Vietnam’s economic growth rate to impulse real estate market 2018

VIETNAM ECONOMY 2017

-

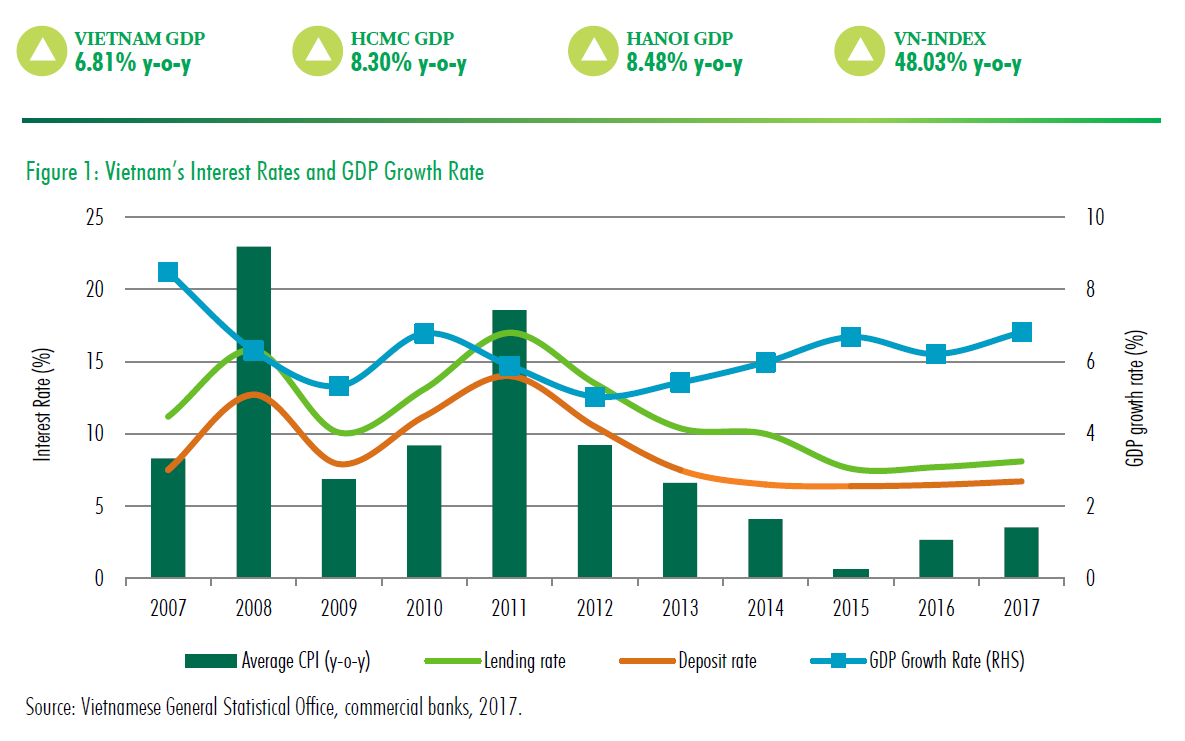

In Q4 2017, Vietnam’s economy grew 7.65% y-o-y. For the whole year 2017, the economy achieved an impressive growth rate of 6.81% compared to 2016 –the highest rate observed since 2008.

-

For 2017, Vietnam received US$21.3 billion from newly licensed projects along with US$8.4 billion in terms of increased capital and US$6.2 billion from share purchase, totaling US$35.9 billion, an increase of 44.4% compared to last year. Japan, Korea and Singapore are top countries with largest share of FDI inflows into Vietnam this year. FDI into real estate accounted for 8.5% of total FDI, ranking third after manufacturing, electricity production and distribution.

-

Export turnover of goods in 2017 grew by 21.1% y-o-y, and Vietnam attained a trade surplus of US$2.7 billion amid a synchronised recovery of the global economy. VN Index reached a 10-year high by the end of 2017, inflation was at 3.53%, while GDP per capita reached US$2,385 (an increase of 7.7% y-o-y). However, some concerns were raised regarding productivity of the labor force, especially in comparion with neighboring countries.

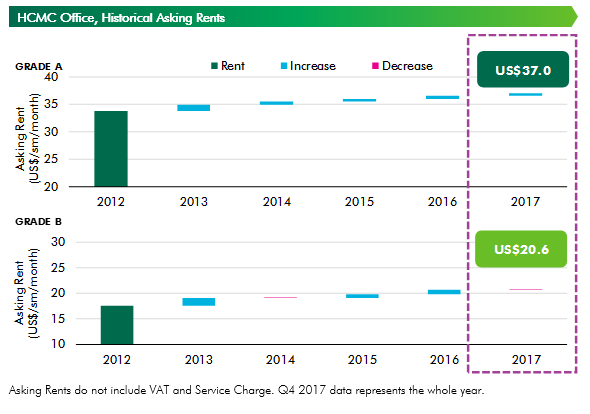

OFFICE MARKET

Office market welcomed seven new buildings in Hanoi and five new buildings in HCMC in 2017. Rents in Hanoi increased for the first time in the last five years in both Grade A and Grade B, while HCMC rents continued to have slight increase. Looking forward to 2018, banking/ insurance, manufacturing and IT, especially co-working space is expected to be a potential source of demand.

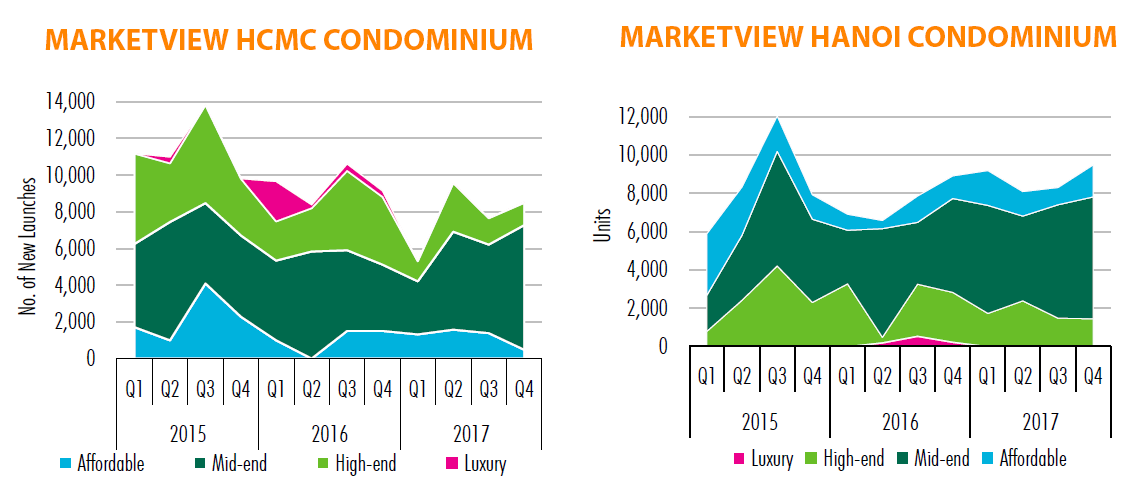

CONDOMINIUM MARKET

2017 ended with a busy quarter in both Hanoi and HCMC, with 9,500 units launched in Hanoi and 8,559 units launched in HCMC in Q4. Total new launch in 2017 for Hanoi and HCMC was estimated at 35,000 and 31,106 units respectively. Market sentiment continued to be positive for both cities, with 23,000 and 32,905 units sold in Hanoi and HCMC respectively. In 2018, the market is expected to focus more on the mid-end segment, with nearly 53% of 2018 new launch units in this segment.

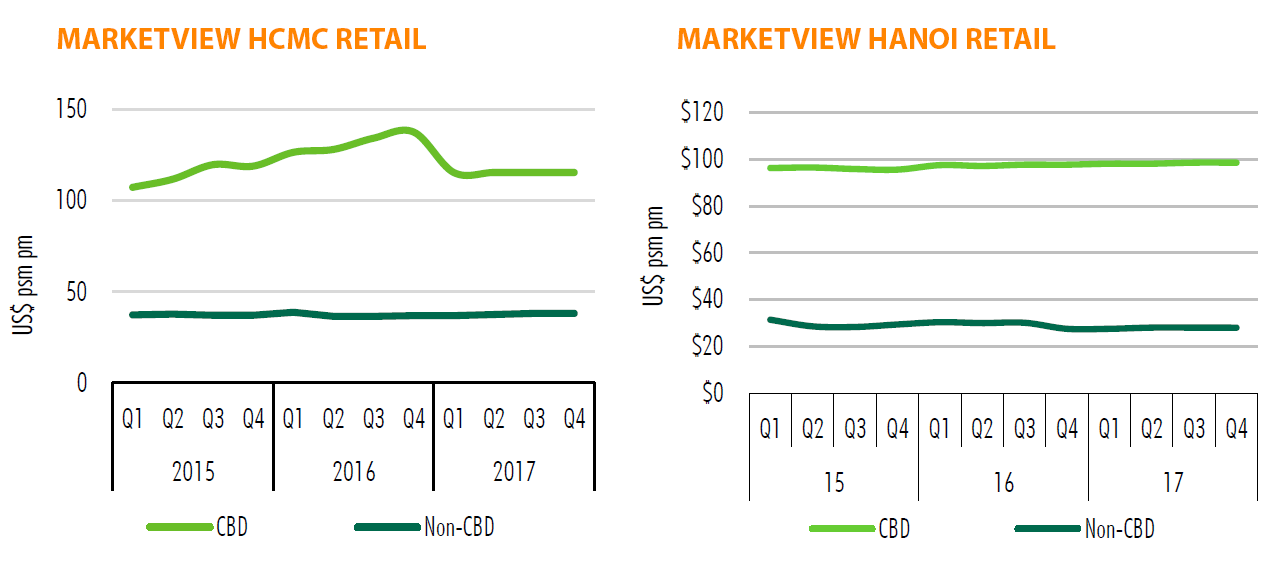

RETAIL MARKET

The retail market had a busy year with two new projects in Hanoi and seven new projects in HCMC, leading to both entries of foreign retailers and expansion of current players. Within the next three years, retail market will be more competitive as a large amount of supply from community retail podium will be launched. Ecommerce, which had recently got much attention from investors and consumers, is expected to develop quickly in Vietnam.

Song Chau Group.

Related news

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2019

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2019