Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2019

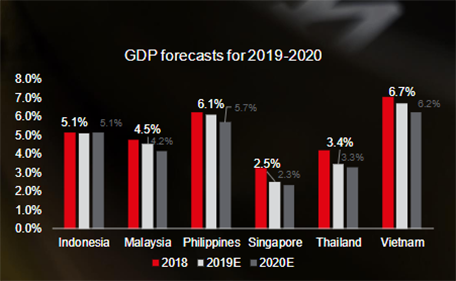

Vietnam economy

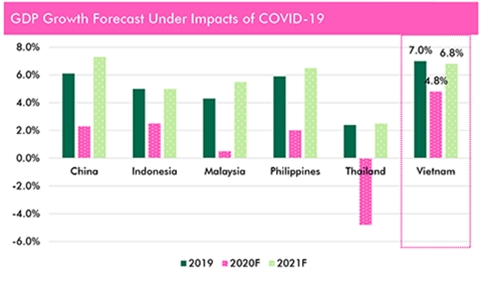

After strong economic growth in 2018, Vietnam’s Q1 GDP increased by 6.79%, lower than the 7.38% growth of Q1 2018, but still higher than that from 2009 – 2017. Albeit lower growth, this is still positive for Vietnam economy, considering the slowdown of the global economy and various world’s issues. The main drivers for achieving such growth were manufacturing and processing industries, which expanded 12.35% y-o-y. Following the Lunar New Year spending echo in February, CPI in February rose 2.64% compared to the same period last year. March posted a 0.21% reduction in CPI from previous month due to low consumption after Lunar New Year and the African swine fever. On average, CPI in the first quarter of 2019 rose 2.63% compared to 2018.

In Q1 2019, foreign direct investment is the brightest side of Vietnam economy. During the period, the total value of FDI, including newly registered capital, increased capital, and stake acquisitions reached US$10.8 billion, equivalent to 86.2% y-o-y increase. Hong Kong surpassed Japan and Singapore to become the largest foreign investor to Vietnam, contributing US$4.4 billion or 40% of total foreign direct investment recorded during the quarter. Manufacturing and processing remain the major attractive sector for FDI with a value of US$8.4 billion, about 77.7% of total FDI. Real estate continues to rank second most attractive investment field, with US$778 million – about 7.2% of total FDI. Hanoi continues to be the most attractive investment destination in Vietnam, with about US$4.2 billion investment – 38% of total FDI to Vietnam.

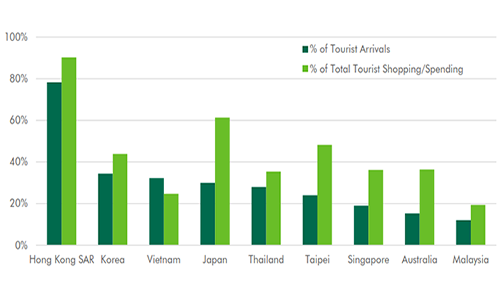

In the first three months of 2019, Vietnam welcomed 4.5 million of international tourist arrivals, up by 7% y-o-y. Asian tourists dominated the tourism market, with arrivals from South Korea, Taiwan, Thailand increasing by 24.1%, 26% and 49.3% y-o-y, respectively. China, with almost 1.3 million arrivals, remains the largest source market to Vietnam, but the amount was down by 5.6% y-o-y.

Condominium market

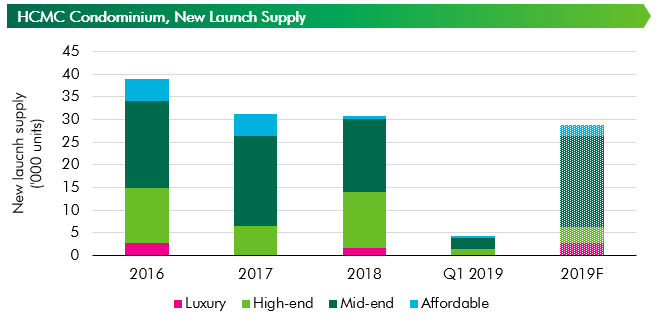

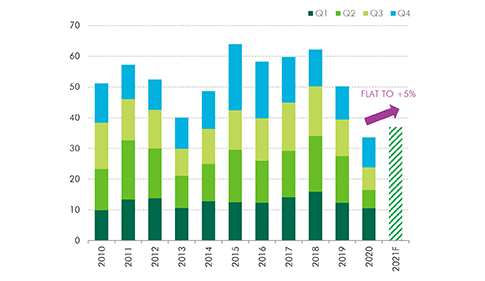

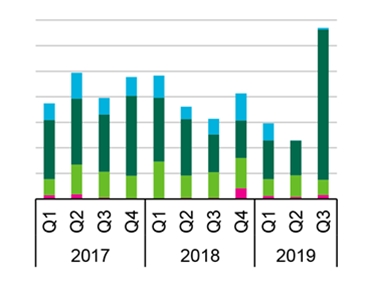

Ho Chi Minh City condominium market was quiet in the first three months of 2019, with new launch dropped significantly due to long Tet holiday and slow licensing process. The number of newly launched projects was lowest in the last three years, with only 12 projects, including both new project lauching first phase and old projects launching subsequent phases normally from 18 to 20 projects launched per quarter, on average. Units from projects that launched the first phase accounted for 60% of total new launched units. Consequently, there were 4,423 launched units, decreasing by 46% q-o-q and 54% y-o-y.

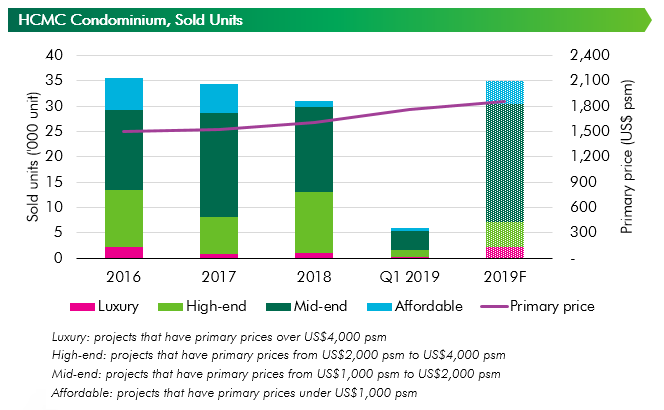

In the context of limited supply, good sold rates were recorded in all segments. Total number of sold units dropped purely because of the reduction in new launch supply. High sold rate from 90% to 100% was observed at projects from reputable developers with reasonable price. 5,924 units were sold in Q1, a decrease of 28% q-o-q and 39% y-o-y. Total number of sold units was 1,500 units higher than new launch, indicating that the market is absorbing inventories from previous launched projects.

In terms of market segmentation, mid-end segment accounted for 55% of total new supply in Q1 2019. This segmentation is expected to support a sustainable growth for Ho Chi Minh City condominium market by focusing on end-users. In terms of location, Ho Chi Minh City’s condominium market continued to expand towards the East and the South, with new projects in Districts 2, 8, 9 and Binh Chanh District.

The average primary selling price in Q1 2019 was US$1,764 psm, representing an increase of 3.1% q-o-q and 14.9% y-o-y. This price growth rate was partly due to the emergence of some luxury projects with high selling price. In general, new luxury projects launched in the last three quarters have set a new pricing level for the market with selling price from US$7,500 – 12,000 psm.

In 2019, new launch supply is expected to improve in the second half of the year. In total, new launch supply in 2019 is expected to reach 28,000 units. In terms of segment, mid-end and affordable will continue to dominate while new launch from luxury and high-end will only account for small proportion. The East will continue to be the market hot spot with new projects in District 2 and District 9. Inventory will be absorbed in next few quarters thanks to limited new launch supply.

Average selling price is expected to increase by 5% y-o-y. Selling prices in mid-end and affordable segments will have modest growth rate from 1%-3% y-o-y while high-end projects are expected to see selling prices higher 5% y-o-y. For approved luxury projects in District 1 and District 3, selling prices are expected to increase from 5%-7% y-o-y, due to scarcity of land bank in the city centre. Secondary market will be more active in 2019 thanks to shortage of new supply, especially in District 1, 2 and Thu Thiem area. Projects in these areas can achieve up to 15%-20% price growth compared with launched prices.

Landed property

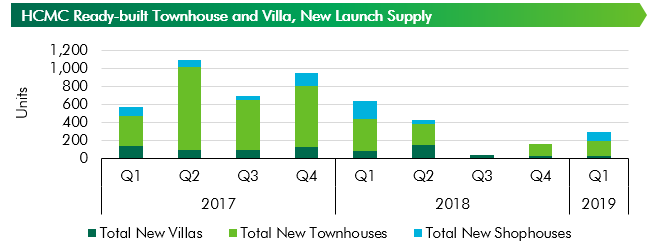

The shortage of new supply in ready-built townhouse and villa market in Ho Chi Minh City continued in Q1 2019. In the first three months of the year, Ho Chi Minh City’s landed property market welcomed 296 new units 28 villas, 167 townhouses and 101 shophouses from three projects: Pier IX "District 12"; Senturia South Saigon "Binh Chanh District" and CityLand Park Hills - Phase 5 "Go Vap District". Pier IX and Senturia South Saigon are new projects which launched their first phase. Total new supply in Q1 2019 increased by 83% q-o-q but only equivalent to 42% of new launch in Q1 2018.

The cumulative supply’s growth rate as of Q1 2019 was only about 2%. While the growth of market scale in Ho Chi Minh City is declining strongly, the market in bordering areas of Ho Chi Minh City are attracting attention from buyers and real estate developers with relatively cheaper selling price and larger supply. Local land fever at the beginning of the year in some areas of Dong Nai such as Nhon Trach, Long Thanh; or District 9, District 12, Binh Chanh District of Ho Chi Minh City has revealed a shift in the market focus to sub-urban and bordering areas more clearly. In Q1 2019, new launched projects in sub-urban areas of Ho Chi Minh City such as Binh Chanh District and District 12 have quoted higher selling price than their market average.

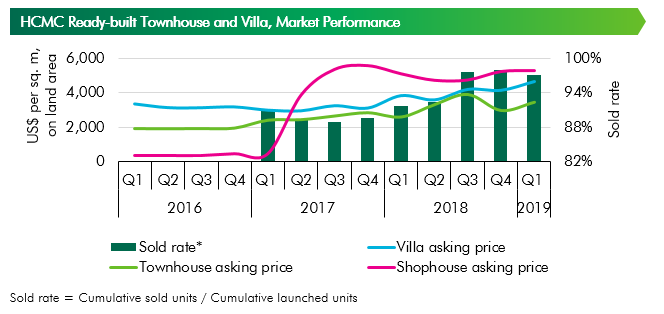

Due to the impact of the delay in licensing process of new projects and the decreasing clean land bank in Ho Chi Minh City, developers concentrate on product with high value. In Q1 2019, shophouses accounted for 34% of the total new supply and continued to have very high prices, such as CityLand Park Hills "Go Vap District" offering this product at US$10,670 per sq. m land. Absorption rate of newly launched projects in Q1 2019 was 84% of total newly launched units. In general, accumulated sold rate (Cumulative sold units / Cumulative launched units) was 96% in Q1 2019. Decreasing inventory together with limited new supply are leading to active secondary market. Specifically, asking price of ready-built villa and townhouse in Q1 2019 went up by 12% q-o-q and 16% q-o-q respectively whereas shophouse’s asking price slightly increased (1% q-o-q). If there is no positive changes in the licensing process, the cumulative supply growth of the market in 2019 will remain low (below 5% per quarter). The shortage of new supply in primary market will keep sold rate at a high level (over 80%) and primary asking price is expected to increase by 4%-5% after each launching period.

The market of ready-built townhouses and villas of Ho Chi Minh City is shifting its focus to the sub-urban and bordering areas of Ho Chi Minh City, including Dong Nai, Binh Duong and Long An province. Positive updates on infrastructure projects connecting Ho Chi Minh City with neighbouring provinces are the main factors for price increase in these areas. Competitive selling price and diversified products are key advantages for these emerging markets.

Office Market

In Q1 2019, Ho Chi Minh City office supply remained scarce when the market only welcomed two new Grade B buildings with total NLA of 19,800 sq. m. The two buildings are Thaco Building in District 2 and OneHub Saigon Tower 1 in District 9.

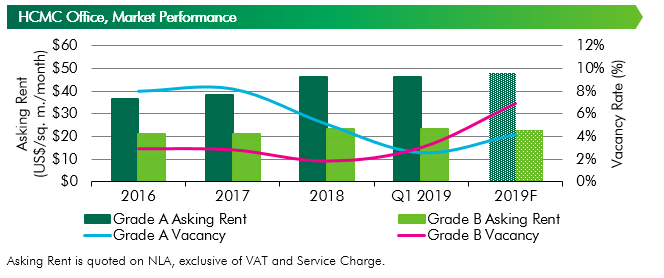

Despite the limitation of existing supply, rental rates of both Grade A and Grade B stayed relatively stable or even decreased slightly in some projects. The average asking rent of Grade A was US$46.31 psm per month, a decrease by 0.2% q-o-q, and Grade B rental rate was US$23.44 psm per month, an increase by 0.5% from the previous quarter.

The main reason behind stable rent of both grades is the upcoming wave of new supply more than 165,000 sq. m. NLA in 2019 from eight buildings. The wave of new supply in 2019 has been boosted by the accelerated construction of the city’s pipeline infrastructure projects such as the Metro Line No.1 and the new Mien Dong Bus Station. Although still under-contruction, new buildings have started pre-commitment lease while offered competitive rental rates and incentives. Therefore, the leasing market has stayed more balanced than 2018. In Q4 2018, when Grade A rental rate hiked up, some tenants began to contract their spaces or relocate to Grade B offices or even to flexible workspaces for cost saving initiatives.

Ho Chi Minh City office market has a healthy performance with vacancy rates of both Grade A and Grade B lower than 5%. In Q1 2019, Grade A vacancy rate was 2.6%, down 2.4 ppts q-o-q. Vacant spaces from tenants whom contracted their leasing spaces in Q4 2018 have been filled up and new spaces were continued to be quickly absorbed. On the other hand, Grade B vacancy rate reached 3%, slightly up 1.2 ppts q-o-q thanks to quick absorption rate from two new Grade B buildings Thaco and OneHub Saigon Tower 1

Due to the healthy performance of traditional office market and limited vacant spaces, head lease/sublease business has been growing in recent years, including Pax Sky, Dragon Fly, Todd’s Realty and GIC Office. These operators are usually lease the entire stand-alone building usually Grade C or basic standard office from an independent landlord and sublease to small tenants.

Besides flexible workspace, insurance companies can become one of the anchored tenants of office market in the next three years. According to a statistic of Swiss Re Institute Sigma, Vietnam is one of the five countries that have low penetration rate, but its insurance premium growth rate is even higher than other developed countries, indicating plenty of opportunities for growth and that the insurance market in Vietnam will likely continue to develop further in the future.

From 2019 to the end of 2021, Ho Chi Minh City office market is expected to welcome 16 new office buildings with more than 400,000 sq. m. NLA. The market is expected to have higher vacancy rates and a slower rental growth for both Grade A and Grade B while rents of Grade A will remain high.

In 2019 alone, rental growth of Grade A is expected to reach 4% and its vacancy will decrease to 4% due to new Grade A supply will only be launched by the end of 2019 or the beginning of 2020. Grade B asking rent is expected to slightly decrease by 1.5% and its vacancy is forecasted to increase by 6.9% due to a large Grade B supply coming on stream this year.

Flexible workspace

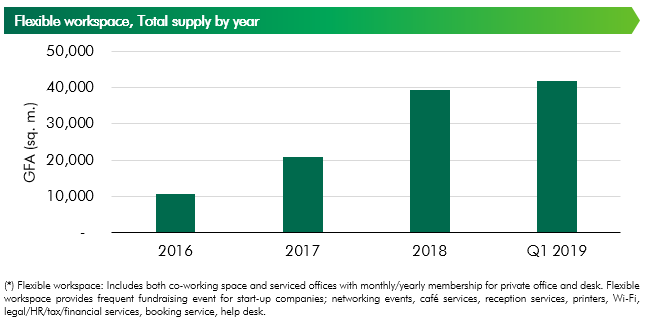

Unlike traditional office with stable growth, flexible workspace market has been expanding at a fast pace. In Q1 2019, the market welcomed two new flexible workspace venues, including Toong - Ham Nghi and Up - Le Meridien with a total GFA of 3,100 sq. m., increasing the existing supply by 6% q-o-q, and 101% y-o-y. In addition, the two “major players” in the market, Toong and Up, have been expanding their brands internationally, in which Toong has opened its first two foreign venues in Laos and Cambodia and Up is planning to expand into Malaysia, Thailand and HongKong.

The rapid expansion of flexible workspace market was partly due its healthy performance. As of Q1 2019, rental rates of the fixed desk and private office sectors increased by 3 – 8% q-o-q with occupancy rate reached more than 80%.

Retail market

Ho Chi Minh City’s total retail supply increased by 67,200 sq. m NLA in the first quarter of 2019 from a new shopping center, Gigamall by Khang Gia Land in Thu Duc District. Although being located in non-CBD, Gigamall achieved an occupancy rate of more than 90% at its opening with more than more than 40% of total NLA designated for F&B. Gigamall’s anchor tenants include Sense City 33,000 sq. m, CGV Cinema 3,200 sq. m, JP World 1,500 sq. m, California Fitness & Yoga 3,000 sq. m, etc. Sense City Pham Van Dong, located on levels 1-2-3 of Gigamall, is the first Sense City by Saigon Co.op in Ho Chi Minh City.

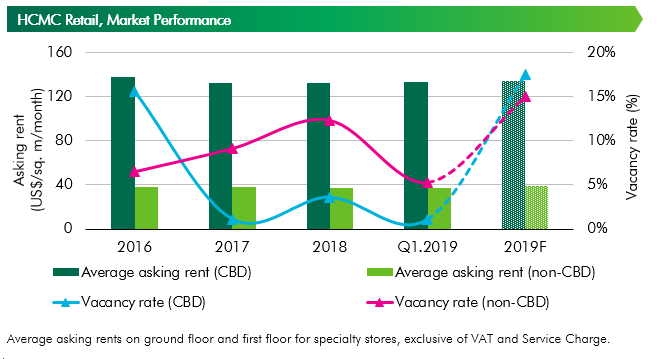

Average asking rents in CBD increased by 0.4% y-o-y, equivalant to US$128.6/sq. m/month, thanks to improving demand for CBD space given limited supply. Meanwhile, non-CBD average asking rent increased by 1.0% y-o-y, reaching US$35.7/sq. m/month, thanks to good absorption at new projects such as Gigamall and Estella Place.

Vacancy rate in CBD hit a 5-year low at approximately 2%, thanks to limited supply. The vacancy rate in non-CBD was also low at 7.3%, down 2.3 percentage points y-o-y.

However, similar to the Ho Chi Minh City office market, Ho Chi Minh City retail market awaits a large future supply in 2019. The cumulative supply in 2019 is forecast to increase by 25% compared to 2018, with new supply mostly in the east of the city. Six new projects in the pipeline are under construction with a total NLA of 179,979 sq. m. Union Square is the only project to come online in 2019 that is located in the CBD, while the remaining projects are all in non-CBD. In District 2, Sala Shopping Center, with an NLA of 60,000 sq. m, once opened in 2019 will be the first shopping center in Thu Thiem area.

Over the next three years, the Ho Chi Minh City retail market will become more competitive, especially in non-CBD, as many large-scale condominium projects will be completed and a significant supply of retail podiums is expected to be added accordingly.

In 2019, increasing new supply in both CBD and non-CBD is expected to raise vacancy rates in these areas, to 17.5% and 15.3%, respectively. Despite scarce supply in CBD, occupancy rate of the new supply in 2019 (to open after renovation) will not be extreme given its large scale and high rental rate, leading to higher vacancy rates in CBD.

In 2019, new supply in prime locations of both CBD and non-CBD, typically offering higher asking rents, are expected to push average rents in these areas to US$134/sq. m per month (+1.5% y-o-y) and US$39/sq. m per month (+5.4% y-o-y), respectively.

In the near future, along with the rise of consumer confidence, changes in consumer behaviours and technology advancements, the retail market in Ho Chi Minh City will continue to grow in a positive direction:

- In 2019, an increasing number of international brands will enter the Ho Chi Minh City market, such as well-known F&B retailers from Asia-Pacific nations like Hai Di Lao Hot Pot and Hachiban Ramen, or specialist clothing brands from Europe like Olivia Burtons. Since CBD supply is scarce, prospective tenants have little advantage in opting for locations while landlords have the opportunity to select their tenants.

- As Ho Chi Minh City has been chosen by many foreign and local brands looking to open their first store in Vietnam, pop-up shop format, which is a low-risk starting point to test a new and potential clientele, is gaining more popularity. These stores typically have unique and interesting designs that trigger curiosity in customers, luring them to visit the store.

- Online retailers are expected to be more active in 2019 as they continue to develop and invest in e-commerce and logistics platforms. According to a report by Euromonitor, internet retailing grew by 32% in 2018, reaching total sales of US$1.65 billion. Looking forwards online retail turnover is expected to increase by more than 20% per annum over the next three years. In recent years, some retailers, especially electronics & appliance, have adopted omni-channel strategy, allowing consumers to look for product specifications and compare prices online before purchasing.

Song Chau Group.

Related news

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2019

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2019