Ho Chi Minh City Office Space Growth In The Next Three Years

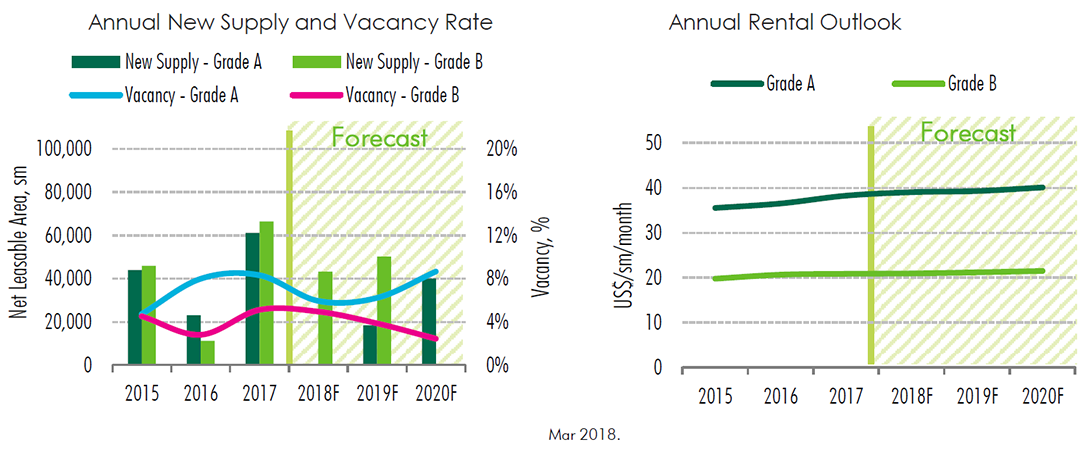

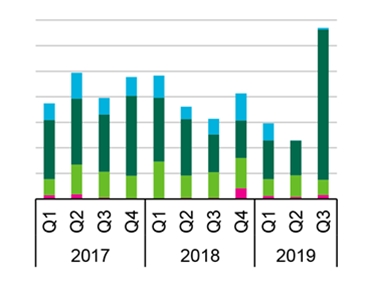

In 2017, while newly added supply helped ease the shortage of office space in Ho Chi Minh City, slower supply growth in Hanoi allowed for rental growth for the first time over the last ten years. The recovery of Hanoi’s rental rates in 2017 has reduced rental gaps between the two cities, but Ho Chi Minh City’s rents remained significantly higher, by up to 50% compared to Hanoi’s, for both grades on average. Occupancy rates of both Grade A’s and B’s exceeded average rates during 2012–2016 in both markets. In 2018, no new Grade A completion is expected in either cities which will support further rental growth and occupancy improvement. Meanwhile, stronger pipeline of Grade B’s will likely lead to flat performance in this segment across the cities.

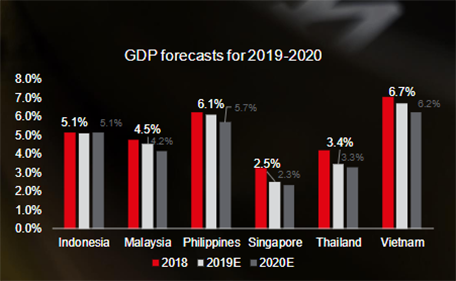

Year 2017 provides a good benchmark for the upcoming office market in terms of expected supply and market performance in 2018–2020 because of stable predicted growth in the economy and the city’s ever improving infrastructure in the form of metro lines. The lack of available land in the CBD likely means a focus on developments in previously ignored fringe CBD areas to keep up with demand for office space over the next three years. The first Grade B office building in the Thu Thiem New Urban Area - Thaco Building, despite offering only 7,000 Sqm NLA, is likely to set a trend for new office developments in this area.

Projected rental growth rate of 2% per annum in 2018–2020 is a result of continuing appetite for quality supply despite the already high baseline (US$38/Sqm/Month for Grade A and US$21/Sqm/Month for Grade B). The trend of relocation to better quality space would also further support rental growth prospects. Healthy economic growth is also expected to encourage tenants from sectors such as IT, Logistics, etc. to be bolder with their relocation and expansion plans to better and newer buildings.

New supply in 2018 will be limited to two Grade B office buildings, including Viettel Phase 2 and the Thaco building. With no new supply added in Grade A segment, rental growth for Grade A buildings are projected to be at 2%. Further supply will be added in 2019 including one new Grade A building and no more than four new Grade B buildings. Rental rates for both grades are expected to increase in 2019, though the increase is anticipated to be lower in Grade A due to new supply coming online during the year.

New supply in 2020 will be dominated by Grade A including the long-awaited projects of (Tax Centre and the Spirit of Saigon) both located in the heart of the CBD. These centrally located developments, combined with the scheduled completion of the new metro line, are likely to boost Grade A rental growth to 2%. It is expected that average rents in this grade will reach US$40/Sqm/Month from the current level of US$38/Sqm/Month. Looking beyond 2020, Ho Chi Minh City office market will gradually shift to higher quality where higher-profile buildings and tenants dominate office space.

Song Chau Group.

Related news

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2019

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2019