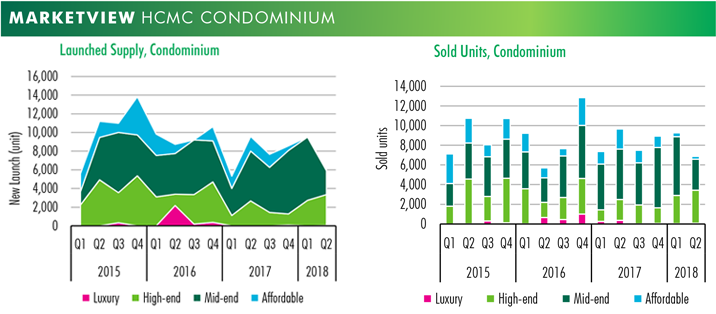

Sold volume condominium units and new launch supply for 1H 2018

In Q2 2018 the HCMC market welcomed an additional 6,109 condominium units, a decrease of 36% y-o-y. However new launch supply for 1H 2018 still increased 5% compared to 1H 2017. Mid-end segment witnessed the biggest decrease in new launch in Q2, down 62% q-o-q and 52% y-o-y. With regards to the breakdown by segment, the high-end segment accounts for the highest proportion of new launch units in Q2 at 54%, followed by mid-end at 42%. Q2 2018 recorded one new luxury launch which is Cove Residence tower of Empire City project with 40 units.

Sales momentum continued to be positive in Q2 2018 with more than 80% of new launch units having been absorbed. In Q2 2018 there were 6,947 sold units in total, a decrease of 25% q-o-q and decrease of 29% y-o-y.

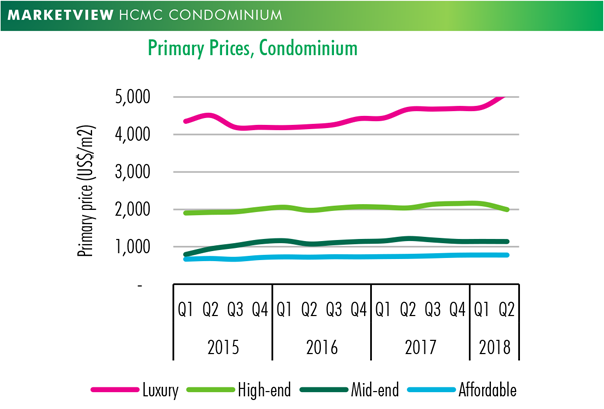

Average price on the primary market was recorded at US$1,580 psm in Q2 2018, an increase of 3% q-o-q due to increase in prices of the luxury segment. Primary price increases of 3%-5% were observed in some districts such as District 4, Binh Tan and Tan Phu District.

The mid-end segment is expected to maintain a high proportion in the new launch units of 2018, thanks to some large-scale projects that are expected to launch in the second half of the year. In terms of area, the East and the South will continue to be hotspots for the second half of 2018, especially the Thu Thiem area. Sales momentum will continue to be upbeat, however developers should focus more on handover quality, facilities and management quality in order to gain customers’ trust and differentiate themselves from the competition.

Song Chau Group.

Related news

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2019

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2019