Q2 2018 Vietnam's GDP growth rate and marketview

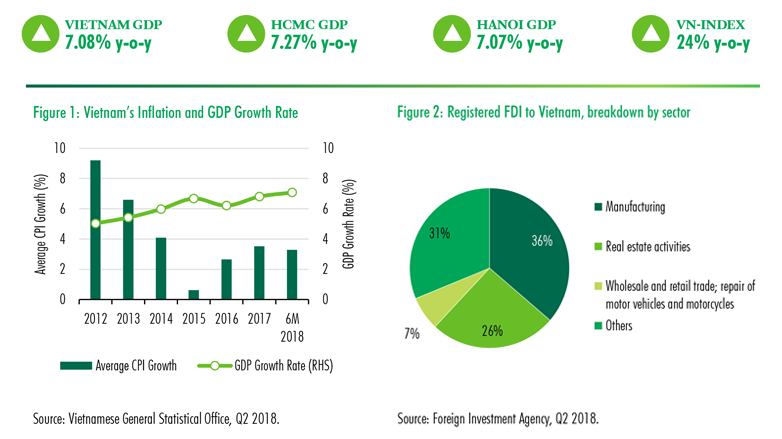

The Vietnam economy continued to achieve an impressive growth in the second quarter of 2018. Vietnam’s GDP increased by 6.79% y-o-y in Q2 2018 and 7.08% y-o-y in the first half of the year, and it is the highest growth observed in the last eight years. Despite the rapid expansion of the economy, the increase of average CPI in the first six months was still maintained below the target of 4% set by the government.

In the six-month period, total registered FDI rose by 5.7% y-o-y and Japan was the top investor to Vietnam with US$6.47 billion, accounting for 31.8% of the total investment. In addition, a total sum of US$5.5 billion was invested in real-estate sector, accounting for 27% total registered FDI in this period. Surging capital helped real-estate to become the second most heavily invested sectors. Among all provinces, Ha Noi took up the largest portion of registered FDI with US$5.8 billion (28.9%), followed by HCMC (18%) and Ba Ria-Vung Tau (9.5%).

Although Vietnam’s economy still put on a stellar performance, uncertainties in the global environment are to be followed closely, especially for an export-reliant economy like Vietnam. With an ease in economic growth in Q2, the government will have to increase measures to boost the economy in the 2H 2018 in order to meet the ambitious annual target for economic growth of 6.7%.

Song Chau Group.

Related news

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2021

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q2 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q1 2020

Ho Chi Minh City Real Estate Market Quarterly Reports | Q4 2019

Ho Chi Minh City Real Estate Market Quarterly Reports | Q3 2019