Ho Chi Minh City Office Market Quarterly Report | Q4 2017

In 2017, Ho Chi Minh City, Vietnam welcomed 4 new supply, 1 Grade A building and 3 Grade B buildings. Q4 2017 specifically welcomed Etown Central, a 36,450 sqm building located in District 4, Ho Chi Minh City with 27 floors and 4 basements to join Grade B supply. This building already boasted 40% vacancy rate in the first quarter of operation and is looking forward to a rapid absorption.

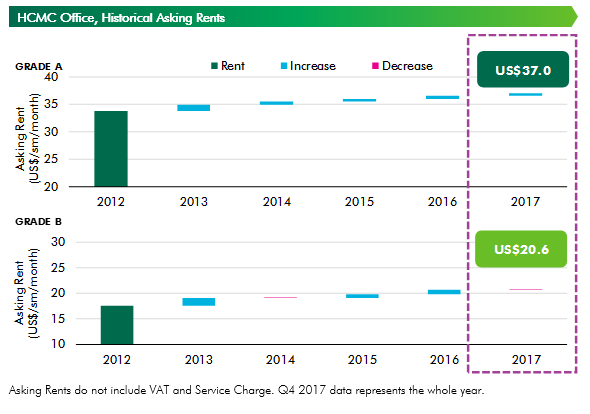

Asking Rents for both Grades displayed a stable trend, with Grade A and Grade B achieving US$37.04 and US$20.63, respectively. Grade A reported an increase of 1.3% y-o-y while Grade B displayed almost no change y-o-y. Grade A increased slightly at 0.9% q-o-q while Grade B dropped 0.5% q-o-q.

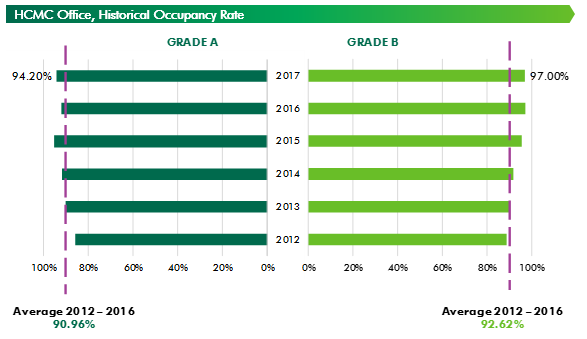

Occupancy rate for Grade A was reported at 94.20% with “Saigon Centre Phase 2” the only new Grade A supply in both 2017 and the previous quarter, continuing to be absorbed by the market. Grade A occupancy rate displayed an increase of 2.2 ppts y-o-y and 0.8 ppts q-o-q. Grade B boasted an exceptional 97% occupancy rate, equivalent to only 3% vacancy rate despite the new supply from “Etown Central”. Changes for Grade B occupancy rate remained minimal, barely a decrease of 0.2 ppts y-o-y and 0.3 ppts q-o-q.

Net absorption in the review quarter was exceptional for Grade B because of leasing spaces from Etown Central as well as vacant spaces in District 7, Ho Chi Minh City from the previous quarter being absorbed by the market, which contributed to 33,258 sqm to overall Grade B. Grade A continued to absorb the remaining space from Saigon Centre Phase 2, recording only 2,869 sqm for overall Grade A.

Regarding tenant trends this quarter revealed a rising demand for space larger than 700 – 1,100 sqm, accounting for 33% of total enquiries. Tenants from Manufacturing and Professional Services each accounted for 19%, while F&B accounted for 10%. The end of the year saw renewal started to account for 19% of total enquiries, while New Letting and Relocation drove up the leasing activities with 24% and 48% of total enquiries.

Overall, 2017 witnessed the office market bustling with new supply and healthy absorption. 2018 onwards will witness the market coming up with better supply albeit at a slower pace than 2017, with only 1 Grade A in the CBD – Deutsches Haus while Grade B supply will continue to spread out at decentralized districts like District 2 and District 10 in Ho Chi Minh City. Rental growth will increase at a slower pace as existing supply will remedy their rents more strategically while vacancy rate will surge up momentarily before dropping down just as quick as the market will continue its healthy absorption momentum with new supply.

Song Chau Group.

Related news

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2019

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2019