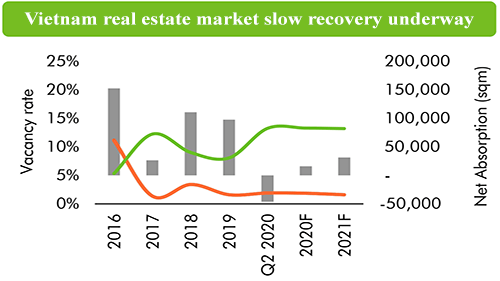

In Q3 2017 Ho Chi Minh City welcomed one new Grade A supply, the long-awaited Saigon Centre Phase 2, adding 32,000 sqm to the total market. The building boasted 25% vacancy rate, an exceptional indicator of good leasing momentum thanks to the developer’s aggressive pre-commitment campaign. No new supply for Grade B was recorded in this quarter.

Market performance continued to be stable in Q3 2017 with strong net absorption from the new supply added between Q2 2017 and the reviewed quarter. Grade A achieved 36.73 USD/Sqm, increasing by 1.1% q-o-q. Although Grade A’s rent decreased by 5.0% y-o-y, it still followed the market general upward trend. Grade B recorded 20.71 USD/Sqm, decreasing slightly at 1.4% q-o-q but increasing 3.9% y-o-y. The decrease q-o-q resulted from lower rents from existing supply to compete with new supply from Q2 2017.

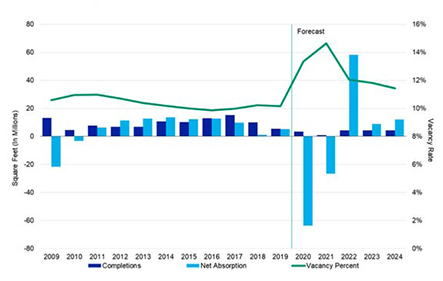

Vacancy rate recorded 6.6% and 2.8% respectively for Grade A and Grade B. Grade A increased 1.4 ppts q-o-q and 2.3 ppts y-o-y because of Saigon Centre Phase 2 entering the market. Grade B reported a slight decrease of 1.2 ppts q-o-q and no change y-o-y due to the absorption of leftover new supply from last quarter.

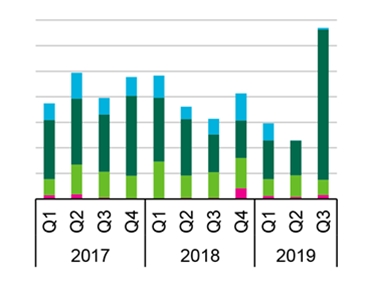

Net absorption in the review quarter was exceptional, with Grade A at 25,510 Sqm and Grade B at 9,831 Sqm. Positive net absorption is due to the level of new properties released to the market as well as good leasing activities recorded at huge quality supply coming from Saigon Centre Phase 2, Mapletree Business Centre and Viettel Complex.

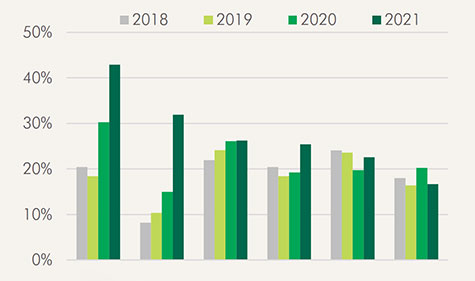

Regarding tenant trends this quarter, Song Chau Group’s enquiries revealed a rising demand for space larger than 700 – 1,100 Sqm, accounting for 28% of total enquiries. Tenants consisted of Manufacturing, Professional Services and Media with 24%, 14% and 10%, respectively. Making up 79% of total enquiries, relocation is the leading purpose for larger space, followed by expansion at 10% and new letting at 12%.

2017 is looking at a strong finish for the office market with the upcoming addition of E-town Central in Q4 2017 and Deutsches Haus in Q1 2018. Future pipeline witnessed larger quality floorplates being planned and under construction, therefore the market will continue its good leasing momentum with larger leasing sizes. Asking rents are at its peak and will continue its stable moderate growth along with steady decrease of vacancy rates.

Song Chau Group.

Related news

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2019

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2019