Retail developers will be forced to lower rental expectations

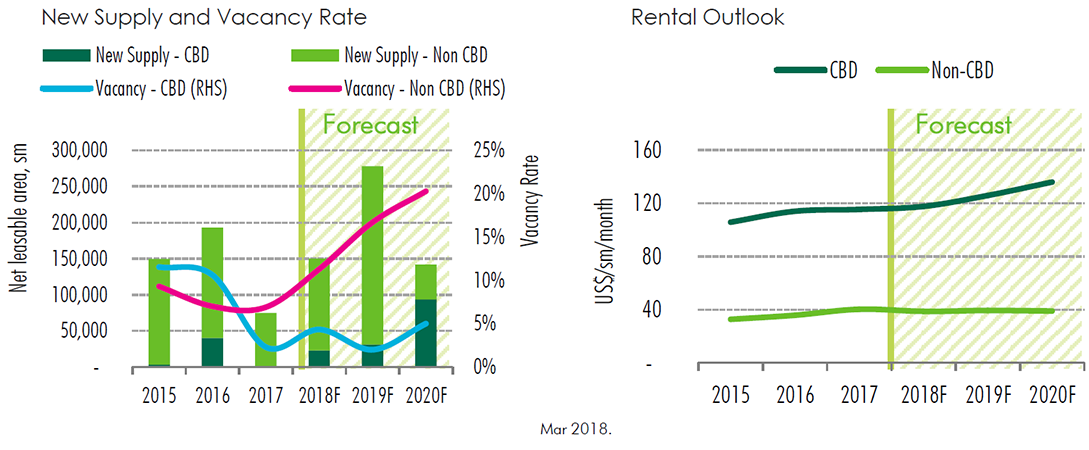

Tenants compete to secure space in the CBD: Upcoming supply in the CBD continued to delay their completion dates. There will be no new supply in the CBD in 2018. In 2019 and 2020, 124,000 Sq. m of new supply will come online from the podiums of luxury mixed-use projects such as Golden Hill, Tax Plaza and The Spirit of Saigon. Due to solid demand, rents of CBD retail property will continue to rise during the next three years and vacancy will remain under 5%. Any available space is expected to be quickly filled up.

Quality supply in Non-CBD area is still at a low level but increasing: With rising competition, rents in Non-CBD areas are constrained while the vacancy rate is expected to increase to 20% by 2020. Some developers without track records in retail development will be forced to lower rental expectations or apply more flexible lease structures to support retailers. In terms of future expansion, the East, including District 2, District 9 and Binh Thanh District will see the majority of new retail supply thanks to their gradual establishment of new residential clusters. Developers anticipating completion of these projects are planning large-scale shopping malls with net leasable area greater than 60,000 Sq. m each.

To guarantee enough foot traffic and increase dwell time, landlords should save larger space for anchor tenants as well as increasing the number of anchor tenants. More importantly, high-impact tenants whose products generate intense word-of-mouth marketing online should receive preferential terms.

Consumers value convenience: According to a report by IGD Research, Vietnam is predicted to lead the convenience store market in Asia by 2021 with CARG of 37.4%, much higher than other regional peers such as China, South Korea, and Japan which have CARG of less than 10%. With a lower starting point, these numbers indicate a large potential market in Vietnam with a growing middle class and a young population who value convenience, modernity and comfort. The driving force behind such growth is the expansion of other international players have either already taken their first steps in to the Vietnam market or are currently considering doing so. The worldwide chain 7-Eleven opened its first store in Ho Chi Minh City in the middle of 2017 and the South Korean chain, GS25, is set to launch in early 2018 signaling further growth for this segment.

Song Chau Group.

Related news

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2019

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2019