Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2017

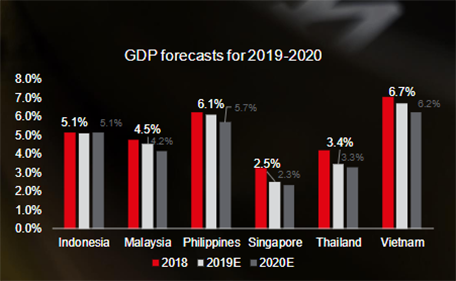

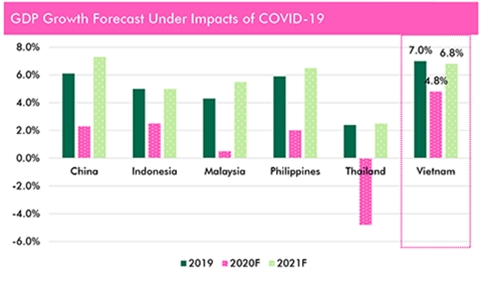

Vietnam’s GDP growth rate has slowed down after high level of growth seen in 2015 (6.7%) and 2016 (6.2%). According to a report released in July by International Monetary Fund (IMF), the country is forecast to grow by 6.3% this year. Highlights of the economy in the review quarter include FDI, growth of retail’s revenue and busy activities of investments.

In first eight months of 2017, Vietnam received 13.5 USD billion from 1,624 newly licensed projects along with 6.4 USD billion in terms of increased capital and 3.5 USD billion in terms of stakeholders’ purchase, totaling 23.4 USD billion, an increase of 45.1% compared to the same period of last year. FDI into real estate accounted for 5% of total FDI, ranking fourth after manufacturing, electricity, AC production and distribution and mining and quarrying.

In 2016 and 2017, private equity investment in real estate companies in Vietnam was 613.5 USD million, the highest amongst other sectors including retail/consumer, education, finance, technology, infrastructure and entertainment, according to Deal Street Asia. Thanks to active capital inflows from foreign funds, local developers are now expanding rapidly. The most notable events in Q3 2017 were from Vincom Retail, Novaland, Dragon Capital and Quoc Loc Phat.

-

Vincom Retail, backed by Warburg Pincus, is implementing procedures to transform its Vincom Retail unit to a public company on the Ho Chi Minh City Stock Exchange to raise 600 USD million.

-

Meanwhile, Shinhan teamed up with Vincapital to invest 100 USD million in Novaland.

-

Samsung Securities will co-operate with Caldera Pacific, a private equity fund from Hong Kong to buy a 40% stake in Dragon Capital to become the second-largest shareholder.

-

Finally, Keppel Land bought 20% of Quoc Loc Phat, the developer of Song Viet Complex in Thu Thiem, District 2, HCMC.

Apart from the above private equity investment deals, the market reported 27 successful deals of tangible assets and development sites worth nearly 900 USD million across Vietnam. Looking forwards, more and more investors are not only eyeing but acting to enter the market and catching up with the game. Q3 2017 was an endless summer to existing developers.

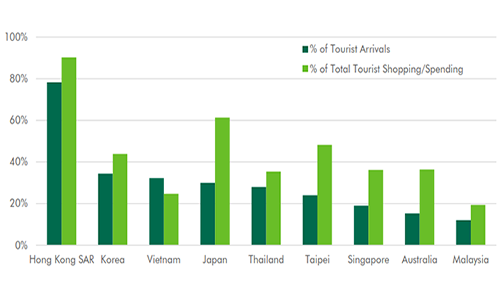

In 8 month 2017, 85,357 new businesses were established in Vietnam, 3.7% of which were in the real estate market (impressively up 65.8% y-o-y). Regarding retail and services, turnover in 8 month 2017 reached 2,580.2 VND trillion, up 8.9% y-o-y, excluding inflation. With the record high level of new supply in 2015 and 2016, the entry of international retailers, and the quick expansion of convenience stores and other modern retail formats/venues, modern retail in Vietnam has been growing rapidly. While it will take some time for Vietnam to catch up with the level of retail in regional countries, the local market is showing very good progress.

Condominium market

-

Luxury: Projects that have primary prices over 3,500 USD/Sqm

-

High-end: Projects that have primary prices from 1,500 USD/Sqm to 3,500 USD/Sqm

-

Mid-end: Projects that have primary prices from 800 USD/Sqm to 1,500 USD/Sqm

-

Affordable: Projects that have primary prices under 800 USD/Sqm

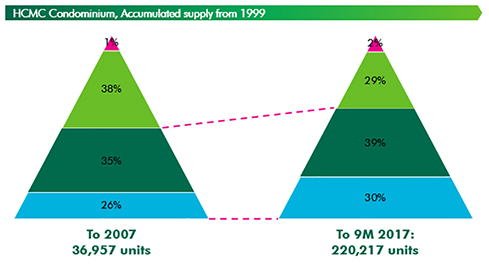

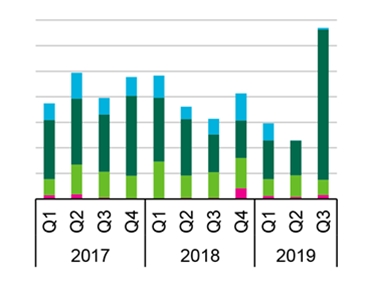

Accumulated new launches supply in Q3 2017 reached 220,217 units, six times larger than the 2007 number. In terms of the proportion of each segment, the market showed a more stable condition than it did 10 years ago. High-end segment reduced their proportion for mid-end and affordable segments.

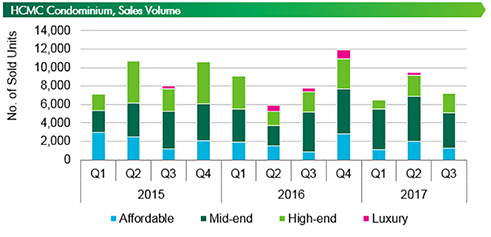

Q3 2017 recorded a reduction in new launches with only 7,651 units launched from 21 projects, mostly in July and August. This represents a decrease of 20% q-o-q and 9% y-o-y, as developers tried to avoid the “ghost month” of September and put more effort to prepare for sale events in Q4 2017. Mid-end segment accounted for 60% of Q3 2017 new launches. High-end segment dropped significantly by 32% q-o-q. In terms of location, the South took the lead from the East, accounting for 50% of total new launches. Most of the supply in the South is in District 7 (River Panorama, Lavida+, Garden Bay, Lux Garden) and District 8 (Topaz Elite, Tara Residence).

While most projects are being developed by local developers, projects like Garden Bay and River Panorama are being developed by a joint venture with a Japanese developer. The East area accounted for 37% with 2,890 units. Only 919 units were launched in the North area in this quarter, all in District 12.

Total number of sold units decreased in Q3 2017 due to a reduction in new launches. 7,207 units were sold in Q3 2017, decreasing by 25% q-o-q and 9% y-o-y. This downward trend is mostly due to a lack of options on the supply side. New launched supply achieved good absorption rate in all segments, ranging from 77% to 84%. Mid-end products accounted for 53% of sold units in the review quarter.

The average selling price reached 1,500 USD/Sqm, indicating a reduction of 3% q-o-q and 15% y-o-y. The significant reduction, in comparison to the previous year, is due to the expansion of mid-end segment. In contrast with the market average, high-end segment increased by 5% q-o-q and 10% y-o-y thanks to the introduction of high quality products from well-known foreign developers such as D’edge and Tilia Residence. These projects also recorded sold rates of 100% each. Secondary price increased in some good location projects such as Empire city, Gateway, the Nassim and Masteri Thao Dien.

In the last quarter of 2017, more high-end products will be launched in the East area. Some notable projects include Q2 Thao Dien (D2, previously known as Glenwood Maison), Masteri An Phu (D2). Since their announcement in Q3 2017, these projects have received a high level of interest from the market, with pre-booking and reservations recorded at over 50%. Average primary price is expected to increase as more high-end products are added in the last quarter.

Retail market

There was no new supply in Q3 2017. The current accumulated supply stayed at 845,765 Sqm from 52 projects, the highest in Vietnam but only one tenth of Bangkok and one fifteenth of Singapore. Despite that, the market was active with both new brand entries and expansion of existing tenants. In the CBD area, Vincom Centre Dong Khoi welcomed the first H&M store, an international fashion retailer, to the local market. This tenant occupied over 3,000 Sqm of floor area on the first and medium level. Also at Vincom Centre Dong Khoi, Pull & Bear, Stradivarius and Massimo Dutti all took significant floor areas on its upper floors. In the non-CBD area, Thuan Kieu Plaza had a soft opening in August 2017 (the official opening is to occur in Q4 2017) and occupied its first floor mainly with F&B brands. The tenant mix so far has accurately targeted real needs of local people in the district. Some notable brand names include KOI the, Gong Cha, Maku, Buffalo Wild Wings, McDonald’s, etc.

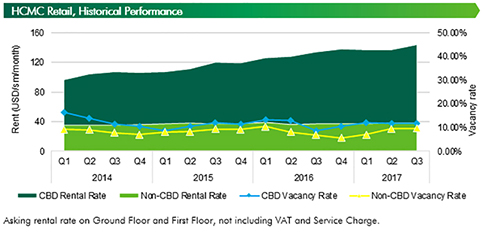

Rental rates increased in both CBD and non-CBD areas, at 4.8% q-o-q and 1.5% q-o-q, respectively. In the CBD area, Vincom Centre Dong Khoi’s renovation re-layout has brought its rental rate up by around 10-15% q-o-q, mostly seen at ground and first floor. In terms of department stores and other formats in the CBD area, rental rate was unchanged. In the non-CBD area, while some shopping centres with high traffic such as Crescent Mall, Lotte Marts, were able to healthily increase their rental rates at 2-5% q-o-q, others were unable to maintain the rental rates. With low traffic and slow tenants filling up vacant spaces, some landlords supported their existing tenants by lowering fixed rent of about 3-5% and at most at 10% q-o-q. Due to lack of new supply and the closure of Index Living Mall at Vincom Megamall Thao Dien (about 3,500 Sqm), net absorption was -943 Sqm. It is reported that the landlord set aside this large for a big international tenant coming soon next year. Other than this, there was not any significant change in tenant mix at other shopping centres.

Based on data regarding future supply, HCMC will welcome more than 500,000 Sqm of new from now to 2019, both under construction and under planning. However, not all of them have revealed details on their opening, operations, concept, merchandising mix etc. up to this point.

Office market

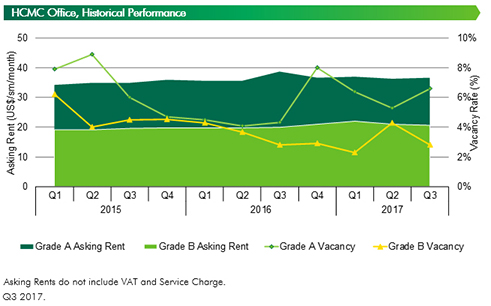

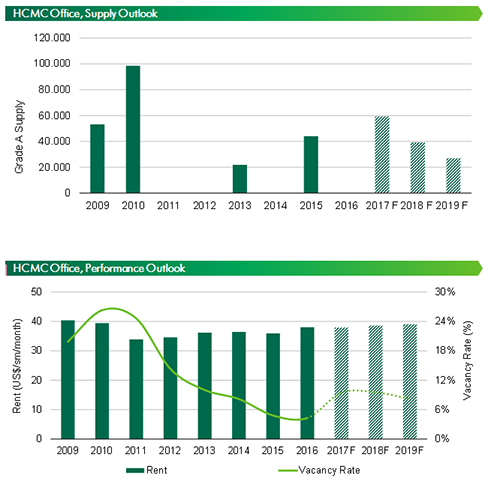

In Q3 2017 Ho Chi Minh City welcomed one new Grade A supply, the long-awaited Saigon Centre Phase 2, adding 32,000 sqm to the total market. The building boasted 25% vacancy rate, an exceptional indicator of good leasing momentum thanks to the developer’s aggressive pre-commitment campaign. No new supply for Grade B was recorded in this quarter.

Market performance continued to be stable in Q3 2017 with strong net absorption from the new supply added between Q2 2017 and the reviewed quarter. Grade A achieved 36.73 USD/Sqm, increasing by 1.1% q-o-q. Although Grade A’s rent decreased by 5.0% y-o-y, it still followed the market general upward trend. Grade B recorded 20.71 USD/Sqm, decreasing slightly at 1.4% q-o-q but increasing 3.9% y-o-y. The decrease q-o-q resulted from lower rents from existing supply to compete with new supply from Q2 2017.

Vacancy rate recorded 6.6% and 2.8% respectively for Grade A and Grade B. Grade A increased 1.4 ppts q-o-q and 2.3 ppts y-o-y because of Saigon Centre Phase 2 entering the market. Grade B reported a slight decrease of 1.2 ppts q-o-q and no change y-o-y due to the absorption of leftover new supply from last quarter.

Net absorption in the review quarter was exceptional, with Grade A at 25,510 Sqm and Grade B at 9,831 Sqm. Positive net absorption is due to the level of new properties released to the market as well as good leasing activities recorded at huge quality supply coming from Saigon Centre Phase 2, Mapletree Business Centre and Viettel Complex.

Regarding tenant trends this quarter, SCBI’s enquiries revealed a rising demand for space larger than 700 – 1,100 Sqm, accounting for 28% of total enquiries. Tenants consisted of Manufacturing, Professional Services and Media with 24%, 14% and 10%, respectively. Making up 79% of total enquiries, relocation is the leading purpose for larger space, followed by expansion at 10% and new letting at 12%.

2017 is looking at a strong finish for the office market with the upcoming addition of E-town Central in Q4 2017 and Deutsches Haus in Q1 2018. Future pipeline witnessed larger quality floorplates being planned and under construction, therefore the market will continue its good leasing momentum with larger leasing sizes. Asking rents are at its peak and will continue its stable moderate growth along with steady decrease of vacancy rates.

Song Chau Group.

Related news

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2019

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2019