Office market from 2018F–2020F will still be a landlord-driven market

Q2 2018, Grade A remained 382,763 Sq.m NLA while Grade B increased 968 Sq.m NLA to 814,330 Sq.m NLA because of Viettel Complex opening more floors for outside leasing. Looking forward to 2H 2018, total new supply for Grade B will come from two decentralized projects Thaco Building in District 2 with approximately 9,600 Sq.m NLA and M Building in District 7 with 3,000 Sq.m NLA. Both buildings are owner occupied and only allowed a small portion of available area for outside leasing.

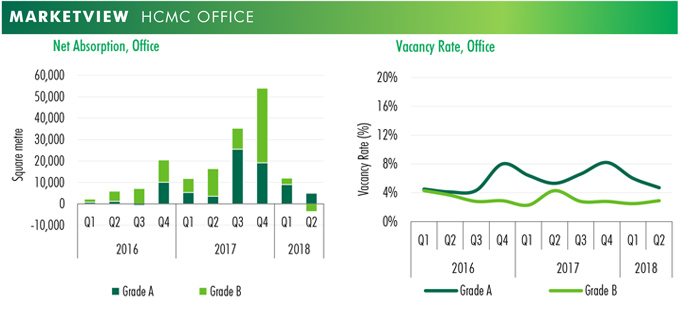

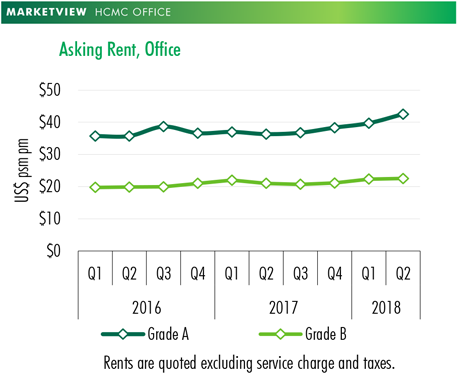

Asking Rents for Grade A and B increased q-o-q and y-o-y. Grade A achieved 7.1% q-o-q and 17.1% y-o-y growth rates which was driven by rapid absorption and limited supply. Similarly, asking rent for Grade B, while not increasing as much as Grade A, also showed a 7.3% growth rate y-o-y. Net absorption for the past year showed rapid absorption. Vacancy rate for both Grades were below 5%.

In terms of demand, traditional sectors such as Manufacturing, Banking/Finance and Services accounted for 66%, though Co-working space and Serviced Office accounted for 4% of total enquiries. In terms of tenant’s nationalities, APAC still maintained a 61% of total enquiries compared to 15% coming from EMEA.

It is expected that Grade A will maintain its increasing path, though at a slower rate, for rental rates because of limited available supply from now until late 2019–early 2020; vacancy rate will also be decreasing slower because of Grade A’s hiked up rental rate. Grade B is expected to have a more stabilized and healthy performance because of its small but more constant supply from now until 2019.

Song Chau Group.

Related news

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2019

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2019