Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2019

Office Market

HCMC office market received no new supply in Q2 2019 for both grades. By 2H 2019, HCMC office market’s total supply achieved 1,225,648 sq. m. NLA from 15 Grade A buildings and 63 Grade B offices. HCMC’s office stock is about 116,352 sq. m. NLA lower than which in Hanoi.

The moderate rental growth of office market in the 1H 2019 is mainly driven by a large amount of new supply expected to come online in the 2H 2019. With six new office buildings (one Grade A and five Grade B), providing more than 130,000 sq. m. NLA to the currently limited office stock, existing landlords will have to face with stiff competition in the near future. However, the rental growth prospects of these two grades might turn into different directions. While Grade A rental growth will be limited by its currently high rental rate associated with intense competition with other Grade B offices and the upcoming new supply, Grade B rental growth seems to have more room to increase further as this segment’s rental rate is just half of the figure of Grade A.

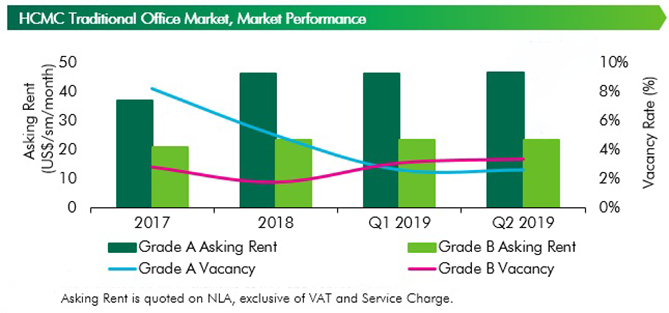

Due to limited supply in the 1H 2019, rents of both Grade A and Grade B continued to increase but at a moderate pace, especially Grade A. As of Q2 2019, the average asking rent of Grade A was US$46.7 psm pm, a slight increase by 0.9% q-o-q and 2.9% y-o-y. Grade B rental rate was US$23.5 per sm per month, an increase by 0.3% from the previous quarter and 4.7% from the same period last year.

Demand for office space continued to be high, especially after the trade dispute between China and the US. The trade war has urged many manufacturing and logistics companies from overseas to actively seek office spaces for shifting from China to Vietnam. Such signs were shown through the increase of new letting inquiries in Q2 2019, accounting for 29% of the total leasing inquiries by purpose, up by 21 ppts y-o-y. Almost 40% of the new letting inquiries were contributed by manufacturing & logistics companies and 50% of those have their offices placed in China. Besides Manufacturing & Logistics, Technology sector was also recognized as a large demand driver with 15% of the total leasing inquiries in the reviewed quarter. These tech firms expanded rapidly, and they sought spaces for consolidation purpose.

Generally, HCMC office market still observed healthy performance with vacancy rates of both Grade A and Grade B lower than 4% due to limited supply in the 1H 2019. As of Q2 2019, Grade A vacancy remained at 2.6%, no change from the previous quarter and a slight decrease by 2 ppts comparing to Q2 2018. Landlords of Grade A offices were also upgrading facilities of the buildings to retain tenants from relocating to other places. On the other hand, Grade B vacancy rate reached 3.4%, slightly up 0.3 ppts q-o-q and 0.5 ppts y-o-y due to a few contractions happened in the decentralized offices.

From 2H 2019 to the end of 2021, HCMC office market is expected to welcome 14 new office buildings with more than 300,000 sq. m. NLA. Half of the new supply is Grade A offices. Welcoming a wave of new supply in the next three years, the market is forecasted to have higher vacancy rates for both office segments. Grade A vacancy in 2019F, 2020F and 2021F is expected to reach 10%, 14%, 20% per year, respectively. Meanwhile, Grade B vacancy will increase to 6.6%, 7,4%, and drop to 3.9% in the same period.

In terms of rental growth, Grade A will slightly increase in the first two years (2019F and 2020F) with the average growth rate of 3% and 0.6%, respectively. However, Grade A rents will then drop down by 2% in 2021F when its vacancy reaches 20% by that year. On the contrary, with comparative rentals and larger room for rental growth, Grade B rents will continue to increase higher in the next three years despite the competitive context of the market. Particularly, from 2H 2019 to 2021, Grade B rents will be up by 2.26%, 1.81%, and 2.58%, respectively.

In the future, office market will witness the demand restructuring. Flexible Workspace, Technology-related Firms and Insurance Companies will replace Finance/Banking to become the three key demand drivers of the market. Moreover, Manufacturing Companies might recover its position as the main occupier for office space as well if there is no changes or negative signs happening on Vietnam’s political-economics in the future.

Flexible workspace

The accelerated enlargement in the future of flexible workspace market was mainly driven by the growth of build-to-suit workspace, also known as the enterprise solution. Many flexible workspace operators are now adopting this build-to-suit service such as Up co-working space, WeWork, Toong, etc. However, only Up co-working space showed its active role in the market.

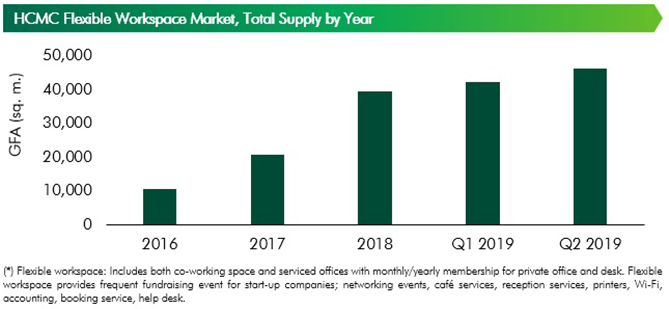

Flexible workspace market in H1 2019 was still on its fast growth momentum. In the reviewed quarter, the market welcomed more than 4,000 sq. m. GFA from five new venues – Up Deustches Haus (Dist.1), The Hive - Huynh Khuong Ninh (Dist.1), Compass Office - Landmark 81 (Binh Thanh Dist.), Leo Palace 21 (Dist.1) and Kafnu – Saigon Pearl (Binh Thanh Dist.). Although flexible workspace expanded rapidly, its performance was still recorded healthy. In the reviewed quarter, rental rates of private office sector has slightly decreased by 3.9% q-o-q due to some high-end serviced offices wanted to attract more tenants to fill up their left-over rooms. Nevertheless, its occupancy was still as high as 80%.

As of Q2 2019, the total market supply reached 46,266 sq. m. GFA, increased by 101% from the same period last year. This figure is projected to be a twofold increase by the end of 2019, lifting the penetration rate of flexible workspace up from 2% in Q2 2019 to 5% by Q4 2019. HCMC flexible workspace market is ranking in TOP 5 developing markets with the CAGR of more than 80% per year.

Condominium market

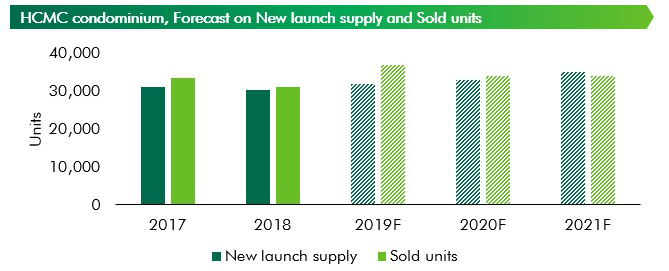

In the second quarter of 2019, due to slow licensing process since last year, new launch supply continued to drop to the lowest number in the last five years. There were 4,124 units launched from 10 projects in Q2 2019, a decrease of 7% q-o-q and 34% y-o-y, bringing total new supply in six months and accumulated supply (since 1999) of HCMC to 8,547 and 268,135 units, respectively. Despite of limited new launch events, developer actively organised pre-launch, expo and client events to gauge market interests in the first half of 2019. These events are promising a dynamic second half of 2019.

In Q2 2019, there were only two new projects that held their first launching events, which are The Marq in "District 1" and The Signial [a project with 50 years leasehold tenure in "District 7"]. The remaining eight projects launched their subsequent phases. These new launch projects achieved high sold rate, over 80% of launched units, even though their price increased by 5% to 10% compared to the previous launches. Demand remains strong in the market which is witnessed through high interest of the market to pre-launch events in the last six months. Booking rates are high in these pre-launch events, especially, some projects received number of booking higher than their launching plan by 50% to 100%. In terms of segment, mid-end segment accounted for the highest proportion of new launch units in Q2 at 56%, followed by high-end at 40%.

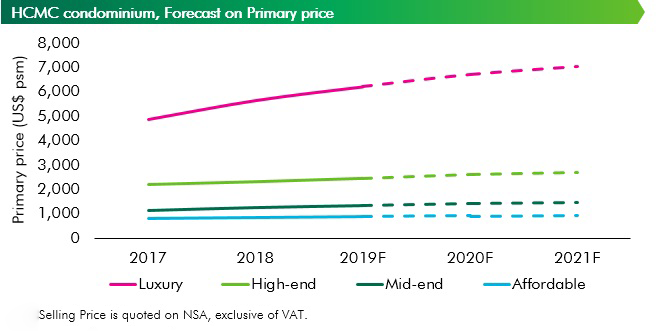

Q2 2019 recorded one new launch in luxury segment which is The Marq with 180 units and launching price around US$7,000 psm. There is no new launch supply in the affordable segment.

Sales momentum continued to be positive in Q2 2019 with more than 80% of new launch units having been absorbed. In Q2 2019 there were 4,576 sold units, a decrease of 23% q-o-q and decrease of 37% y-o-y. The reduction in sold units was purely due to a decrease in new launch supply. Inventory overall in HCMC was absorbed gradually with 2,000 units per year in average for the last three years. There were only approximately 15,000 units remaining in the primary market, accounting for 5% of the accumulated new launch supply (since 1999). The remaining units are mainly from old projects with generally inferior quality (large size units, inferior design and unit layout).

Average price on the primary market was recorded at US$1,873 psm in Q2 2019, an increase of 5% q-o-q and 20% y-o-y thanks to the lack of supply and good sale performance in previously launched projects. Increases in primary price were observed across the market. The located District 2, District 7 and District 9 recorded highest price escalation of 15%-25% y-o-y.

In the last two quarters of 2019, the market is expected to welcome a wave of new launch supply from the East which is led by Vinhomes Grand Park in District 9 with over 10,000 units and five new projects in District 2. Other areas also become more active such as the West with AIO City, Akari City and D-Homme; and the South with subsequent phases of Eco Green Saigon, Sunshine City Saigon and new project called Lovera Vista. In total, there will be over 23,000 units launched in the second half of 2019.

In the last three years, primary had increased by 7% y-o-y in average. In 2020 and 2021, primary selling prices are expected to have average growth rate at 5%-10% y-o-y. Mid-end segment is expected to have lower pricing escalation due to large supply coming from the East, West and South areas. Luxury segment will have prices increased by 10% y-o-y thanks to limited supply and better project quality. High-end project in the next two year will have better quality however, the location will be further to the CBD which lead to a lower growth rate of 6% y-o-y. Affordable segment will have a modest growth of 3% y-o-y.

Condominium ranking criteria:

- Luxury: projects that have primary prices over US$4,000/sqm

- High-end: projects that have primary prices from US$2,000/sqm to US$4,000/sqm

- Mid-end: projects that have primary prices from US$1,000/sqm to US$2,000/sqm

- Affordable: projects that have primary prices under US$1,000/sqm

Retail Market

In Q2, HCMC welcomed one new project TNL Plaza in "District 4" and one expansion Aeon Celadon City in "Tan Phu District", adding a total of 47,179 sq.m new supply to the market. Total accumulated supply is 1,050,000 sq.m from 58 projects, the highest in Vietnam, followed by Hanoi at the second place with 930,000 sqm. Currently, all other cities in Vietnam have less than 100,000 sq.m of modern retail NLA each.

TNL Plaza is the retail podium of The Gold View, consisting of limited retail trades yet sufficiently facilitating the project’s residents. As of Q2 2019, TNL Plaza already welcomed Starbucks, Wayne’s Coffee, Jmart, DNP Game zone amongst several local F&B brands. In the next two months, the podium is expected to include Familymart, California Fitness and Lotte Cinema in its tenant mix.

Following the success of Aeon Celadon City over the last five years (occupancy rate always higher than 95%), the developer increased its NLA by 36,000 sq.m. The shopping centre added quite a few new brands to its tenants mix, some of which are first-timers in Vietnam retail market. Notably, Decatholon took over 2,600 sq.m of the shopping center’s first floor, selling over 14,000 products lines from 70 sports. Delamibrands, an Indonesian specialty retailer, also brought several of its brands such as Jaspal, Et cetera, Colorbox, etc. In Q2 2019, occupancy of this retail project is a bit short of 90%; the occupancy is expected to improve in the future with more F&B brands, Kids and entertainment (TimeZone).

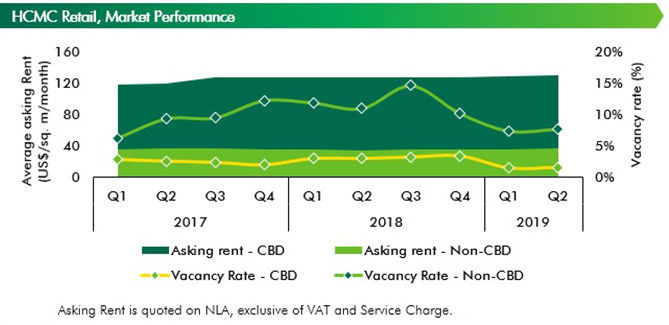

Average asking rents in CBD increased by 1.5% q-o-q (1.9% y-o-y), equivalant to US$130.6/sq. m/month, thanks to improving demand for CBD space given limited supply. Even though the high rental rates in the CBD area may cause some closures, the vacant spaces are usually taken up very quickly. New leases in the CBD in Q2 2019 include Starbucks, Missguided, Grand Jete, Ha Di Lao Hot Pot, etc. New foreign tenants most of the time consider CBD for their first stores. Meanwhile, non-CBD average asking rent increased by 1.2% q-o-q (4.1% y-o-y), reaching US$36.1/sq. m/month, thanks to openings of good quality projects in the past year such as Estella Place, Vincom Center Landmark 81, Giga Mall, etc. Vacancy rate in CBD was still at low level of 1.6%, due to limited new supply. The vacancy rate in non-CBD was also low at 7.7%, a slight uptick of 0.4 percentage points from last quarter, due to the opening of TNL Plaza which was 50% full as of Q2 2019. Other districts with small increase in vacant spaces are Tan Phu District, District 7, Binh Thanh District, etc. with 1,000-2,500 sq.m of new new vacant spaces each.

In the second half of 2019, the market is expected to add four more projects to its current supply, totalling over 130,000 sq.m. For the period of 2020 onwards, in the present over 363,000 sq.m of future supply is under construction. The market will become more competitive, both for CBD and non-CBD areas. However, we witnessed short term delay in construction progress at some under construction projects and therefore, the future completion is expected to be less than 10% (lower than previously forecast: 15%). The vacancy rates, as a result, are not going to hike significantly as previously forecast. Rental rates are expected to increase by 2-3% in H2 2019.

Song Chau Group.

Related news

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2019

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2019