Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2020

Vietnam’s economy

- Vietnam's economic growth slows down, due to the impact of Coronavirus: Vietnam's GDP in Q2 2020 was estimated to increase by 0.36% over the same period last year. For 1H 2020, GDP grew 1.81% y-o-y, which was also the lowest increase of all first half in the years 2011-2020. In particular, the service sector achieved the lowest growth rate, 0.57% y-o-y, contributing 14.97% to the overall growth of the economy. Next was the agriculture, forestry and fishery sector, which increased by 1.19% y-o-y, only half the growth rate of the same period last year. Although the industrial and construction sector grew the highest among the three, nearly 3% y-o-y.

- CPI affected by mixed factors: Average CPI of Q2 2020 increased by 2.83% y-o-y, but decreased by 1.87% q-o-q. On average CPI increased by 4.19% y-o-y in 1H 2020, slightly higher than the set target of 4%. The CPI increased in 1H 2020 as food prices climbed over the same period last year. Particularly, pork price increased by 68.2% y-o-y, contributing to 2.86% increase in the overall CPI in the same period. Prices of drinking items, cigarettes and ready-made clothes also soared. In the opposite direction, a number of factors contributed to a curb of the CPI growth in 1H 2020, such as the price of essential commodities such as gasoline, oil, and gas. In addition, the demand for travel and tourism decreased under the influence of Coronavirus, resulting in a drop in travel package price, as well as the transportation cost. Besides, the electricity price also dropped under the support of Vietnam Electricity Group during Coronavirus season.

- Vietnam’s total import-export turnover decreases: Generally for the first half of 2020, the import and export turnover totaled USD 238.4 billion, down 2.1% y-o-y, of which exports reached USD 121.2 billion, down 1.1% y-o-y. During the period, the United States was the biggest export partner, accounted for USD 30.3 billion, up by 10.3% y-o-y. With the significant growth in the cellphone and its components (up by 127.9% y-o-y), China ranked the second biggest export partner with USD 19.5 billion, an increase of 17.4% y-o-y. Regarding the country’s imports, in the same period, the total import was at USD 117.2 billion, down by 3% y-o-y. China continued to be the major importing country of Vietnam’s goods, at USD 34.8 billion, down by 2.2% y-o-y.

- Vietnam’s FDI falls: The Coronavirus epidemic was keeping investors on the sidelines as to whether to invest or expand businesses in Vietnam. Total foreign investment amounted nearly USD 15.7 billion in 1H 2020, down 15.1% y-o-y. Of the total, USD 8.5 billion came from newly licensed projects, while those with additional registered capital and those with capital contribution, share purchase totalled USD 3.7 billion and 3.5 billion, respectively. Of the 18 sectors invested in 1H 2020, manufacturing industry took the lead of over USD 8 billion, accounting for 51.1% of the total registered investment. Electricity production with USD 3.95 billion ranked in second place, equivalent to 25.2% of the total. This was followed by retail sales and real estate investment with USD 1.08 billion and nearly USD 850 million respectively. In terms of investment partners, Singapore topped the lead in 1H 2020 with USD 5.44 billion, accounting for 34.7% of the total investment. Thailand and China followed in the second and third place respectively.

- International arrivals: With the continuing travel restriction, quarantine regulations, and reluctance to travel due to the Coronavirus outbreak, Vietnam’s hospitality market in the first half of 2020 continued to be severely affected. The incurring international arrivals to Vietnam are mainly foreign experts and technicians working on projects in Vietnam. In 1H 2020, Vietnam welcomed 3.74 million international tourist arrivals, down by 55.8% y-o-y.

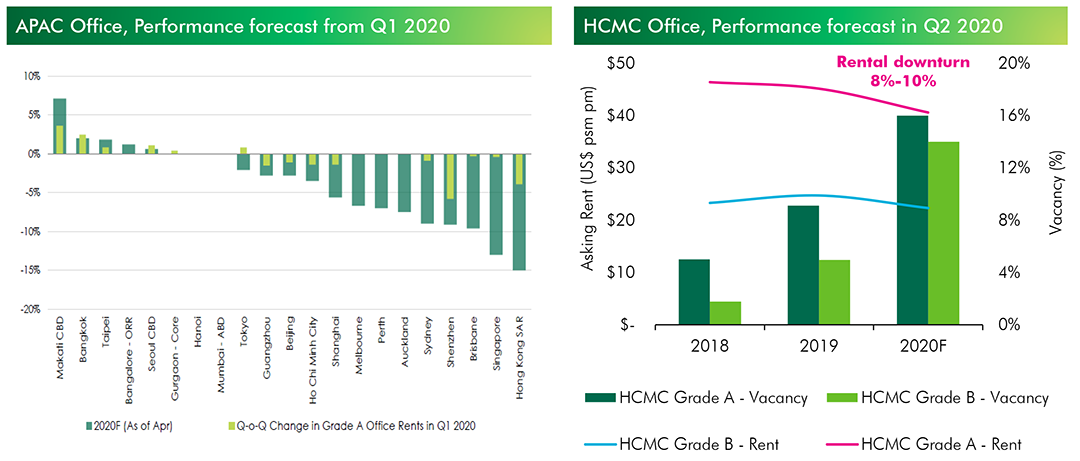

Office Market

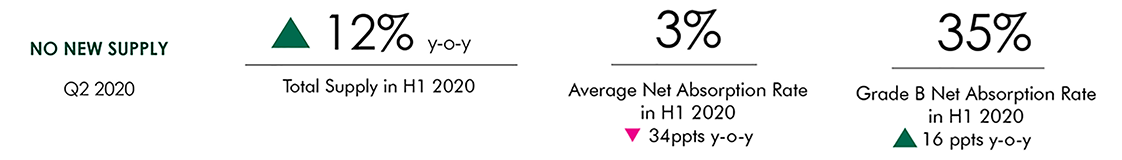

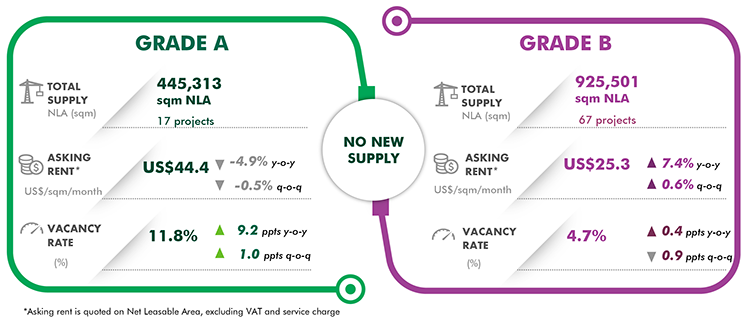

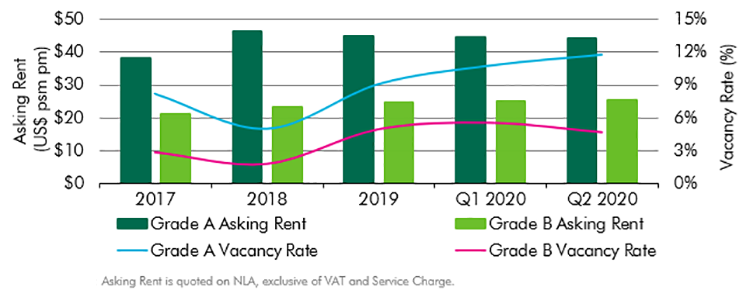

HCMC office market was no new supply in Q2 2020 (supply remained at 1,370,814 sqm NLA), new leasable office area in 2019 and Q1 2020 have not been fully absorbed by the market. Grade-A buildings were impacted stronger than Grade-B buildings. The average rent of Grade A was USD 44.4 psm pm, down 4.9% y-o-y and vacancy rate increased by 9 ppts y-o-y, reaching 11.8%.

Many tenants have been planning to either contract their office space in current buildings or relocate to buildings with lower cost, located at the edge of the CBD or sub-urban area, Grade B still recorded stable performance, especially buildings with rents of less than USD 30.0 psm pm.

In Q2 2020, vacancy rate of Grade B was recorded at 4.7%, a slight increase of 0.4 ppt y-o-y. Rent of Grade B reached USD 25.3 psm pm, up 7.4% y-o-y due to the introduction of some new buildings from the previous quarters with good quality and higher rents compared to market average.

The construction of new office buildings in HCMC were still moving forward and more than 70,000 sqm NLA is expected to complete by the end of this year. Most of the new additions will concentrate in the East (Binh Thanh) and the South (District 7). Landlords of these upcoming buildings have proactively decreased asking rents by USD 1.0 to USD 3.0 psm pm compared to Q4 2019 to attract tenants.

Landed property (Ready-built Villa and Townhouse)

-

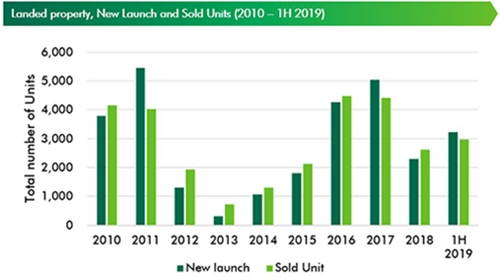

Supply low: Limited new launches alongside increasingly cautious buyers saw primary supply at its lowest for five years. First half Villa/Townhouse and Land Plot primary supply was down -43% y-o-y to approx. 3,250 dwellings/plots. Land Plots at -53% fell sharper y-o-y than the -23% Villa/Townhouse decline. Total new H1 2020 supply of over 1,900 plots/ dwellings was down -58% y-o-y. Post lockdown Villa/ Townhouse gained 240 new units, or around 36% of Q1 2020 launches saw a -27% q-o-q drop in primary stock. The around 440 new land plots saw stock decrease -24% q-o-q and primary stock drift -1% q-o-q. Large-scale compound projects have eastern districts dominating with almost 80% of primary dwellings. Districts Binh Chanh and Cu Chi were the two leading land plot suppliers.

-

Challenging performance: Supply constraints resulted in the worst performing first half for 5 years. Total Villa/Townhouse sales fell -34% y-o-y with Shophouse leading performance. Land plot sales slumping -67% y-o-y were affected by a Coronavirus related drop in speculative interest. With Villa/Townhouses at 50% and land plots 43%, moderate absorption was maintained over Q2 2020. Around 61% of active projects kept q-o-q land prices steady over Q2 2020. However, additional discounting alongside longer payment timelines were offered to trigger sales.

-

Shophouse rising: Limited supply alongside strong price growth has seen Shophouse demand sharply increase in recent years. The highest landed product absorption in Q2 2020 was for this sub-segment. Commercial value combined with living space has Shophouse priced higher than Townhouse with supply accordingly allocated for project return. Vinhomes Grand Park - The Manhattan, launched in Q2 2020 with 93% Shophouse tilted segment new supply to 65%.

-

Prices continue to move higher: Primary prices set another new record high in Q2 2020, reaching USD 5,277 per sqm land, up 35.9% y-o-y and 5.2% q-o-q. This was mainly due to the entrance of new projects with higher-than-average price. Owing to the developer’s confidence back by the scarity of supply and health demand, many developers were seen to keep the prices unchanged over the quarter, or some gave out discounts in the promotion package format after slightly raising the prices. This led to the prices almost stable q-o-q on the project basis.

-

Outlook market: H2 2020 anticipates more activity with over 3,600 units from new entries and existing project next phases. Until 2022, the segment expects 12,800 dwellings/plots to launch. Eastern districts earmarked for over 50% of future supply will retain their dominant position. Ongoing infrastructure improvements will see increased interest for satellite cities Dong Nai, Binh Duong and Long An with large-scale townships offering competitively priced, more diversified products.

Condominium market

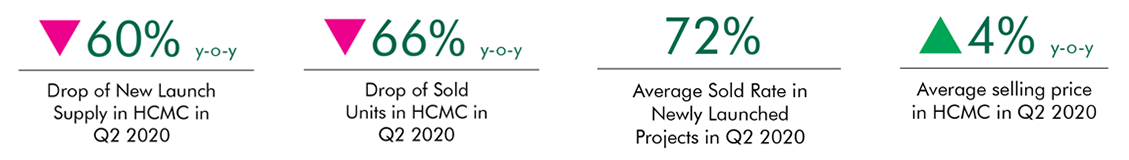

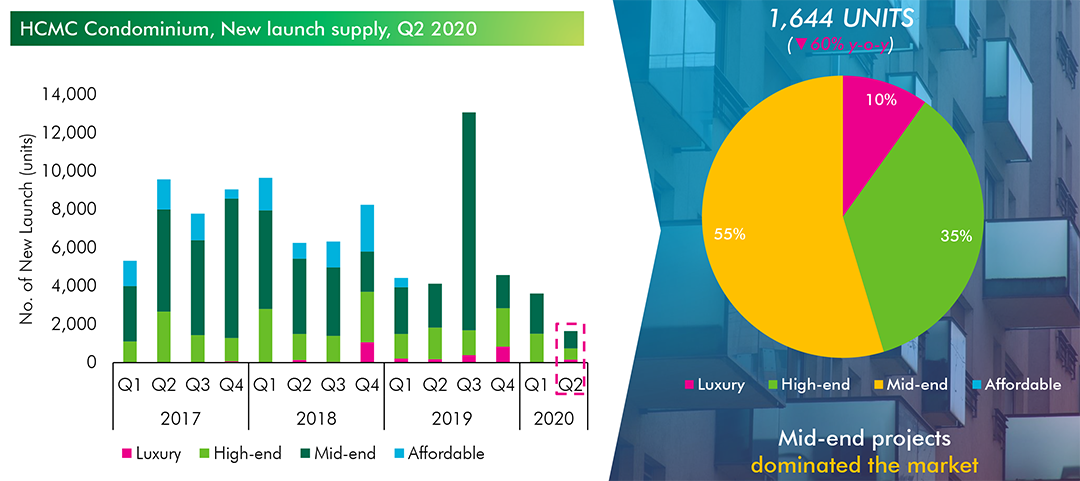

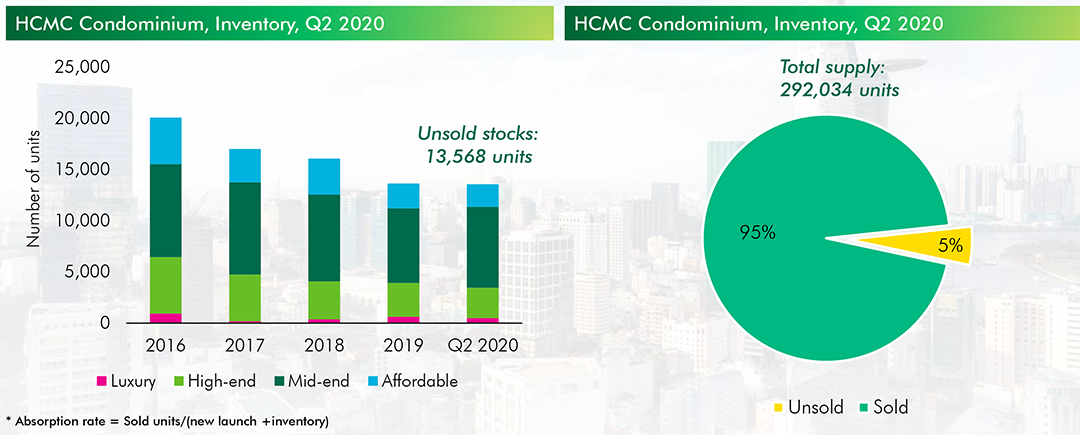

New launch supply in HCMC hit the lowest point in the last five years. Foreign developers were particularly quiet in H1 2020, accounting for only 10% of new launch supply compared to around 20%.

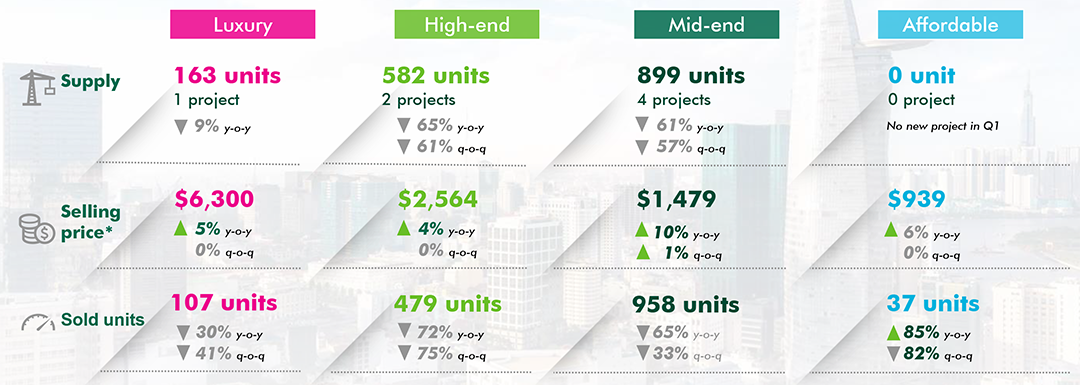

Q2 2020, new supply volume was recorded at 1,644 units from seven projects, a drop of 54% q-o-q and 60% y-o-y. In H1 2020, a total of 5,250 units were launched, a decrease by 39% y-o-y.

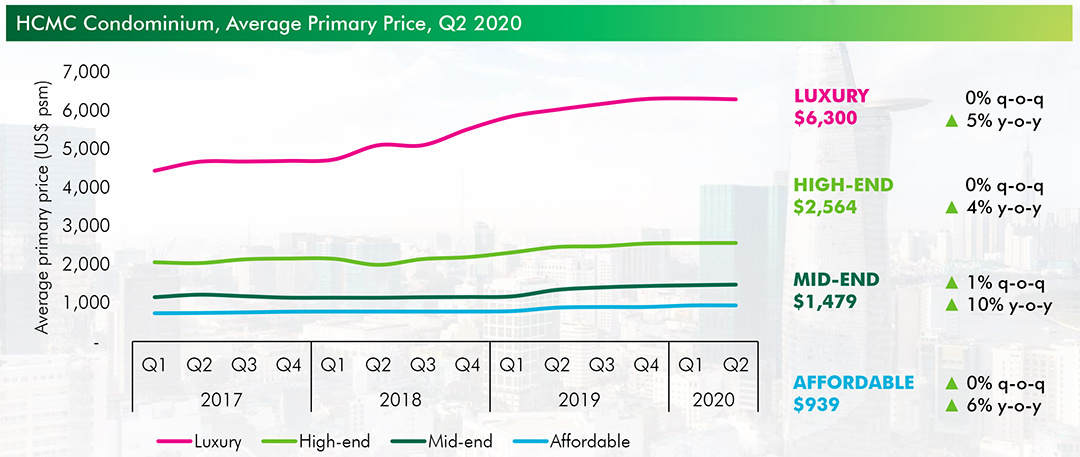

The average selling price for the primary market was at USD1,940 psm, relatively stable from the previous quarter, and up by 4% y-o-y. Mid-end selling prices increased slightly by 1% q-o-q thanks to subsequent phase of successful projects in Q1 such as Citi Grand and West Gate Park. This segment also recorded the highest price growth of 10% y-o-y. Meanwhile, other segments’ prices remained stable from the previous quarter and higher than the same period last year by 4%-6%.

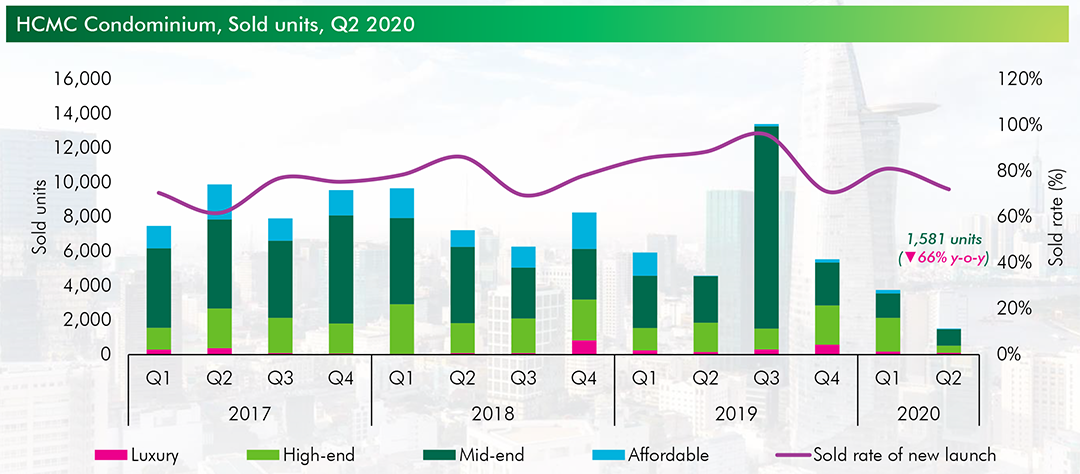

Sold rate in Q2 2020 reached 70%, a decrease of 10-15 ppts q-o-q. Because of high selling price and the impacts of Coronavirus in Q2 2020, buying demand diminished during this period. In Q2 2020, sold units were recorded at 1,581 units, a decrease of 58% q-o-q and 66% y-o-y. In H1 2020, a total of 5,338 units were sold, a decrease by 49% y-o-y.

In terms of segmentation, the mid-end segment continued to dominate in terms of new launch supply and sold units, at 55% and 61% respectively. In terms of location, HCMC condominium market continued to expand East and South, concentrating in District 2, District 7 and Binh Chanh District.

Condominium ranking criteria:

- Luxury: projects that have primary prices over US$4,000 psm

- High-end: projects that have primary prices from US$2,000 psm to US$4,000 psm

- Mid-end: projects that have primary prices from US$1,000 psm to US$2,000 psm

- Affordable: projects that have primary prices under US$1,000 psm

(Selling price excludes VAT.)

New launch supply is predicted to improve in the second half of 2020 and achieve a total of 18,000 units, a decrease of 32% y-o-y. Mid-end segment will continue to account for a high proportion of new launch supply. In terms of location, the East remains a hot spot in the real estate market, with many new projects in District 2 and District 9.

The average marketwide selling price for 2020 is expected to increase 5% y-o-y, with high-end and luxury segments forecasted to have a modest growth rate of 3% y-o-y. Mid-end segment is expecting a price increase by 5% y-o-y thanks to high price growth rate in H1 2020. The sold unit volume is forecasted to reach 16,000 units, a drop of 45% y-o-y, because of the impacts of Coronavirus.

To adapt to the new normal, the market needs more flexible solutions. In the short term, developers are supporting local buyers in terms of payment term, enhancing management team to ensure safety of residents. In addition, developers should prepare supporting policies for foreign buyers, who cannot enter Vietnam due to Coronavirus, such as handover policy, unit management and secondary transactions. In the long term, products, sale strategies and price strategies should be reviewed carefully. Furthermore, land banks should be expanded to various locations in HCMC and other provinces.

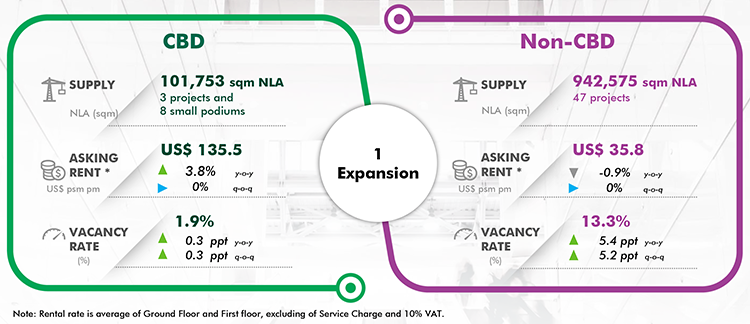

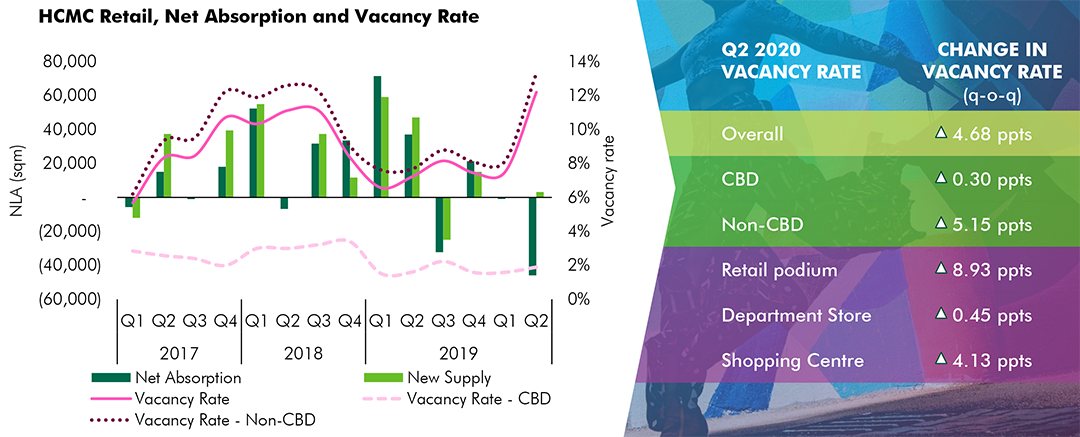

Retail market

There was no new project in Q2 2020 in HCMC. In the non-CBD area, Vincom Megamall Thao Dien has added over 3,000 sqm on B1 floor to its NLA, which used to be utlized as office. As of Q2 2020, total NLA of HCMC retail market is 1,040,000 sqm, which has not changed significantly since the end of 2019.

Retail market of Vietnam, in general, and of HCMC, in particular, started to show signs of recovery, albeit at minimal level. According to Google Mobility Index, which used location data to estimate the level of footfall to shopping and retail centres, footfall has recovered up to 80% of the level seen in January 2020, one of the busiest retail months in Vietnam as consumers stocked up for Lunar New Year. However, according the HCMC statistics, total retail and service turnover decreased by 4% y-o-y. Tourism services was hit with the biggest decrease among all, which was down 71% y-o-y. Positive sign came from retail goods turnover, which was up 10% y-o-y.

At shopping centres, average asking rent on Ground floor and First floor increased by 3.8% in the CBD area and decreased by 0.9% in the non-CBD area. In terms of vacancy rate, CBD area recorded an increase of 0.3 ppt (equivalent to 300 sqm) and non-CBD area recorded an increase of 5.4 ppts (equivalent to 49,000 sqm). Besides the location factor, increase in vacancy rate varies across retail formats. Those shopping centres which normally had good level of footfall recovered faster than those without interesting and reasonable tenant mix. On average, vacancy rate was up 4 ppts for shopping centres, 0.5 ppt for department stores, and 9 ppts for retail podiums. Contractions were seen more often at retail podiums from F&B and local fashion categories. Other categories such as Supermarket, Healthcare, Convenience store are under normal operation.

In Q2 2020, Uniqlo opened other two stores in HCMC and in Q3 2020, MUJI, a brand from Japan, will open their first store in the city. However, these transactions were dated back in 2019. In 2020, the number of new international brands was sharply down compared to the last four years.

Vacancy rate is expected to have mild recovery in H2 2020 while asking rents are expected to maintain the current level, backed by short-term rental support policy from developers. Against the global backdrop of Coronavirus, most retailers in the world postponed seeking new spaces and instead, they are focusing more on recovering performance of existing stores.

In Vietnam, some brands have introduced their online platforms such as Starbucks, Maison and soon so will ACFC. Some mid-end F&B, coffee brands such as Pizza4P, Ong Bau Coffee, etc. became more creative and introduced kiosk, semi-truck formats to quickly expand their market coverage. On the other hand, some local brands wanted to utilize this low market cycle to accelerate their expansion strategy to boost their competitive capacity in the near future.

All pipeline projects postponed their opening date, awaiting for recovery of leasing demand as well as Metroline No.1, which is expected to open next year. The opening of the first Metroline will be followed by change in rents at projects with direct connection as well as category mix to better suit new consumers profile. Moreover, a nascent retail format in Vietnam and HCMC, underground retail, can become more popular thanks to the introduction of the metro lines. In H2 2020, the market will not have any new retail project; one project in the CBD area can be re-opened after two years of renovation.

Related news

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2019

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2019

Vietnam’s Economic Backdrop Quarterly Reports | Q2 2019